View Single Comment

-

phil

September 4th, 2015 at 6:52 amGood morning!

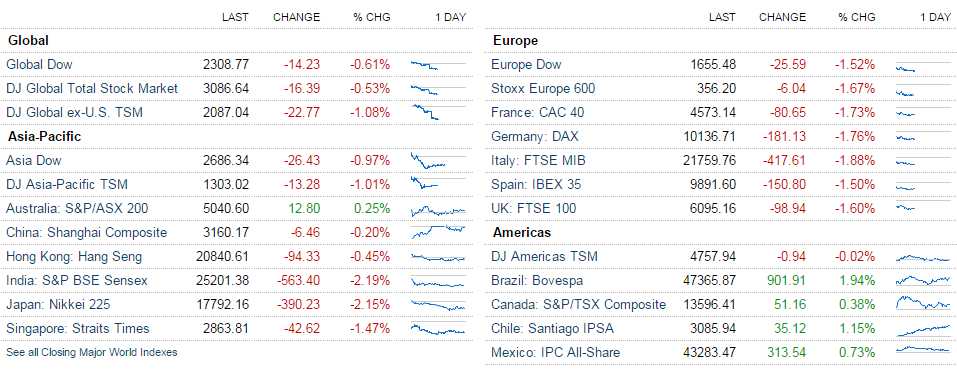

Amazingly, people were surprised German factory orders were down despite the fact that our factory orders were down 2 days ago (as well as all the other data that pointed to that outcome). Anyway, that's burst Europe's bubble and they've given back all of yesterday's gains and our Futures are trading down with them, which is extra-silly as we didn't go up with them yesterday!

Of course the key takeaway here is that the DAX sucks and now it joins team death cross at our 11,000 line. We called this, what, 3 months ago?

Futures-wise, we're back to 16,200, 1,925, 4,175 and 1,130 – yawn… This is why (and I may have mentioned this a few times) I don't like to do anything when we're bouncing around between the weak and strong bounce lines. The whole point of the lines is to wait for a confirmed breakout – one way or the other!

- Dow 16,200 (weak) and 16,650 (strong)

- S&P 1,900 (weak) and 1,950 (strong)

- Nasdaq 4,550 (weak) and 4,700 (strong)

- NYSE 10,050 (weak) and 10,300 (strong)

- Russell 1,130 (weak) and 1,160 (strong).

A lot of you may not remember this but the Big Chart used to be just the spreadsheet in the right corner of StJs chart because I went 30 years without even looking at charts and was more accurate using my 5% Rule and a spreadsheet than all the other TA people combined.

Yesterday, we lost green boxes on the S&P and the Nasdaq and the Russell turned red – that's a BAD DAY – that's all you need to know about technicals. It wasn't bad enough to make us more bearish and neither are today's drops IF these lines hold (huge if). NYSE finished right at 10,049 but will be back at around 9,900 this morning. This NYSE chart is very disturbing:

That's 82% of the NYSE is now BELOW the 200 dma. WTF is holding the indexes up should be the real question and the answer is what I was talking about last week, when I said I can't trust any "recovery" that puts AMZN back to $500 and NFLX back to $110 because a lot of these 100x MoMos are the stocks that most need to capitulate, so that money can be put to better use in the real economy (as opposed to the fantasy future economy that doesn't exist yet – and maybe never will).

If you are going to look at TA, those monthly charts are the most reliable, since they already cancel most of the noise. Notice the scary similarity of this move to the death-cross move in 2008. This is why I called for CASH!!! this week – you can't hedge bullish positions against that kind of drop (without getting crazy-aggressively bearish) and, since there was a POSSIBILITY that that could happen – it was easier to get to cash than to attempt to perform some miraculous portfolio balancing act.

I will look like quite a genius after the fact but those of you who found it "too inconvenient" to cash out positions may want to consider this fear you are feeling now to be a very important market lesson – even if we do luck out and turn around!

