Courtesy of Mish.

With all the chatter about whether the Fed will hike on September 17 or not, let’s do an interest rate and bond yield recap of where various rates are, where they have been, and where they are likely headed.

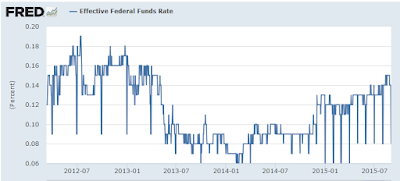

Effective Federal Funds Rate

As of yesterday, the effective federal funds rate was a mere 8 basis points. Since April, it has been swinging from a low of 6-8 basis points to a high of 14-15 basis points.

I suspect the odds of a hike are close to 50-50.

The CME Fed Watch has the hike odds at 27% as of September 2. However, the CME does not consider a move to 0.25% a hike.

I do, because it clearly is.

The current Fed stance is 0.00% to 0.25%. With the effective Fed Funds rate hovering between 8 and 15 basis points, a move to a firm 0.25% would be about an eighth of a point hike.

Why nearly everyone expects a quarter point hike is a pure mystery to me.

If the Fed delays until December, we may see such a move (if the economy stays reasonably firm), but even then, I believe the Fed will baby-step this in a Market May I approach, quite similar to the childhood “Mother May I” game.

Yellen vs. Greenspan

…