Financial Markets and Economy

U.S. Index Futures Erase Gains With Stocks Set for Weekly Rise (Bloomberg)

U.S. stock-index futures erased an earlier advance, with equities heading for gains in a week of wide-ranging swings amid speculation over a Federal Reserve rate decision this month.

Europe's most important finance minister warns we're 'moving towards the next bubble' (Business Insider)

Europe's most important finance minister warns we're 'moving towards the next bubble' (Business Insider)

Wolfgang Schaeuble, the German finance minister, is undoubtedly one of the most important people in European economic policy.

The European Central Bank's Mario Draghi might edge him out for the number one spot, but out of the finance ministers, everyone knows that Schaeuble reigns supreme.

China's Credit Growth Expanded in August as Rate Cuts Kick In (Bloomberg)

China's Credit Growth Expanded in August as Rate Cuts Kick In (Bloomberg)

China’s broadest measure of new credit increased in August, suggesting demand for loans is holding up after renewed rounds of monetary easing that followed the stock-market debacle of the past three months.

Aggregate financing rose to 1.08 trillion yuan ($169.5 billion) in August, from 718.8 billion yuan in July, according to a report Thursday from the People’s Bank of China that matched the estimate for 1 trillion yuan in a survey of economists.

China central bank seen ready to intervene again if offshore pushes yuan too far (Business Insider)

China central bank seen ready to intervene again if offshore pushes yuan too far (Business Insider)

A spike higher in the offshore yuan following suspected rare intervention by Chinese state banks is expected to be short-lived, especially with a looming U.S. interest rate rise likely to add to the attraction of owning dollars.

But those betting on a further depreciation in the yuan are likely to have only limited room to push the offshore rate down relative to the onshore rate without drawing the ire of the Chinese central bank and the risk of further state intervention, market sources said.

Oil prices could sink to $20 a barrel, warns Goldman (Market Watch)

Oil prices could sink to $20 a barrel, warns Goldman (Market Watch)

The global supply glut in the oil market is even bigger than expected and could push prices to as low as $20 a barrel, Goldman Sachs warned in a report on Friday.

Over the past two months, crude oil CLV5, -2.26% has plunged from around $60 a barrel to below $40 a barrel at one point, underscoring the weak fundamentals in the energy markets, analysts at the investment bank said. Brent LCOV5, -2.19% futures have slumped from around $65 in June to below $50 in recent days.

Emerging Stocks Head for Best Weekly Gain Since April; Won Rises (Bloomberg)

Emerging-market stocks pared their biggest weekly gain since April amid conflicting speculation about whether or not the Federal Reserve will raise interest rates this month and China’s economy will avoid a hard landing.

European markets are heading down while they wait for the US Fed (Business Insider)

European markets are heading down while they wait for the US Fed (Business Insider)

European markets are having a feeble end to the week, with all eyes on the US Federal Reserve meeting next week.

Overnight on Wall Street, US markets closed up a little higher at 0.5%.

"The overriding factor for markets from now until next week will still focus on the 'will they won’t they' hike rates at the coming FOMC 16th & 17th meeting," Mic Mills, head of client services at CapitalIndex, said in an e-mail.

U.S. stocks: Futures drop, but weekly gain still eyed (Market Watch)

U.S. stock futures fell early Friday, but investors still eyed weekly gains as they waited for readings on consumer sentiment and wholesale prices.

S&P 500 futures ESU5, -0.26% dropped by 8.85 points, or 0.5%, to 1,940.75, while those for the Dow Jones Industrial Average YMU5, -0.21% shed 65 points, or 0.4%, to 16,241. Nasdaq 100 NQU5, -0.36% futures lost 26.75 points, or 0.6%, to 4,268.25.

Charting the Markets: Global Stocks Set for Weekly Gain (Bloomberg)

Asian stock markets look set to end their longest losing streak in four years. The MSCI Asia Pacific Index is headed for its first weekly gain in eight amid optimism Chinese authorities will stabilize the nation's economy and financial markets. The week opened with People's Bank of China Governor Zhou Ziaochuan saying the rout in Chinese equities is close to ending. Chinese Premier Li Keqiang bookended the week by saying authorities have sufficient tools to prop up the economy.

Japan business mood rebounds, PM Abe to pressure firms to raise capex (Business Insider)

Japan business mood rebounds, PM Abe to pressure firms to raise capex (Business Insider)

Japanese business sentiment turned positive in July-September and companies stuck to upbeat spending plans, a government survey showed, offering some relief for policymakers worried about a hit from slowing Chinese growth and ensuing market turmoil.

The poll, the first comprehensive business confidence survey for the current quarter, followed a recent run of gloomy data, including a survey showing the service sector's mood worsening in August.

An investing lesson from the 9/11 tragedy (Market Watch)

Dumping stocks during a panic is never a good idea.

