Visit Phil's Stock World for the latest market news, market commentary and investing ideas and strategies.

Financial Markets and Economy

Apple is important. Perhaps the most important company not only for the Dow Jones, but because it also happens to be the largest company by market cap, in the world. As such nobody will be happy that moments ago AAPL reported results which were in a word, lousy.

It wasn't so much the earnings, because the EPS of $1.85 was a modest beat of expectations of $1.81, while revenues also beat consensus of $49.4 billion fractionally, printing at $49.6 billion; the margin also beat slightly coming at 39.7% above the exp. 39.5%.

Weak results from IBM, others send US stock indexes lower (AP at Yahoo)

THE QUOTE: "The market is being cautious, waiting for a little more direction," said Ian Kerrigan, global investment specialist at J.P. Morgan Private Bank. "There are people who are taking some gains out there and waiting a little while to see what happens with Greece, what happens with China, what happens with the Fed."

ALL ABOUT EARNINGS: About 60 percent of the companies in the S&P 500 report over the next two weeks. Investors are combing the results to get a read on how the economy is doing. But it's still early days. Roughly 12 percent of the S&P 500 companies have reported so far. Some 70 percent of them have beaten Wall Street's already low expectations.

Novartis CEO Says U.S. Health Insurer M&A to Crimp Drug Prices (Bloomberg)

Novartis CEO Says U.S. Health Insurer M&A to Crimp Drug Prices (Bloomberg)

Novartis AG Chief Executive Officer Joe Jimenez said the consolidation spree among U.S. health insurers is making it harder for drugmakers to increase prices in a market that has for years been a primary driver of growth for the pharmaceutical industry.

“Across the board in the U.S., the pricing environment is more difficult,” Jimenez said in a phone interview Tuesday. “With a consolidated payer base as well as consolidated providers, you have to assume going forward that price increases in the U.S. are going to be quite limited.”

This week's gold crash reminds us of a much scarier risk in the markets (Business Insider)

This week's gold crash reminds us of a much scarier risk in the markets (Business Insider)

On Monday, gold crashed by more than 3% in just a matter of seconds.

And experts are still trying to come to a consensus over the cause of the stunning move.

"The move has largely been attributed to the prospect of Fed liftoff and the recent strong run in the Dollar with attention moving back to the Fed after recent events in Greece and China," Deutsche Bank strategist Jim Reid wrote Tuesday morning.

Just call it 'Germoney' after Greek crisis (CNN)

Just call it 'Germoney' after Greek crisis (CNN)

Some Germans have come up with a new name for their country: "Germoney."

In fact, they have made a new flag for their homeland. Out goes the tricolor of black, red and gold. In comes a Greek flag bearing "Germoney" in big red letters.

Oil prices struggle around $50-a-barrel mark (Market Watch)

Oil prices struggle around $50-a-barrel mark (Market Watch)

Oil prices slipped Tuesday, struggling to move significantly above the $50 mark amid persistent concerns over a global oil glut.

A stronger U.S. dollar is also weighing on oil prices after the ICE U.S. dollar index hit a three-month high on Monday, triggering a selloff across commodities as investors shifted to other asset classes.

Light, sweet crude futures for delivery in August CLQ5, +0.28% traded at $50.10 a barrel, down 4 cents, or 0.1%, on the New York Mercantile Exchange. It lost 1.5% in the previous session, falling to a near four-month low of $50.15 a barrel. September Brent crude BRU5, +0.42% on London’s ICE Futures exchange gave up 4 cents, or 0.1%, at $56.61 a barrel.

Lockheed is Latest in Industry's Build-and-Break Surge: Real M&A (Bloomberg)

Lockheed is Latest in Industry's Build-and-Break Surge: Real M&A (Bloomberg)

Lockheed Martin Corp. is the latest industrial giant to grow and shrink in one shot.

