Up and down we go.

Up and down we go.

Where we stop, no one seems to know. Mario Draghi is speaking at 9 am this morning and, now that the Fed has put off their rate increase, the ball is in his court to do SOMETHING to stop the collapse of the European markets. Not only have the indexes fallen 5% this week (and today bouncing the obligatory weak 1% ahead of Draghi's speech – as we predicted yesterday in "Back to Bouncing"), but the Euro has fallen 2.5% – leaving no escape for any asset class in Europe.

Former Goldman Sachs Managing Director Draghi is already in the process of giving $1,300,000,000,000 to EU Banksters (including his alumni, of course) and, like Janet, they want more, More, MORE! It's very possible yesterday's horrific 3% drop in the EU markets was nothing more than an engineered cry for help by the Banksters, giving Draghi the excuse he needs to enrich his friends further without too much public outcry.

There's really nothing left to do but cry for European Citizens, who have seen Draghi devalue their life's savings by 25% since he took power in November of 2011. And yet they are "puzzled" as to why there's no inflation when the buying power of every European has been reduced by an average of 6% a year for the last 4 years. Hey, I know, let's give more money to rich people – that will fix everything! <end sarcasm font>

Somebody actually said to me on Seeking Alpha yesterday: "Trickle down works like this: the rich buy large houses, this puts carpenters to work, then they buy appliances/furniture, which helped to create Home Depot and Lowe's, they have landscapers, house cleaners, nannies, etc. – all created from their wealth."

Somebody actually said to me on Seeking Alpha yesterday: "Trickle down works like this: the rich buy large houses, this puts carpenters to work, then they buy appliances/furniture, which helped to create Home Depot and Lowe's, they have landscapers, house cleaners, nannies, etc. – all created from their wealth."

After I stopped laughing, I did try to point out that a lot more people are employed building 300 $330,000 homes than a single $100M home but our problem isn't the lone commenter on SA – it's the fact that ALL of our Governments are following this horribly flawed plan to "fix" the Global economy when all they are actually doing is upwardly distributing wealth and income UP to the rich and AWAY from the less rich (the bottom 6.4Bn).

Another SA commenter said I should stop focusing on politics and inequality and just give people stock picks so the rich readers can get richer and pretend these problems don't exist. Actually, I think it was the editor… Anyway, as I noted this weekend, it IS part of my investing premise because the unequal distribution of wealth affects the spending power of the consumers in various classes which then affects the companies that are trying to do business with them – what can be more fundamental than that?

Focusing on inequality and Global politics is what led us to conclude the rally would collapse at just the right time and our paired Long-Term and Short-Term Portfolios are up 60% in this mess – again it's BECAUSE we keep our eye on the macro picture and we knew when to hold 'em and when to fold 'em. Ignore politics at your peril folks!

Focusing on inequality and Global politics is what led us to conclude the rally would collapse at just the right time and our paired Long-Term and Short-Term Portfolios are up 60% in this mess – again it's BECAUSE we keep our eye on the macro picture and we knew when to hold 'em and when to fold 'em. Ignore politics at your peril folks!

Speaking of politics that are being ignored, we're barreling ahead to another Government shut-down in just 7 days and, as usual, there's barely a mention of a GOP-engineered crisis in the MSM. Oh, I know, to be "fair and balanced" we can pretend the Democrats are equally at fault but this time there's not even the hint of an issue that the Republican-controlled Congress or Republican-controlled Senate can blame on the Democrats – they are simply trying to wreck the economy ahead of the election so they can blame Obama next November.

Odds are currently running at 75% that our Government will grind to a halt next week as the GOP refuses to back off attaching a bill to defund Planned Parenthood to the Federal Budget. This is DESPITE the fact that the hoopla that got the ball rolling on this issue has been proven to be FAKE: over and over and over again. Rather than backing off though, GOP leaders have doubled down on this issue and are willing to hold the country hostage if they don't get their way.

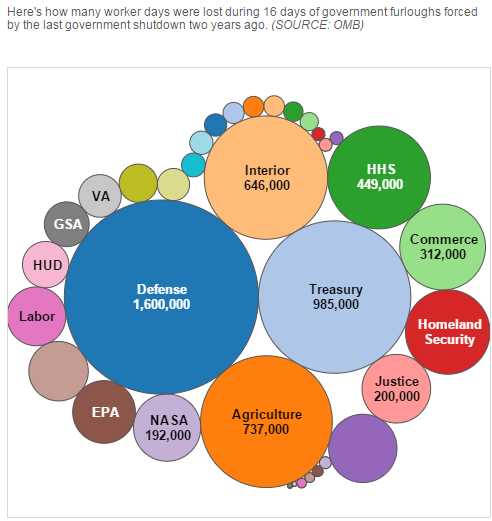

Do you think this doesn't affect your investments? Just two years ago, the same GOP leaders closed down the government for nearly three weeks in an effort to defund the Affordable Care Act. Although they were ultimately unsuccessful in that attempt, the shutdown shaved an estimated $24Bn off our GDP, directly costing every single American worker $250 per family. How is this fiscal responsibility? It also shut down our military and made us much less safe – but why bring logic into this, right?