That’s true even when it’s caused by something as awful as the U.S. being attacked, as it was 14 years ago today. It’s important to remember that, since it’s inevitable that this country again will fall victim to a terrorist attack sometime in the future.

Oil Supply Outside OPEC to Fall Most Since 1992, IEA Forecasts (Bloomberg)

Oil supplies outside OPEC will decline next year by the most in more than two decades as the price rout curbs U.S. shale output, according to the International Energy Agency.

Oil weakens as Saudi sees no need for oil summit to defend prices (Business Insider)

Oil weakens as Saudi sees no need for oil summit to defend prices (Business Insider)

Crude oil prices dipped on Friday and were poised for a weekly fall after news that top oil exporter Saudi Arabia sees no need for a producer summit to defend prices, partly offsetting a strong rally in the previous session.

The front-month October contract for Brent, the global oil benchmark, shed 5 cents to $48.84 a barrel as of 0217 GMT after it settled up $1.31, or 2.8 percent, on Thursday at $48.89 a barrel.

Euro Area Toughens Up as China Deals Blow to Global Fortunes (Bloomberg)

The euro area might have built up enough momentum to shrug off China’s woes for now.

U.K. Stocks Decline Second Day, With BT, Vodafone Leading Losses (Bloomberg)

U.K. stocks fell for a second day, paring a weekly gain, as telecommunications companies retreated.

Politics

Gamblers are betting against a Trump White House (CNN)

Gamblers are betting against a Trump White House (CNN)

Don't bank on Donald Trump becoming the 45th president of the United States.

That's the message from the gamblers placing bets on the 2016 race for the White House.

Emotional Biden tells Colbert he’s ‘not there’ on White House bid (Market Watch)

Emotional Biden tells Colbert he’s ‘not there’ on White House bid (Market Watch)

Vice President Joe Biden did not use his appearance on the third episode of “The Late Show With Stephen Colbert” as a springboard for his potential White House bid.

In an emotional interview, with only the scarce joke mixed in, Biden directly spoke about the idea of running for president when pressed by Colbert but made no major news.

Technology

SpaceX just released footage of its new manned spaceship and it looks weirdly cool (Quartz)

SpaceX just released footage of its new manned spaceship and it looks weirdly cool (Quartz)

SpaceX just showed off the interior of its new Crew Dragon ship that will transport astronauts to the International Space Station (ISS). The launch video released today (Sept. 10) looks like something a luxury car manufacturer might use to show off a new sedan.

Crew Dragon was designed to be an enjoyable ride. With four windows, passengers can take in views of Earth, the Moon, and the wider Solar System right from their seats, which are made from the highest-grade carbon fiber and Alcantara cloth.

Health and Life Sciences

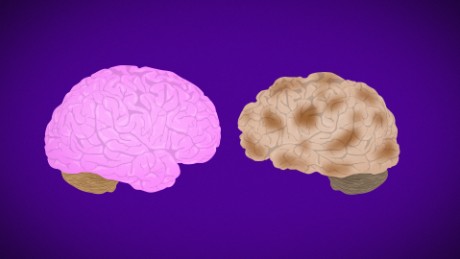

No, Alzheimer's is not contagious (CNN)

No, Alzheimer's is not contagious (CNN)

The headlines tossed across the front pages of British newspapers certainly sound shocking: "You can catch Alzheimer's" the front page of the Daily Mirror screamed. "Alzheimer's disease may be infectious," The Independent wrote. The Daily Mail said "Alzheimer's link to blood transfusions."

The problem? They're wrong.

Life on the Home Planet

El Nino Will Be Big, But It Probably Won’t Kill the Drought (Wired)

El Nino Will Be Big, But It Probably Won’t Kill the Drought (Wired)

THE WHOLE WIDE west is craving a wet winter, and the big El Niño brewing in the Pacific looks poised to satisfy. Today, the National Weather Service released its monthly update on the weather phenomenon, and the meteorologists are saying this year’s is one of the strongest El Niños on record.

But that forecast comes laden with caveats. For one, it matters where and when that precipitation falls. If it falls too far south, it won’t fill crucial reservoirs. Neither would it help much with the Pacific Northwest’s wildfires….

Not everyone in Germany is eager to welcome refugees (Mashable)

Not everyone in Germany is eager to welcome refugees (Mashable)

About 100 volunteers lined up outside an enormous concrete storage hall at the convention center early Thursday morning, waiting to sort mounds of clothing, shoes, toys and toiletry donated to the city’s growing number of refugees.

Less than two miles east, in a leafy neighborhood called Poeseldorf, grass was overgrowing on the site of a former military recruitment center slated to house 200 refugees. This asylum shelter — in a wealthy neighborhood in one of Germany’s richest cities — has been blocked from opening for almost two years, the plans tied up in a legal battle with nearby homeowners.