European Stock Selloff Intensifies as DAX Heads for Bear Market (Bloomberg)

The European stock rout is getting worse as equities tumbled for a fourth day and Germany’s benchmark gauge headed for a bear market.

"Black Monday" – Shanghai Composite Goes Red For The Year, Wiping Out 60% In Gains, 2000 Stocks Limit Down (Zero Hedge)

Judging by the first few minutes of trading in the first thing to open this evening on the mainland, the CSI 300 Index Futures which immediately tumbled by 4% to 3340, China's attempt to deflect attention from the fact that it did not do a 50-100 bps RRR cut is not doing too well.

GIRD YOUR LOINS: Here's your preview of this week's big market-moving events (Business Insider)

The global financial markets are getting walloped.

The Dow ended Friday at 16,450, down a whopping 1,018 points for the week. The blue-chip index booked its first back-to-back, down-300-plus-point days since November 2008. It's now down 10.3% from its May 19 high of 18,351, which means that the market is now in a correction.

World stock markets from China to Europe to the Middle East are getting slammed. Meanwhile, commodities like oil and copper are getting wrecked.

All of this puts the Federal Reserve in a precarious position as it considers tightening monetary policy in the very near future.

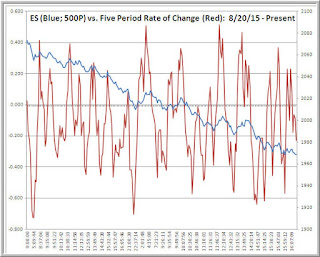

Adapting to the Market's True Clock (TraderFeed)

The previous post illustrated why trading is challenging, as markets change their volume, volatility, and trendiness–sometimes quite radically. On Friday, for example, SPY traded with a true range of over 3%, three times the average daily true range of the previous 20 trading sessions. Volume expanded to over 345 million shares, also three times the average volume of the prior 20 sessions. Friday's pure volatility (volatility per unit of volume) rose to twice the level we had averaged since April–meaning that, not only were we getting more volume coming into the market, but the volume was creating twice the previous movement.

Crash Rules Everything Around Me (A Wealth of Common Sense)

It’s very easy to dwell on the bad times because that’s when the majority of investors make their worst mistakes. Loss aversion is a well-known behavior trait by now, but just because we know that losses hurt much more than gains feel good doesn’t mean we can all of the sudden change our mental or physical make-up. Studies have shown that losses are processed in the same part of the brain that responds to mortal danger. And it’s true that some people can even relive losses in their sleep.

Global Stocks Plunge Further Amid Doubts About China (NY Times)

HONG KONG — Global markets continued to plunge on Monday, with stocks across Asia sliding sharply, led by a rout in China.

The main Shanghai share index was down 8.4 percent by early afternoon, erasing its gains so far this year. The selling in China has accelerated despite extraordinary government intervention in the past two months aimed at propping up share prices. As Monday’s slide highlighted, those efforts have not been a success.

This Week’s Market Sell-Off May Not Be Such a Bad Thing (NY Times)

It has been a frantic week on Wall Street and in other financial centers, with stocks and other risky assets experiencing their worst week in years.

The 3.2 percent drop in the Standard & Poor’s 500-stock index on Friday culminated the worst week for United States stocks since 2011, and put the index 7.5 percent below its recent peak on May 21. Many global markets have performed even worse, with stocks down across Asia and Europe. And the price of oil and emerging market currencies around the world continued a decline that dates to last year.

It’s about time.

10 Underrated Charlie Munger Quotes (A Wealth of Common Sense)

I got the chance to read an early copy of Tren Griffin’s excellent new book on Munger, Charlie Munger: The Complete Investor, and it didn’t disappoint. Here’s the blurb I wrote for the book:

Griffin is better than anyone else at explaining the most important ideas from the best and brightest minds in business and investing in a way people can easily understand. This book is overflowing with wisdom. Readers will receive a master’s degree in decision making, investing, human psychology, and much more. The definitive book on Warren Buffet’s business partner.