Down in the pleasure centre,

hell bent or heaven sent,

listen to the propaganda,

listen to the latest slander.

China has set a new Global record by dumping almost $200Bn (over 1Tn Yuan) in stimulus into their overheated markets in just two days. Sunday night it was a rate cut AND lowering the reserve requirements for banks and yesterday afternoon they dropped another $50Bn in a "Reverse Repo" operation and, to cap it off this morning, the Finance and social Security Ministries published draft rules that would permit the state pension fund to invest up to 30% of its net asset value in securities, potentially allowing ANOTHER 600B yuan ($97B) to enter the market.

Take 30% of our retirement savings and buy stocks that already gained over 100% this year in an attempt to prevent a bear market from wiping out all of the gains – BRILLIANT!!!

Certainly Chinese speculators thought so as the Shanghai went from down 5.6% at the open to up 5.6% at the close! This allowed them to save a little face at the close of the Quarter and, more importantly, promises Fund Managers a whole new round of suckers to dump shares into in July.

Certainly Chinese speculators thought so as the Shanghai went from down 5.6% at the open to up 5.6% at the close! This allowed them to save a little face at the close of the Quarter and, more importantly, promises Fund Managers a whole new round of suckers to dump shares into in July.

10% happens to be a Strong Bounce off the 25% drop, per our 5% Rule™, so we're not going to be too impressed until we see some follow-through. Like us, Bloomberg is skeptical, saying: "China's Magic Tricks Can't Save Its Stock Market" warning us:

Only time will tell if Beijing's bag of tricks is empty. But if it is, the fallout on global markets could dwarf the impact of Greece's flirtation with default. The world, after all, has had a few years to contemplate a Greek exit from the euro. But if the world's biggest trading nation suddenly hit a wall, it would be a catastrophe of a different order, wreaking havoc on economies near and far.

Europe seems a bit relieved and has worked itself into a flatline this morning while the US Futures are up about 0.5% but that's just a weak bounce off yesterday's drop that we already called a long for in our Morning Alert to Members (also Tweeted out for you cheapskates who don't subscribe). We're playing for the bounce but we already took the money and ran on /RB (Gasoline Futures) at $2.025 and Russell Futures (/TF) stopped us out at 1,252.50 with a 2.5-point, $250 gain per contract – enough to pay for a nice breakfast as we wait for better entries.

Europe seems a bit relieved and has worked itself into a flatline this morning while the US Futures are up about 0.5% but that's just a weak bounce off yesterday's drop that we already called a long for in our Morning Alert to Members (also Tweeted out for you cheapskates who don't subscribe). We're playing for the bounce but we already took the money and ran on /RB (Gasoline Futures) at $2.025 and Russell Futures (/TF) stopped us out at 1,252.50 with a 2.5-point, $250 gain per contract – enough to pay for a nice breakfast as we wait for better entries.

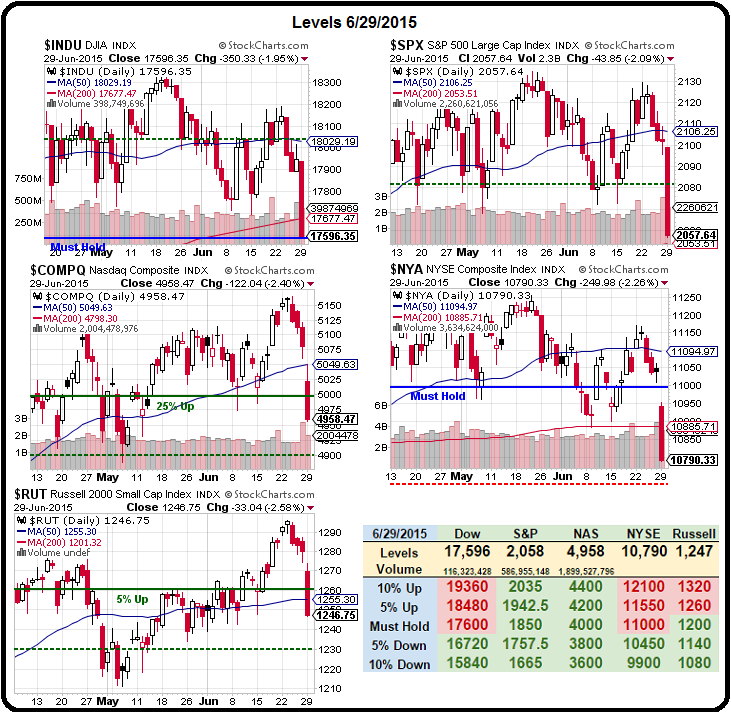

As you can see from Dave Fry's SPY chart, our 5% Rule nailed 2,055 on the S&P (10x SPY) almost to the penny (see prediction at the bottom of yesterday's morning post which, by the way, made $1,000 per contract as a day trade for you!) and, let's not forget, we are now looking for a bounce as high as 2,075 today (strong bounce) and, if that fails, we'll expect the next test of 2,055 to fail and then we're ready to complete the correction trip to 2,035, which is the 10% line on our Big Chart:

Notice how the Dow stopped dead on our Must Hold line? These are same lines we've been using to predict market channels since early 2009, when we first looked ahead to a 5-year recovery plan. Here we are in year 6 and the Fundamentals haven't improved enough for us to bump up those Must Hold lines – that's right where the market should be (at a mid-point) and the S&P and the Nasdaq are still way over their levels, and perhaps not for good reasons.

