Courtesy of Benzinga.

Benzinga recently spoke with Leav Graves, founder of Option Samurai, about eBay Inc (NASDAQ: EBAY)’s spinoff of digital payment company PayPal Holdings Inc (NASDAQ: PYPL).

Graves discussed why he prefers PayPal over eBay, what he has seen in the options market since the PayPal spinoff and which big-name tech companies are his favorite names to buy right now.

PayPal Vs. eBay

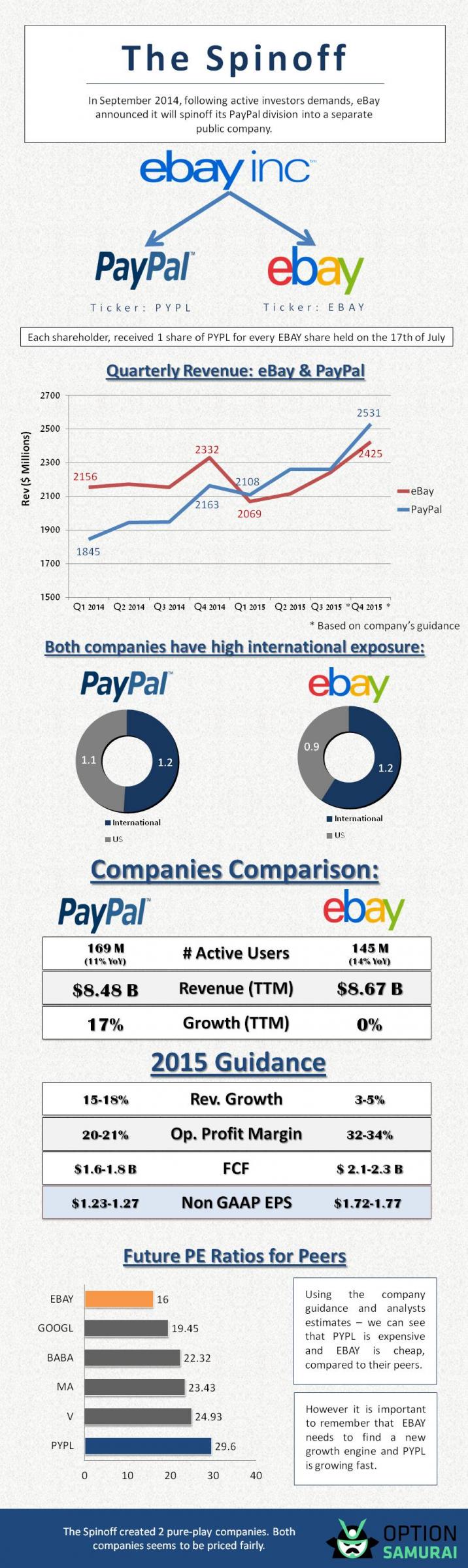

Now that the highly-anticipated PayPal spinoff is in the books, which stock should investors hold going forward? Graves created a detailed infographic pitting the two stocks head-to-head.

Related Link: Citi: Buy PayPal

While PayPal’s valuation, including a forward price to earnings ratio of 29, is steep compared to eBay, Graves sees good reason for the disconnect.

“I’d rather hold PayPal, as it’s a leader in a growing industry,” Graves told Benzinga. “eBay still needs to find a new growth engine, and it is unclear what it will be.”

EBay is currently projecting 2015 revenue growth of 3-5 percent, while PayPal is projecting growth of 15-18 percent.

Options Advice

When Benzinga asked about the brand new PayPal options market, Graves issued a word of caution to eager traders. The market’s extreme volatility has made it dangerous to trade so far, and he would recommend waiting for a reduction in volatility before taking a position. He added that, if premiums remain high, he would consider selling far puts with a low strike price (for example, $30), which would potentially allow investors to buy shares of the stock at a lower price.

Top Tech Picks

Although the excitement in the tech space seems to have centered on growth rather than value in recent months, Graves’ favorite tech pick is currently value play International Business Machines Corp (NYSE: IBM).

“I think that they have a diversified product offering and the management has consistently proved that they can steer the company down a profitable path,” he said.

For tech investors who prefer stronger growth, Graves is also bullish on Check Point Software Technologies Ltd (NASDAQ: CHKP).

Latest Ratings for EBAY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jul 2015 | Morgan Stanley | Initiates Coverage on | Equal-weight | |

| Jul 2015 | Raymond James | Downgrades | Outperform | Market Perform |

| Jul 2015 | Barclays | Maintains | Equal-weight |

View More Analyst Ratings for EBAY

View the Latest Analyst Ratings

Posted-In: Analyst Color Options Exclusives Markets Analyst Ratings Tech Best of Benzinga