The $65 billion defense contractor on Monday announced it was buying United Technologies Corp.’s Sikorsky helicopter unit. At the same time, Lockheed said it’s exploring a sale or spinoff of its information-systems business.

Acquisitions and divestitures are increasingly a package deal for industrial companies as they seek to expand faster-growing businesses and shed those that are holding them back. It’s a move that’s popular with shareholders: General Electric Co. and Danaher Corp. both announced big acquisitions and breakups, and they’re outpacing peers this year. Lockheed climbed about 2 percent on its deal news as investors cheered its tighter focus on defense hardware.

Is This Why The Dollar Is Sliding? (Zero Hedge)

Stocks, bond yields, and the Dollar suddenly started dropping right as The Fed unveiled its revisions for industrial production and capacity utlization.

China's counting on 'kicking the can down the Silk Road' (Business Insider)

The crowd has been fleeing commodities since last year and continues to do so. My contrarian instincts are on full alert. However, I’m hard pressed to make the case for a sufficient pickup in global economic growth to advise going against the crowd.

U.S. stock futures waver with Apple earnings ahead (Market Watch)

U.S. stock futures waver with Apple earnings ahead (Market Watch)

Wall Street braced for a mixed open Tuesday as U.S. stock-index futures struggled for direction on a day likely to be dominated by earnings reports from high-profile companies, including IBM, with few significant economic reports on tap.

Nasdaq-100 index futures NQU5, +0.01% added 3.5 points, or 0.1%, to 4,674.75, on track for a fourth straight session in record territory. The Nasdaq Composite IndexCOMP, -0.10% ended at an all-time closing high on Monday as markets extended a recent relief rally, which has been spurred by better-than-expected earnings and calm in Greece’s bailout saga.

Boomers Competing With Millennials for U.S. Urban Rental Housing (Bloomberg)

Mike Abelson calls it his “man cave.”

After his wife passed away, the 65-year-old sold his house and began renting a 1,400-square foot apartment eight miles away in Bethesda, Maryland. The trial attorney now uses his downtime to enjoy warm summer evenings on his terrace.

Harley-Davidson second-quarter earnings fall, beat expectations (Business Insider)

Harley-Davidson second-quarter earnings fall, beat expectations (Business Insider)

Harley-Davidson Inc. <HOG.N> on Tuesday posted a lower quarterly net profit as the strong U.S. dollar hurt international sales while the company's foreign competitors cut prices.

The company beat analysts' expectations by reporting a net income of $299.8 million or $1.44 per share in the second quarter, down about 15 percent from $354.2 million or $1.62 share a year earlier.

Bank of England Books to be Opened to Auditors in Osborne Plan (Bloomberg)

Bank of England Books to be Opened to Auditors in Osborne Plan (Bloomberg)

The 321-year-old Bank of England’s books will be opened to auditors under a proposal by Chancellor of the Exchequer George Osborne.

Osborne will announce Tuesday that the National Audit Office, an independent government office, will provide “transparency and accountability” to the central bank. Parliament will vote on the bill in the fall, the Treasury said in a briefing note.

The "Energy" Cash Flow Alarm Is Back: Chesapeake Suspends Dividends, Stock Plunges To 12 Year Low (Zero Hedge)

Back in January, the panic surrounding the energy space and specifically the collapse in industry cash flows as a result of the collapse in oil prices, peaked when one after another company announced they would halt dividend payments and all other distributions to shareholders to conserve cash, culminating with the dramatic announcement on January 30 when one of the giants in the space, energy major Chevron, suspended its stock buybacks.

A surprising number of luxury brands depended on bribery in China to generate their revenues (Business Insider)

A surprising number of luxury brands depended on bribery in China to generate their revenues (Business Insider)

Rémy Cointreau, the French high-end spirits group behind Rémy Martin cognac and Mount Gay rum, put out some disappointing numbers on Tuesday.

Sales dived by 9% in first quarter of its financial year, largely due to one big problem: A crackdown on corruption in China, which has led to plummeting sales in China for luxury brands and premium spirit makers.

