Financial Markets and Economy

U.S. Stock-Index Futures Decline as Investors Weigh Fed Policy (Bloomberg)

U.S. stock-index futures fell as investors weighed the implications of the Federal Reserves decision to hold off raising rates.

Those 10% average yearly stock gains aren’t likely coming back soon (Market Watch)

Those 10% average yearly stock gains aren’t likely coming back soon (Market Watch)

Two financial industry heavyweights are giving different forecasts for future U.S. stock market returns, and the more pessimistic view may be correct.

First, Barron’s published an interview with Joe Rosenberg, a retired Wall Street legend who spent most of his career at Lowes Corp, the Tisch family conglomerate. Regarding the stock market, Rosenberg said.

Goldman: It's not going to happen in October (Business Insider)

Goldman: It's not going to happen in October (Business Insider)

Forget about October.

On Thursday, we finally learned the Federal Reserve's updated plan for interest rates, and as expected they delayed raising its target rate range of 0 to 0.25%. It's been at this near-zero level since December 2008.

The Fed repeated that the labor market needs to be even better, inflation needs to be closer to its 2% target, and the global economy cannot be falling apart.

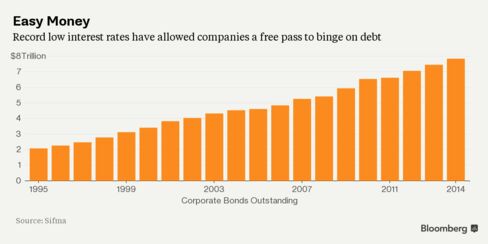

It's Party On in Credit Markets as Fed Stays at Zero for Longer (Bloomberg)

The $11.8 trillion U.S. corporate borrowing binge will carry on.

Gold rallies to nearly one-month high as Fed stands pat on rates (Market Watch)

Gold rallies to nearly one-month high as Fed stands pat on rates (Market Watch)

Gold futures on Friday looked ready to log their highest close in almost a month, as prices rallied on the back of the Federal Reserve’s decision to keep interest rates at historically low levels.

Gold for December delivery GCZ5, +1.78% jumped $23.20, or 2.1%, to $1,140.20 an ounce on Comex. A close around this level would be the highest since Aug. 24. December silver SIZ5, +1.41% also gained 24.1 cents, or 1.6%, to $15.225 an ounce.

JPMorgan third quarter trading revenue down like other firms, CEO says (Business Insider)

JPMorgan third quarter trading revenue down like other firms, CEO says (Business Insider)

JPMorgan Chase & Co <JPM.N> third quarter markets revenue is running "about the same as everybody else," CEO Jamie Dimon said on Friday after two major competitors said their revenue is down about 5 percent from a year earlier.

Dimon did not give a percentage change for JPMorgan. He was speaking at an investor conference sponsored by Barclays where in the past two days executives from Bank of America Corp <BAC.N> and Citigroup Inc <C.N> gave their 5 percent decline estimates with two more weeks to go in the quarter.

Glencore Stock Dips Below Sale Price of $2.5 Billion Offering (Bloomberg)

It took just two days for Glencore Plc investors to get a better deal on the stock.

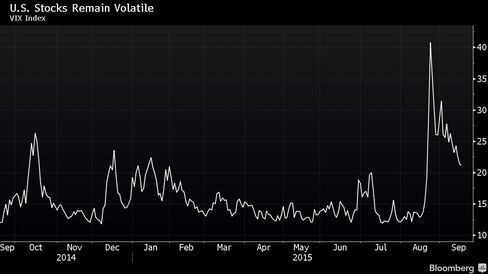

Stocks are getting slammed (Business Insider)

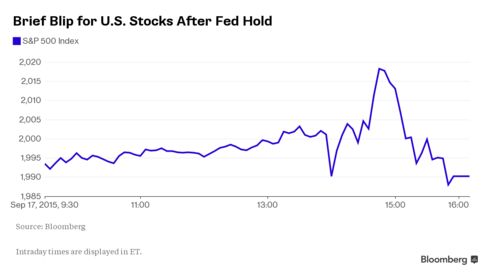

It's the day after the Federal Reserve's big meeting in which it decided to keep interest rates pegged near 0%.

And after a wild swing on Thursday that saw stocks ultimately end the day lower, they opened in the red on Friday morning.

