Courtesy of Benzinga.

The major indexes have started the week off on a positive note Monday morning. Here’s a list of charts that Brean Capital technical analyst Frank Longman is watching this week.

For the Daily SP500 E-mini, Longman believes “there’s an inclination to test the primary uptrend at 2007 before a new high.” He is predicting a bounce off of that trend line on the first test.

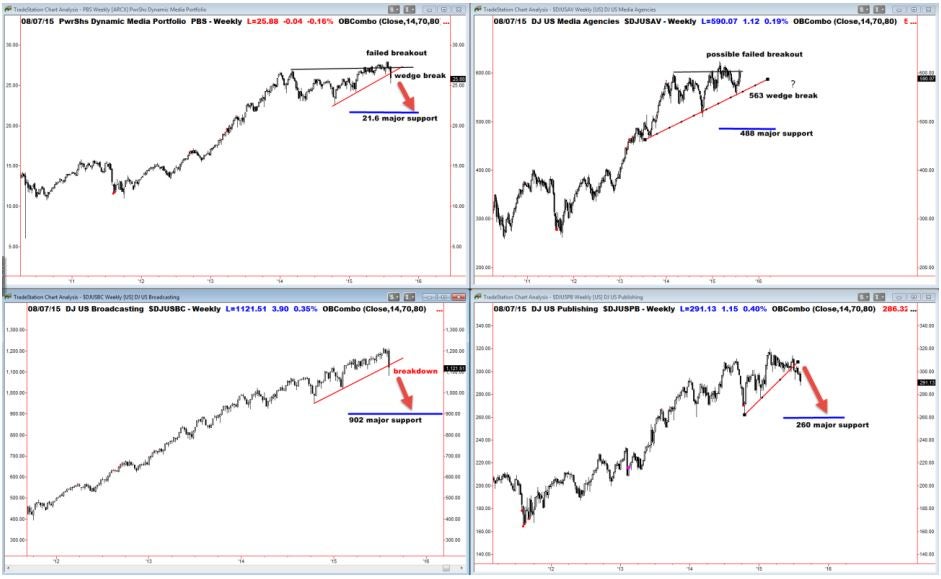

Media stocks were hit hard last week, and Longman is looking for the group to test long-term support levels. “The damage thus far has us thinking that a correction of the uptrend that began at 2011’s lows has begun and we’ve labeled the 38% retracement versus that low ‘major support,’” he explains.

Despite recent weakness, Longman points out that the long-term bullish trend in biotech remains intact. He believes that a retracement of another 11 percent is in store for the iShares Nasdaq Biotechnology ETF (NASDAQ: IBB) before the sector resumes its uptrend.

Despite recent pressure, it’s not all bad news for the tech sector from a technical perspective. Longman still sees technical strength in the charts of Arista Networks Inc (NYSE: ANET), F5 Networks Inc (NASDAQ: FFIV), Mobileye NV (NYSE: MBLY) and Zebra Technologies Corp (NASDAQ: ZBRA).

Longman recommends taking profits on the SPDR S&P Regional Banking ETF (NYSE: KRE) after the ETF recently broke below its support line.

Longman also notes that weakness in regional banks should have owners of the Financial Select Sector SPDR ETF (NYSE: XLF) watching closely for a similar technical breakdown.

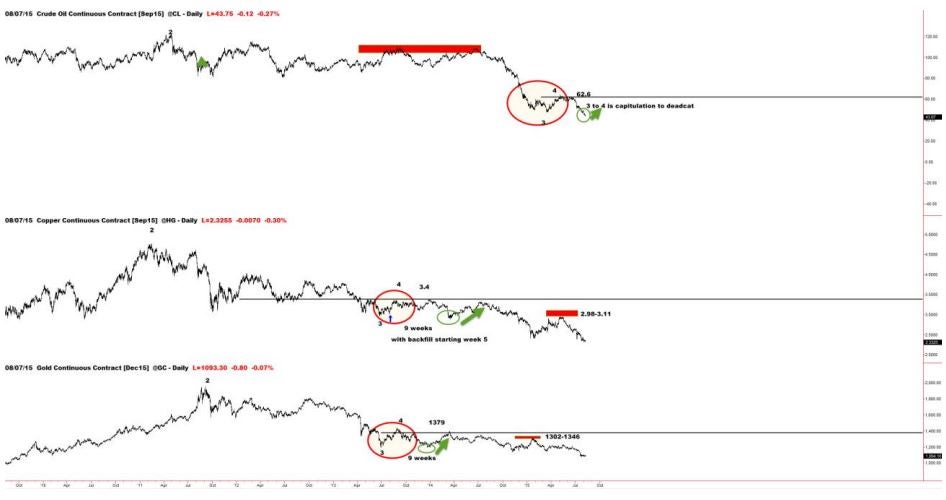

Finally, while Longman believes that WTI oil prices are still entrenched in a long-term downtrend, he feels a short position at this juncture would be “more trouble than it’s worth.” He predicts a short squeeze could be coming soon for crude oil based on comparisons to the price action of gold and copper back in 2013.

Posted-In: Analyst Color Biotech Sector ETFs Specialty ETFs Technicals Commodities Top Stories Markets Best of Benzinga