Do you think this doesn't affect your investments? Just two years ago, the same GOP leaders closed down the government for nearly three weeks in an effort to defund the Affordable Care Act. Although they were ultimately unsuccessful in that attempt, the shutdown shaved an estimated $24Bn off our GDP, directly costing every single American worker $250 per family. How is this fiscal responsibility? It also shut down our military and made us much less safe – but why bring logic into this, right?

“I know Democrats have relied on Planned Parenthood as a political ally, but they must be moved by the horrifying images we’ve seen," McConnell said. "Can they not resolve to protect women’s health instead of powerful political friends?”

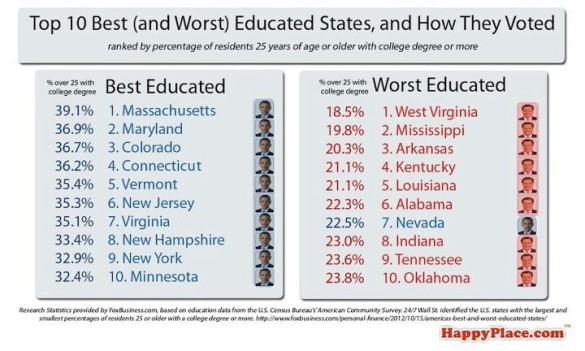

But the photos were FAKE!!! McConnell knows they are fake but he said this yesterday, because he's a professional politician and he knows his constituency and he knows the chance of them actually reading a paper or watching anything other than Fox news is not even worth worrying about.

But the photos were FAKE!!! McConnell knows they are fake but he said this yesterday, because he's a professional politician and he knows his constituency and he knows the chance of them actually reading a paper or watching anything other than Fox news is not even worth worrying about.

Mitch's Kentucky is proudly #4 on the list of least-educated states (which is why he has to talk so slowly) but, with the education cutbacks he's proposing, they may be able to bump Mississippi from the #2 spot – even though they can't possibly spell it…

Anyway, once again this is why we are in CASH!!! and just watching this idiocy from the sidelines. Fortunately, we went to cash at the tippy top of the market and now Harvard has joined us (albeit a bit late) in getting to the sidelines with their $38Bn endowment fund and is actively looking for fund managers with expertise as short-sellers for what they believe will be the bear market norm in 2016.

Back on July 27th, in conjunction with our FREE Live Trading Webinar that week, we posted a FREE post over at Seeking Alpha titled: "Using Stock Futures To Hedge Against Market Correction" where we discussed my Twitter Alert that morning were shorting the Dow Futures (/YM) at 18,000, S&P (/ES) at 2,120 and Nasdaq (/NQ) at 4,675 and, as of this morning, those trade ideas are:

Back on July 27th, in conjunction with our FREE Live Trading Webinar that week, we posted a FREE post over at Seeking Alpha titled: "Using Stock Futures To Hedge Against Market Correction" where we discussed my Twitter Alert that morning were shorting the Dow Futures (/YM) at 18,000, S&P (/ES) at 2,120 and Nasdaq (/NQ) at 4,675 and, as of this morning, those trade ideas are:

- Dow Futures at 16,200 (down 10%) – up $9,000 per contract

- S&P Futures at 1,930 (down 9%) – up $9,500 per contract

- Nasdaq Futures at 4,267 (down 8.7%) – up $8,160 per contract

These are nice, quick ways to balance out your portfolio with quick protection, anytime day or night so Futures are something I would urge you to add to your trading toolbook, whether you learn it from our educational site or somewhere else. We didn't like the weak bounce we saw in early September and I published "Hedging for Disaster," where we put up 3 great hedging ideas to protect your portfolio with options (for the Futures-challenged).

I'm not going to do a victory dance on those just yet – we'll see what kind of bounce Draghi (today) and Yellen (tomorrow night) can engineer and we do have some longs left for balance but, on the whole, we're still very short-term bearish and no way will we get bullish again until the Government manages to go fund itself.