The Return of Policy Uncertainty

Courtesy of Menzie Chinn, Econbrowser

From Hatzius et al., in Goldman Sachs Global Macro Research yesterday:

A federal shutdown due to a funding lapse looks no less likely than it did two weeks ago, and we believe the probability is nearly 50%. The Senate is expected to begin voting later this week on a funding extension, but the House looks unlikely to act until shortly before the September 30 deadline.

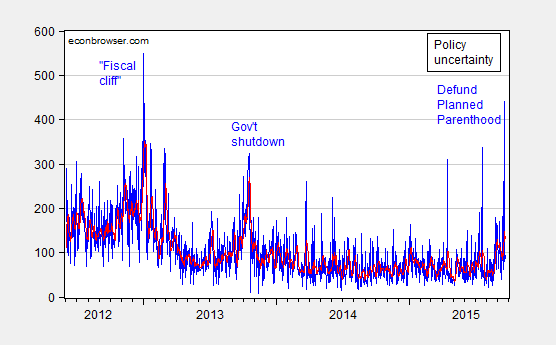

The impact on measured policy uncertainty is shown in Figure 1 below.

Figure 1: Daily policy uncertainty index (blue), and 7 day trailing moving average (red). Source: Baker, Bloom and Davis, at policyuncertainty.com, accessed 9/22/2015. [Read my note below to understand how the “policy uncertainty index” values, the Y-axis coordinates, are determined. ~ Ilene]

The reason we are fast approaching the brink? From Politico:

McConnell set up a Thursday vote that would fund the government through Dec. 11 while gutting federal funding for Planned Parenthood and boosting defense spending by $13 billion — an approach favored by conservatives on the right.

That legislation will fail due to Democratic opposition, allowing McConnell to argue that Senate Republicans tried the hard-line tactic proposed by Sen. Ted Cruz (R-Texas), but it couldn’t pass. McConnell could then turn to a “clean” funding bill that Democrats have promised to support.

“There’s going to be votes to defund Planned Parenthood. But I think, given the president’s opposition and Democrats’ opposition, at some point, I anticipate there will be a clean (continuing resolution),” Senate Majority Whip John Cornyn (R-Texas) told reporters. “But, that’s not the end of the fight over late-term abortions and over Planned Parenthood.”

But first, McConnell agreed to test Cruz’s approach, touting the benefits of a bill that is at bipartisan spending levels and “would defund Planned Parenthood and protect women’s health by funding community health clinics.” And consistent with the GOP leader’s tight-lipped nature, McConnell refused to confirm that he will then turn to a clean CR when the attack on Planned Parenthood fails later this week.

…

By moving first, the Senate has more time to clear through the procedural hoops in the chamber — allotting just a handful of days before a shutdown to throw the funding hot potato into the House’s lap. The move would put the onus on the lower chamber to prevent a federal shutdown. It also would make it harder for opponents like Cruz to throw sand in the gears at the last moment.

But there’s no guarantee that the House will accept what the Senate sends over. And there’s no guarantee Cruz won’t fight McConnell tooth and nail, as he has done all year, though, at this point, he’d have to mount a herculean effort to disrupt McConnell’s government funding train.

Oh, and there’s the debt ceiling issue as well.

****

Policy Uncertainty Index explained at Policy Uncertainty:

To measure policy-related economic uncertainty, we construct an index from three types of underlying components. One component quantifies newspaper coverage of policy-related economic uncertainty. A second component reflects the number of federal tax code provisions set to expire in future years. The third component uses disagreement among economic forecasters as a proxy for uncertainty.

The first component is an index of search results from 10 large newspapers. The newspapers included in our index are USA Today, the Miami Herald, the Chicago Tribune, the Washington Post, the Los Angeles Times, the Boston Globe, the San Francisco Chronicle, the Dallas Morning News, the New York Times, and the Wall Street Journal. From these papers, we construct a normalized index of the volume of news articles discussing economic policy uncertainty.

The second component of our index draws on reports by the Congressional Budget Office (CBO) that compile lists of temporary federal tax code provisions. We create annual dollar-weighted numbers of tax code provisions scheduled to expire over the next 10 years, giving a measure of the level of uncertainty regarding the path that the federal tax code will take in the future.

The third component of our policy-related uncertainty index draws on the Federal Reserve Bank of Philadelphia's Survey of Professional Forecasters. Here, we utilize the dispersion between individual forecasters' predictions about future levels of the Consumer Price Index, Federal Expenditures, and State and Local Expenditures to construct indices of uncertainty about policy-related macroeconomic variables.

More details about our methodology can be found in the paper: Paper and Figures