Rampant speculation in the Nasdaq and S&P with crazy valuations on momentum stocks like NFLX (p/e 168), AMZN (p/e 300), TSLA (p/e 100), CRM (p/e 100), UA (p/e 88), etc., when they are accepted, begin to drive us the valuations of ordinary stocks and now the entire indexes are overvalued by at least 10% and the only reason earnings come CLOSE to justifying the numbers is because the companies are depleting their cash reserves and even BORROWING MONEY to buy back their own stocks – thus reducing the number of shares their earnings get divided by and "fixing" their p/e rations. BRILLIANT!!!

Rampant speculation in the Nasdaq and S&P with crazy valuations on momentum stocks like NFLX (p/e 168), AMZN (p/e 300), TSLA (p/e 100), CRM (p/e 100), UA (p/e 88), etc., when they are accepted, begin to drive us the valuations of ordinary stocks and now the entire indexes are overvalued by at least 10% and the only reason earnings come CLOSE to justifying the numbers is because the companies are depleting their cash reserves and even BORROWING MONEY to buy back their own stocks – thus reducing the number of shares their earnings get divided by and "fixing" their p/e rations. BRILLIANT!!!

Or perhaps, like China (you remember China? This is an article about China) we'll find out that EU and US companies are not just cooking the books by reducing their share count but are also outright faking sales and profit reports, like our friends at Alibaba (BABA) have been accused of or the entirely fake banks they have in China. Zhuhia Boyuan Investments has taken a new tactic for China – honesty (belatedly):

“The company’s board of directors, board of supervisors and senior management are unable to guarantee the truthfulness, accuracy and comprehensiveness of the annual report. Nor are they able to guarantee that the report doesn’t contain any false records, misleading statements or significant omissions.”

In fact, just this weekend, the National Audit Office said that 14 state-owned groups, including well-known names such as State Grid, China Ocean Shipping (Cosco) and China Southern Power Grid, falsified nearly 30Bn Yuan ($4.8 billion) in revenue and nearly 20Bn ($3.2Bn) in profits in 2013. Last week, a separate agency, the Communist party's anti-graft watchdog, said it would probe China Railway, China Aluminum and People's Daily, the official party mouthpiece, in the latest round of inspections at state companies. The audit office statement said 56 serious cases had been handed over to "relevant departments", probably a reference to prosecutors or the party's anti-corruption commission.

In fact, just this weekend, the National Audit Office said that 14 state-owned groups, including well-known names such as State Grid, China Ocean Shipping (Cosco) and China Southern Power Grid, falsified nearly 30Bn Yuan ($4.8 billion) in revenue and nearly 20Bn ($3.2Bn) in profits in 2013. Last week, a separate agency, the Communist party's anti-graft watchdog, said it would probe China Railway, China Aluminum and People's Daily, the official party mouthpiece, in the latest round of inspections at state companies. The audit office statement said 56 serious cases had been handed over to "relevant departments", probably a reference to prosecutors or the party's anti-corruption commission.

This is why Corporate defaults on bond payments are becoming rampant in China and the Government can lower the rates every week but that won't put cash in the hands of those who have already borrowed way over their head in order to prop up their companies so they could take advantage of the hottest IPO market in history (even beating our .com days) so they could make Billions off of anything that sounded like it combined China and Internet. Sound familiar? Not to Chinese investors, who have margined themselves up to the eyeballs chasing these "unicorns."

Unicorns are pre-IPO start-ups that are already getting valuations in excess of $1Bn from investors in the private marketplace. Already this year there are 111 of them and, just this morning, the term sheets for Uber's $1Bn bond sale Term Sheet revealed that this little unicorn lost $470M on $415M in sales. Like our friend Jeff Bezos: "Sure they lose money on every transaction but they make it up with VOLUME!"

Unicorns are pre-IPO start-ups that are already getting valuations in excess of $1Bn from investors in the private marketplace. Already this year there are 111 of them and, just this morning, the term sheets for Uber's $1Bn bond sale Term Sheet revealed that this little unicorn lost $470M on $415M in sales. Like our friend Jeff Bezos: "Sure they lose money on every transaction but they make it up with VOLUME!"

Like many unicorns, Uber promises infinite growth in China, even while the country's GDP growth is rapidly contracting. Like their Chinese cousins, Uber is paying out 8% interest on Billions in bonds and borrowing another $2Bn from Wall Street (and they already raised $1.6Bn this year in convertibles note with GS clients at a $40Bn valuation) all in the expectations of going public and getting a $100Bn valuation – all without making a dime.

Meanwhile, in Reality Land, Komatsu (the Japanese version of Caterpillar), is so down on the Chinese market, with heavy equipment demand down 50% from last year's levels, that they are cutting staff and Hitachi Construction Machinery has scaled back plants in China by 50% to begin burning off excess inventory – these are not "blips" that correct themselves quickly! In fact, Hitachi's CEO Ohashi is already looking to 2017 before a turnaround begins.

So perhaps it's a bit soon for China to rally back?