Endless Pursuit of German Street Sweeper Blunts Czech Central Bank (Bloomberg)

Czechs are getting short-changed.

An economic resurgence that's outshining western Europe hasn't brought a proportional uptick in salaries. Eleven years after the nation joined the European Union, average wages still trail those of a German street sweeper.

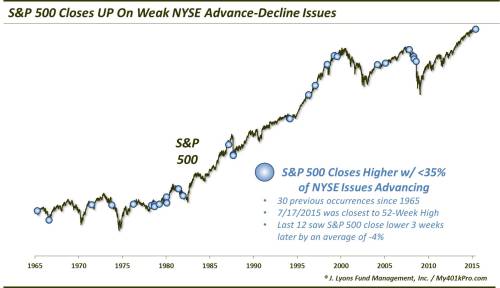

If Beauty's On The Inside, This Market Wins The Ugly Contest (Dana Lyon, Tumblr)

We talk often about the importance we place on solid internals when gauging the health of the stock market. The more stocks that are advancing versus declining, the stronger the foundation – and the more adversity the market is able to withstand. This is especially valid on a longer-term, cumulative basis. However, short-term readings can signal a red flag in the near-term as well. For example, we have taken note of several days over the past 12 months that, on the surface via the major averages, appeared to be strong. However, looking deeper at the internals of such days (including July 18, 2014, November 13, 2014,April 24, 2015 and May 1, 2015), we see that the broader market of stocks was actually relatively weak. Such days are not always an ominous signal of substantial weakness, and indeed the aforementioned dates were not precursors to any major market damage. However, the market did struggle to make any gains over the subsequent 2-3 months each time, despite the generally positive environment during the period.

Japan is worried that the massive Toshiba accounting scandal could scare away investors (Business Insider)

Japan is worried that the massive Toshiba accounting scandal could scare away investors (Business Insider)

Japanese Finance Minister Taro Aso said accounting irregularities at Toshiba Corp were "very regrettable", coming at a time when Japan is trying to regain global investors' confidence with better corporate governance.

"If (Japan) fails to implement appropriate corporate governance, it could lose the market's trust," Aso told a news conference on Tuesday. "It's very regrettable."

Swiss Banks Rehabilitating Russia With Years Biggest Eurobond (Bloomberg)

A lender from Tatarstan is about to go where no other Russian bank has dared in six months: the Eurobond market.

China's master plan (Business Insider)

China's master plan (Business Insider)

Query: How much gold does it take to get international prestige while not ticking off the powers that be?

1,658 tons, apparently. At least officially…

But before we explain further, a look at the yellow metal. Gold’s down $11, at $1,132, near its November 2009 lows. Inflation numbers, as measured by CPI, printed this morning and met surveyed economists’ expectations. Maybe that’s why.

South Africas Stock Index Glitters Even as Golds Appeal Fades (Bloomberg)

In South Africa, once the world’s biggest producer of gold, it’s the stock market that is glittering more than the precious metal.

Mexico's state oil company is paying $295 million to settle a dispute with German conglomerate Siemens (Business Insider)

Mexico's state oil company is paying $295 million to settle a dispute with German conglomerate Siemens (Business Insider)

Mexican state oil company Pemex reached a $295 million settlement with a group including German industrial conglomerate Siemens in a longstanding dispute over a refinery project, a person familiar with the matter said on Monday.

The deal was originally announced in March but did not give details of the final settlement.

Top Currency Gain More Mirage Than Oasis as Kiwi Downtrend Holds (Bloomberg)

Don’t be fooled by the rebound in New Zealand’s dollar. Trading patterns show that the currency is set to continue its descent.

What ‘peak hatred’ for gold may mean for stocks (Market Watch)

What ‘peak hatred’ for gold may mean for stocks (Market Watch)

Even as major indexes are crawling along, the Nasdaq COMP, -0.05% remains on a tear, finishing Monday’s session at a record, the third in a row.

