Courtesy of Benzinga.

Oppenheimer technical analyst Ari Wald’s new report out this week highlight’s the firm’s 10 “Worst of the Worst” stocks to sell on technical weakness. Here’s a breakdown of the 10 names included in the report.

1. ConocoPhillips (NYSE: COP)

Support that had been holding for ConocoPhillips throughout 2015 recently broke down, leaving more room to the downside for the stock.

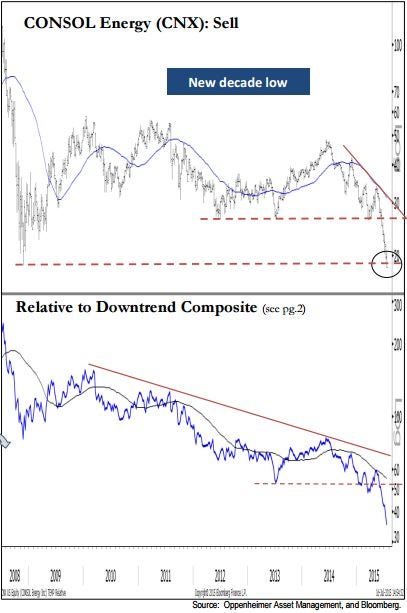

2. CONSOL Energy Inc (NYSE: CNX)

After CONSOL recently broke below a support level dating back to early 2012, the bottom fell out of the stock. CONSOL is now trading at 10-year lows.

3. Nucor Corporation (NYSE: NUE)

Nucor is currently in danger of breaking below a support level that held for the stock earlier this year. A breakdown below that level would leave much more room for downside.

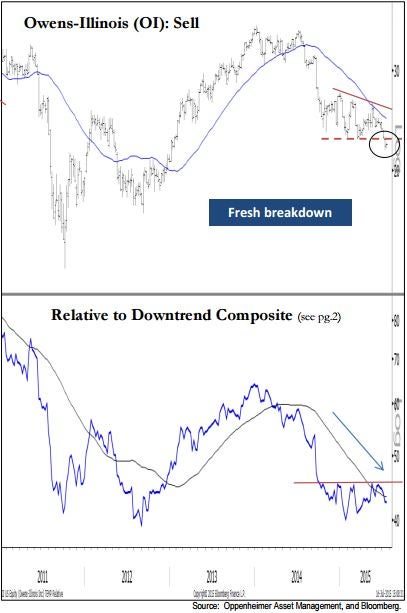

4. Owens-Illinois Inc (NYSE: OI)

After forming a series of lower highs throughout 2015, Owens-Illinois is now in the process of establishing a new 2015 low.

5. Fluor Corporation (NYSE: FLR)

After a bounce earlier in the year, Fluor’s stock now finds itself trading at multi-year lows.

6. Emerson Electric Co. (NYSE: EMR)

Emerson is another stock that bounced earlier this year, but it’s now once again headed south.

7. EMC Corp (NYSE: EMC)

EMC broke below its ascending support line early in 2015, and it appears that the line is now serving as resistance for the stock.

8. Teradata Corporation (NYSE: TDC)

When Teradata’s lateral support line and descending resistance line pinched the stock into a corner, the stock eventually broke out to the downside.

9. Coach Inc (NYSE: COH)

Hopes that the double bottom established in 2014 would once again hold as support for Coach were recently dashed, and the stock is now trading at five-year lows.

10. NRG Energy Inc (NYSE: NRG)

As was the case with Teradata, when NRG’s resistance line and support line converged, resistance won out, and the stock broke down to new multi-year lows.

Latest Ratings for COP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jul 2015 | Barclays | Maintains | Overweight | |

| Apr 2015 | Edward Jones | Downgrades | Buy | Hold |

| Apr 2015 | Nomura | Initiates Coverage on | Neutral |

View More Analyst Ratings for COP

View the Latest Analyst Ratings

Posted-In: Ari Wald OppenheimerAnalyst Color Technicals Analyst Ratings Trading Ideas