Courtesy of Mish.

Looking for a reason Chicago bonds are rated junk?

This guest post by Michael Johnston at Fixed Income Database explains why Chicago is junk in seven easy to understand charts.

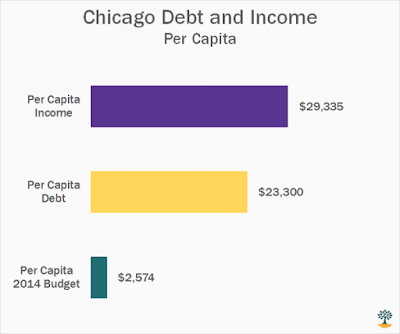

Chart #1: Massive Debt Burden

Simply put, Chicago is shouldering an enormous amount of debt. By some calculations, the city is on the hook for as much as $63 billion when pensions, long-term notes, and health insurance obligations are included. That amounts to a staggering $23,300 for every inhabitant of the city, representing a huge chunk of the annual income for the city’s residents and nearly 10 times the size of the per capita annual budget.

Data Sources: Illinois Policy Institute, 2010 Census, Chicago Budget. Per capita income estimate is for Cook County.

Chart #2: Growing Payments

While the current state of the city’s balance sheet is dismal, the real problem relates to what is expected to develop over the next decade. Chicago pension plan payments are expected to double from 2014 to 2015, and will then continue to rise for another decade before they begin to decline. By the time payments peak in 2026, they will be four times the 2014 level.

Data Source: Moody’s estimates

Chart #3: Limited Taxing Ability

…