As Tweeter @needgoodcharts points out, the Nasdaq-100 Trust exchange-traded fund QQQ, -0.05% doubled in the stretch from April 1999 to the peak before the crash of 2000 to 2002. Naturally, there’s some anxiety rippling through the markets right now, with momentum stocks like biotechs and Internet crushing the S&P 500 SPX, -0.09% .

Go Big or Go Home Leads to Caution as Nasdaq-100, S&P 500 Climb (Bloomberg)

Gains in U.S. stocks have become so focused on the shares of larger companies that the market appears ready to falter, according to Cam Hui, an adviser to Qwest Investment Management Corp.

There's Hope Beyond Botox as Pharma Races for First Migraine Fix (Bloomberg)

Some wear sunglasses indoors, apply cold vinegar compresses or chew on ginger. Others sit in the dark for days. But there’s one thing most migraine sufferers agree on: the pharma industry has failed them.

Politics

Barney Frank has a one-line zinger to sum up Donald Trump's candidacy (Business Insider)

Barney Frank has a one-line zinger to sum up Donald Trump's candidacy (Business Insider)

Real-estate magnate and Republican presidential candidate Donald Trump has said some pretty controversial things since he announced he was running for president last month.

His comments on everything from Mexican immigrants to veterans and Sen. John McCain (R-Arizona) have landed him in hot water with members of his own party.

Democrats, on the other hand, have been relishing how Trump has grabbed attention —and leads in a number of polls.

Jeb Bush is pushing to make it tougher for lawmakers to become lobbyists (Market Watch)

Jeb Bush is pushing to make it tougher for lawmakers to become lobbyists (Market Watch)

Former Florida Gov. Bush, who is seeking the Republican presidential nomination, says lawmakers should be banned from lobbying their ex-colleagues for six years after leaving office. As the Washington Post writes, that would significantly lengthen the “cooling off period” for members of Congress who later lobby lawmakers on behalf of corporations. House members now have a one-year ban on lobbying and Senate members have a two-year ban. In a speech in Florida on Monday, Bush also called for more lobbying disclosure. “Every time a lobbyist meets with any member of Congress, that should be reported online—every week, and on the member’s official Web site,” he said.

Former High Ranking US Senator Wants To "Hang Edward Snowden On The Courthouse Square" (Liberty Blitzkrieg)

Former High Ranking US Senator Wants To "Hang Edward Snowden On The Courthouse Square" (Liberty Blitzkrieg)

It appears the past few days have represented a sort of coming out party for formerly powerful players in the U.S. government to showcase their fascist tendencies. Earlier today, I highlighted General Wesley Clark’s clear suggestion during a MSNBC interview that Americans who are “disloyal” should be forcibly separated from the “normal” general population through the use of WWII style internment camps.

In the latest display, video has emerged of former Republican Senator, and ex-vice chairman of the Senate Select Committee on Intelligence, saying that Edward Snowden should be hanged in the courthouse square. What ever happened to fair trials?

Mayor: No more Trump deals in NYC future (CNN)

Mayor: No more Trump deals in NYC future (CNN)

New York City's mayor has had enough Trump, thank you.

During a press conference on Monday, Mayor Bill de Blasio said that while he's uncertain whether the city can break several existing contracts with the Republican presidential hopeful, one thing is clear: There will be no future deals between the Big Apple and Trump.

Technology

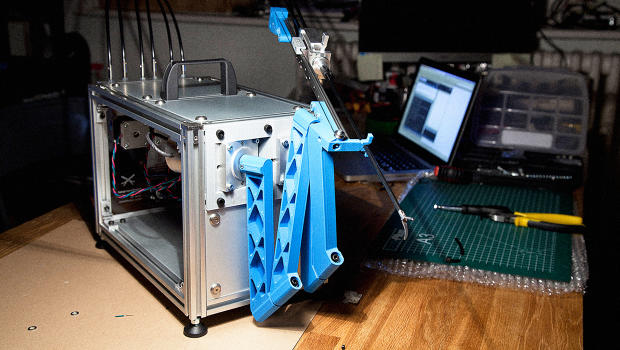

DIY Surgery: The Future Of Medicine? (Fast Company)

DIY Surgery: The Future Of Medicine? (Fast Company)

The Open Surgery Machine concept is an open-source robot that can perform simple operations in the comfort of your home.