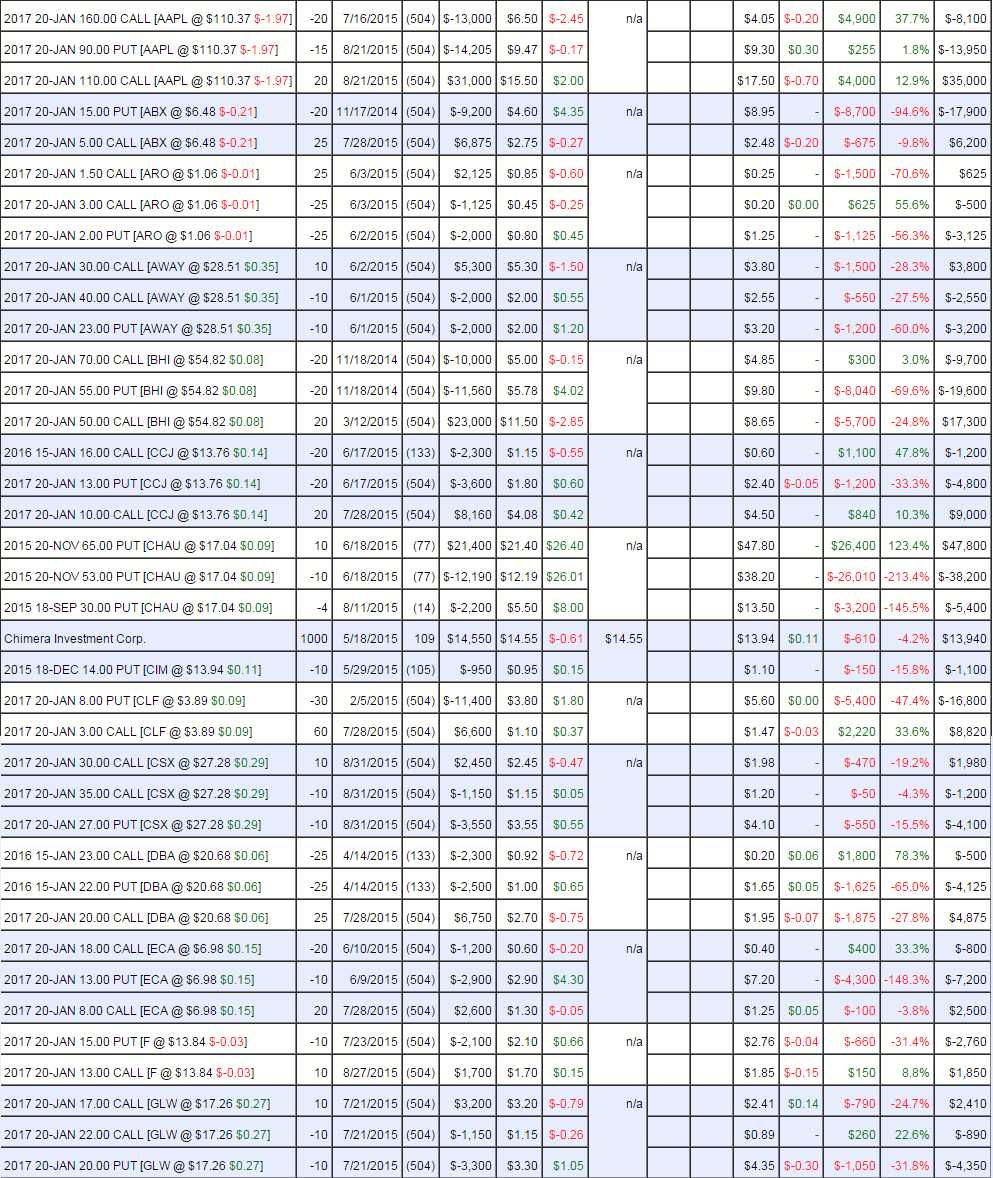

Speaking of which, we're going to cash SCO out in the STP because it's too much to risk (up $34,000 with only $17,000 left to gain) and also because it nets us more bullish as a market crash is probably an oil crash so removing that trade alone from the STP turns us much more bearish overall:

We're very close to balance with the LTP for the last two weeks:

That's $987,207 folks, that's up $387,207 (64.5%) overall. When your gains are outpacing the market by a wide margin – YOU CASH OUT!!! This is why hedge funds don't outperform – they are pressured by their Members to stay invested, even when market conditions change drastically. I'm not some idiot hedge fund manager and I am going to go with my gut here (now that I've looked over these positions and since I said SCO will balance us more bearish) and CASH OUT!!!

One caveat is don't liquidate positions in a panic. If you aren't getting a good NET exit (near what you show on the balance sheet), then that can be one you hang on to. The more cash you have, the more you can afford to roll or double down the positions you have left…

This does not apply to the Butterfly Portfolio, which is now up 66% on it's own but, at 55% – I'll probably look to cash that too.

If I'm wrong, then our LTP becomes a Buy List and we can begin picking up new positions and, if I'm right, we'll be able to buy A LOT of stuff much cheaper. I am sorry if this is a pain in the ass but I can't, in good conscience, recommend staying invested in this market – it's simply too dangerous.

Now, if you must stay invested, I'm going to write a post about disaster hedges this morning and we can discuss proportions etc. in chat today.

Again, sorry about the hassle but I regret not screaming the same thing in 2008 and this time I'd rather be the idiot that cashed out ahead of the next round of stimulus than the idiot who let people pressure him into keeping positions open against his better judgement.