Congratulations to Bill Ackman!

Desperately needing a win after getting crushed on his Herbalife (HLF) short battle with Carl (still the King) Ichan, Ackman had a $1Bn shortfall to cover (allegedly) in his Pershing Square Fund so he bet it all on black with a $5.5Bn bet on Mondelez (MDLZ), who used to be Kraft, but no one is going to value Kraft at 33 times earnings but MONDELEZ sounds foreign and webby – so why not?

Do me a favor and Google "Ackman Mondelez" and see how many stories there are on this "news." Now, as you know, I don't like talking about things everyone else is talking about because we teach our Members at PSW not to be one of the Beautiful Sheeple and dig a little deeper into these stories. As it turns out, Ackman already owned 6M shares of MDLZ as early as March of 2013, when the stock was $27 ($162M at the time).

So Ackman didn't suddenly buy $5.5Bn worth of MDLZ at the current, crazy price – he's been buying it since 2013 and NOW he is ready to tell you about it (because now he wants to start selling, most likely). Ackman and Nelson Peltz have been touting the story that PEP or (name any big, wealthy company) would be interested in buying MDLZ since 2013 and now that the stock is 60% higher, they are rolling it out again because it's time to cash out sheeple!

So Ackman didn't suddenly buy $5.5Bn worth of MDLZ at the current, crazy price – he's been buying it since 2013 and NOW he is ready to tell you about it (because now he wants to start selling, most likely). Ackman and Nelson Peltz have been touting the story that PEP or (name any big, wealthy company) would be interested in buying MDLZ since 2013 and now that the stock is 60% higher, they are rolling it out again because it's time to cash out sheeple!

That's why this story is hitting the wires now, the Big Boys, who bought it at $30-40 are flooding the press with stories and calling in favors from their media puppets to stampede the sheeple into an already overpriced stock so they can dump their Billions of Dollars worth of shares on retail investors.

$48 is an $80Bn valuation on a company that made $2Bn last year with projections to make $2.04 per share next year, if all goes well – still a stiff PE of 24 compared to the average p/e for the Consumer Goods sector of 14.8 – even in today's crazy market and even with MDLZ bringing up the average considerably. You'll hear Peltz and Ackman spout the usual nonsense about China but do you really think people in China haven't heard of Oreos or Trident or Cadbury? Cadbury has been in China longer than the US (it's British)!

By the way, if you want a laugh and to also understand why there's not all that much value to US food brands in China – check out this and this video of Chinese people trying American staple foods.

Speaking of Ackman being wrong by a mile, HLF just knocked it out of the park with their earnings beat and, if Ackman is still short, he might need to liquidate that MDLZ stock to cover HLF at this pace. Ackman had been short $1Bn worth of HLF but, as of June, he claimed to have switched to puts yet the biggest put position on HLF is 54,568 of the Jan $50 puts, which were $8.80 at yesterday's close for $48M – that wouldn't put a dent in getting Ackman's losses back (and a big loss today as HLF pops 8%).

It will be interesting to see how Pershing Square's investors react to this news as $5.5Bn is about 1/3 of the fund's $18Bn total and that's a lot of money riding on a single position. Still, buying the stock and then making the big announcement can give Ackman a 10-20% gain on his $5.5Bn (on paper – it's going to be hard to sell in quantity at that price) to offset his losses on HLF, which will help placate his investors so, mission accomplished.

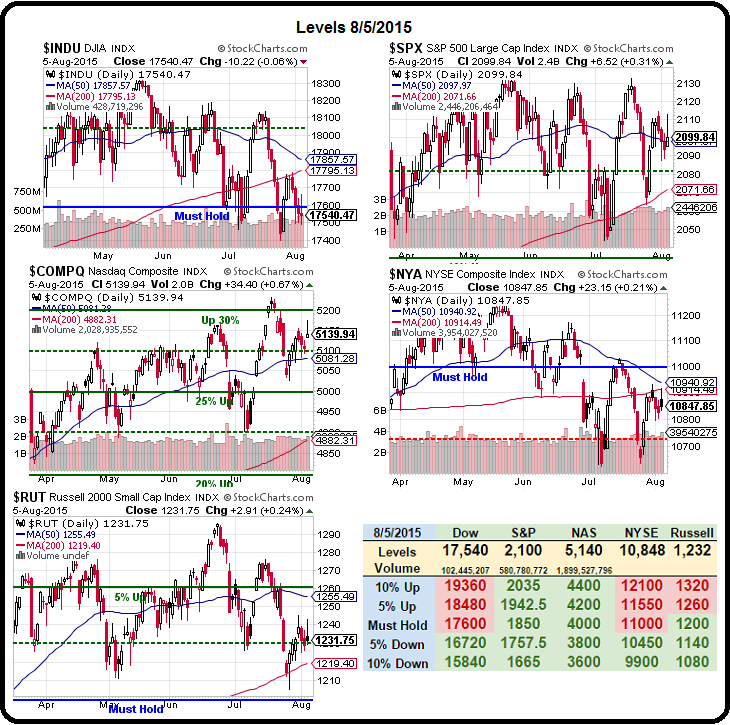

Speaking of manipulation, I was off on my S&P 2,100 call yesterday and I apologize as the S&P finished at 2,099.84 for the day. We are double-checking our math to see why we had that 0.16 miss… As you can see from the Big Chart, death crosses on the Dow and the NYSE seem inevitable at this point and the S&P has to hold 2,100 just to stop the 50 dma from falling but that still lets the 200 dma rise so the S&P has to be over 2,120 to change it's fate – 2,100 is not going to be enough.

And, of course, any day the NYSE and Dow are below their 200 dma's (17,800 and 10,900) is another day that line bends down, sharpening the 50 dma's (17,850 and 10,950) angle of attack as it prepares to pierce the big red line and give a very strong bearish signal to the Technical Traders, who now make up close to 80% of the market and probably more of that on a volume basis.

That's why we have to switch off our brains and go technical in this kind of market. While TA may be voodoo, it's a voodoo a lot of people believe in and that, in itself, gives it power. It also gives us power to make money as we can see though the tricks that the Banksters are using to manipulate the TA and our Futures lines from yesterday still stand although Russell Futures (/TF) are 1,230 now and we also like Nasdaq Futures (/NQ) short at 4,600.

For more detailed notes on Futures, Commodities, TSLA, Greece and Inflation – see this morning's tweet.