_edited-1.png)

Oil prices fall as investors grapple with U.S. rate uncertainty (Market Watch)

Oil prices fall as investors grapple with U.S. rate uncertainty (Market Watch)

Oil prices fell in European trade Friday after the U.S. Federal Reserve’s decision to keep interest rates unchanged left markets in the lurch.

Investors are now grappling with uncertainty about the timing of a U.S. interest-rate increase. The late Thursday decision weakened the greenback sharply, which should be supportive for oil prices, but the macroeconomic concerns behind the decision are having a bearish impact on the oil market.

Charting the Markets: Fed? What Fed? Unless You're in Treasuries (Bloomberg)

If you were counting on Janet Yellen to either set the markets alight or you fretted about the coming apocalypse last night, you were in for a more nuanced reaction – unless you’re in credit markets. The U.S. two-year T-bill yield jumped the most since March 2009. But the benchmark U.S. index, the S&P 500, took just 48 minutes to give up its post-decision gains.

The number of 'unicorn' startups worth over $1 billion has grown by 3000% since 2009 (Business Insider)

A note from investment bank Credit Suisse on Friday shows just how much the valuation of many of the most well-known and successful start-ups has exploded in the post-financial crisis years.

Dollar on track for three-week low after Fed stands pat (Market Watch)

Dollar on track for three-week low after Fed stands pat (Market Watch)

The dollar extended its losses against other major currencies on Friday, underscoring investors’ wariness over weakness in the global economy and markets after the Federal Reserve’s decision to keep interest rates unchanged.

The Federal Reserve left short-term interest rates unchanged Thursday after weeks of market-churning debate over whether the central bank would end an era of near-zero rates. Fed Chairwoman Janet Yellen said concerns about inflation, China and financial markets contributed to the Fed’s decision to stand pat.

U.K. Stocks Fall for Second Day After Fed Delays Raising Rates (Bloomberg)

U.K. stocks fell, tracking losses in European equities, after the Federal Reserve proved reluctant to raise rates amid concern about global economic and market risks.

Fiorina Increased Hewlett-Packard’s Sales, but Not Its Profits (NY Times)

Fiorina Increased Hewlett-Packard’s Sales, but Not Its Profits (NY Times)

At Wednesday’s Republican presidential debate, Carly Fiorina defended her record as C.E.O. of Hewlett-Packard. She was fired in 2005, and Donald Trump, among others, has criticized her performance.

The early 2000s were a tough time for the tech industry, she said, and yet, “despite those difficult times, we doubled the size of the company, we quadrupled its topline growth rate, we quadrupled its cash flow, we tripled its rate of innovation.”

NYSE is making a big change after being attacked for its handling of market chaos (Business Insider)

NYSE is making a big change after being attacked for its handling of market chaos (Business Insider)

The New York Stock Exchange is about to make a change to how it shares information with investors, after coming under fire from clients for how it handled stock market swings in August.

The Big Board will extend the length of time certain trading firms are able to see imbalances between buy and sell orders, according to people familiar with the matter.

Why investors should ignore the Fed, the election, and the market (Market Watch)

Why investors should ignore the Fed, the election, and the market (Market Watch)

I asked some two dozen fund managers a simple question this week: Would the Federal Reserve Board’s decision — whether it was to raise interest rates or to hold them steady for a bit longer — affect shareholders in their fund in any long-lasting, meaningful way?

The respondents represented a mix of asset classes, from short-term to long bonds, domestic stocks to international equities, covering various investment styles.

Politics

Hillary Clinton says she’ll reveal Keystone pipeline position ‘soon’ (Market Watch)

Hillary Clinton says she’ll reveal Keystone pipeline position ‘soon’ (Market Watch)

Hillary Clinton is “soon” going to tell voters what she thinks of the Keystone pipeline, she says.

Clinton, the Democratic presidential frontrunner, said she “can’t wait too much longer” to reveal what she thinks of the controversial Canada-to-U.S. Gulf Coast oil pipeline. “I have been waiting for the [Obama] administration to make a decision. I thought I owed them that,” she said at a town hall in New Hampshire on Thursday. She added: “I am putting the White House on notice. I am going to tell you what I think soon,” according to ABC News. Clinton’s rivals for the nomination, Sen. Bernie Sanders and former Maryland Gov. Martin O’Malley, oppose the pipeline and bring it up as a contrast with the former secretary of state.