In 2015, if you need an operation, you go to a hospital. The Open Surgery Machine imagines a future in which getting an appendectomy is as DIY as downloading a template from Thingsverse and firing up your MakerBot: an open-source robot surgeon in a box that is capable of performing simple, low-cost operations safely and with little doctor intervention.

Lexus built a car that glows in time with its driver's heartbeat (The Verge)

Lexus built a car that glows in time with its driver's heartbeat (The Verge)

Cars are not usually thought of as living things, except in the movie Christine (and also the movie Cars). Still, it's hard not to see something a little anthropomorphic about them. Now Lexus has made automotive sentience even easier to imagine, by equipping a custom RC-F coupe with a human heartbeat.

The car is a new conceptual project by Lexus Australia and M&C Saatchi Australia's creative tech division that aims to more deeply connect the car to its driver. The coupe is covered in electroluminescent paint that glows when hit with an electric charge…

Health and Life Sciences

Eli Lilly's Alzheimer's bet: Blockbuster or bust? (CNN)

Eli Lilly's Alzheimer's bet: Blockbuster or bust? (CNN)

Drug makers are scrambling to figure out a way to manage Alzheimer's, the only leading cause of death that can't be prevented, cured or slowed.

Unless a credible Alzheimer's treatment is developed, the memory-destroying disease could cost the U.S. health care system $1 trillion a year by 2050, according to the Alzheimer's Association.

New Antibody Fights Several Flu Strains At Once (Popular Science)

New Antibody Fights Several Flu Strains At Once (Popular Science)

Researchers have recently discovered a unique antibody that can kill several different types of the flu virus, which could help them develop more powerful flu shots, according to a study published today in Nature Communications.

Each autumn, everyone from your mom to your physician tells you to get a flu shot. That’s necessary because every season the flu virus mutates slightly and your immune system can’t quite identify it, which means that the virus has more time to infect you and make you sick. Of the three types of viruses, Influenza A can cause the most severe symptoms and can infect several different species, meaning that the virus can “jump” from animals like pigs or birds to humans. Flu vaccines effectively give your immune system a “wanted” poster based on researchers’ best predictions for the mutation that year. The goal is that, when the virus arrives, antibodies will be able to bind to the virus and kill it before it can infect you.

Life on the Home Planet

Rhinos get camera implants to deter poachers (The Verge)

Rhinos get camera implants to deter poachers (The Verge)

Conservationists in the UK have created a system that uses GPS tags, heart rate monitors, and embedded cameras to deter poachers from slaughtering rhinos. The Real-time Anti-Poaching Intelligence Device (RAPID) was developed by Protect, a British nonprofit focused on conservation and animal welfare. The device is already being tested in South Africa, where rhino populations are under threat from poachers seeking their valuable horns.

California Farm District Accused of Diverting Water (NY Times)

California Farm District Accused of Diverting Water (NY Times)

California water regulators cracked down Monday on a rural irrigation district accused of illegally diverting water in the midst of the state’s drought emergency, proposing a record $1.5 million fine in what they said would be the first of many penalties like this.

The civil penalty filed against the Byron Bethany Irrigation District, which provides water to farmers in a 45-square-mile area in the Sacramento-San Joaquin River Delta, signals what state officials said would be an aggressive enforcement action directed at water providers that defy cutbacks ordered by the State Water Resources Control Board. It is the first time the state has invoked tough financial penalties, adopted into law last year, that kick in during a drought emergency.