Carried-Interest Tax Break Divides Again, After Trump Revives the Issue (NY Times)

Carried-Interest Tax Break Divides Again, After Trump Revives the Issue (NY Times)

At first, the capitalists’ lobby dismissed the billionaire Donald J. Trump’s call to end the so-called carried-interest tax break for “hedge fund guys” as an eccentric idea from one of their own.

Then Jeb Bush, Mr. Trump’s rival for the Republican nomination, embraced it. Some of Wall Street’s heaviest hitters approved. And predictably, Democrats led by President Obama and the party’s presidential candidates piled on, because the tax-the-rich idea had been theirs to begin with.

Technology

Ford's new smartwatch apps unlock your doors from your wrist (Mashable)

Ford's new smartwatch apps unlock your doors from your wrist (Mashable)

If you own a Ford hybrid, the car company just gave you a new reason to consider getting a smartwatch.

Ford rolled out two new smartwatch apps Wednesday for the Android Wear and the Apple Watch. The apps allow users to unlock their doors, check their mileage and battery stats and find directions to where they parked.

Play Pokémon While Shredding Hot Riffs With This Combination Electric Guitar and Game Boy (Gizmodo)

Play Pokémon While Shredding Hot Riffs With This Combination Electric Guitar and Game Boy (Gizmodo)

Like millions of humans on planet earth, I’m a self-identified gamer and guitar player. But I never had the genius idea, or the technical prowess, to smash the two together. Luckily, one electronic maker did and now we get to bask in his glorious creation.

Made by Fibbef, an administrator on BitFixGaming boards, and spotted by Hackaday, the Guitar Boy is a working electric guitar and also a working oversized Game Boy.

Health and Life Sciences

How to get blood pressure down to 120 (CNN)

How to get blood pressure down to 120 (CNN)

Doctors have long known that systolic blood pressure below 120 was considered normal and meant a lower risk of heart disease and kidney problems. But they would often only treat patients if that top number crept above 140, the threshold for officially having high blood pressure.

Recent findings from a large National Institutes of Health study now suggest that it's worth treating patients in that prehypertension gray area of 120 to 140, in order to bring them down into the normal range.

Is this why Americans are getting fatter? (Market Watch)

Is this why Americans are getting fatter? (Market Watch)

Americans are drinking more diet soda and bottled water to stay slim, but they’re also eating more butter.

Butter sales in the U.S. were up 14% in 2014 from a year earlier and are up 6% in the first three months of this year, according to a new report — “Fat: The New Health Paradigm” — by the Credit Suisse Research Institute in Switzerland, citing data from Nielsen. In fact, on average each American ate around 5.6 pounds of butter last year, up from 4.5 pounds in 2000, according to separate data from the U.S. Department of Agriculture. (This compares to a global rate of growth for butter of 2% to 4% per year.)

These 10 Tips Will Help You Look Younger and Fresher This Fall (Bloomberg)

These 10 Tips Will Help You Look Younger and Fresher This Fall (Bloomberg)

This season, as you unpack sweaters and restock your sock collection, consider investing in a few new friends for your bathroom counter, too.

Weather and indoor conditions in fall and winter do different things to your skin and hair than what happens during the summer months, so you should be prepared. Just because your youthful tan will eventually be replaced by a more faded complexion, it doesn't mean you have to look older and more tired.

Life on the Home Planet

The refugees who made it to Germany (Mashable)

The refugees who made it to Germany (Mashable)

Thousands of migrants and refugees from the Middle East and North Africa are pouring into Europe — some fleeing brutal wars, others running from poverty.

For many, the goal is Germany.

The country said it will take in 800,000 asylum applicants this year, and refugees have been welcomed there, some even arriving to applause as they crossed the border. But even Germany has limits. Though their pledge is much more than other European nations, not everyone will find a home. More than 4 million people have fled Syria alone.

A Refugees Survival Guide to Crossing Greece (Bloomberg)

A Refugees Survival Guide to Crossing Greece (Bloomberg)

Vodafone sales staff are among the first people to greet the thousands of refugees arriving every day in Athens from the country's outlying islands.

There were six of them at Piraeus Port when we visited, kitted out with Vodafone-branded caps and bags.