Courtesy of Pam Martens.

By Pam Martens and Russ Martens: October 1, 2015

An uncanny number of people woke up this week with the same thought – it’s time to panic over the size, structure and illiquidity of the junk bond market. (Not to put too fine a point on it, but Wall Street On Parade made the warning in 2013 and again on August 18 of this year.)

On Tuesday morning, it was both Carl Icahn, the famous hostile takeover artist and hedge fund billionaire, along with the more staid academics at the International Monetary Fund (IMF), who issued junk bond warnings. (Junk bonds are corporate debt with ratings below investment grade, also known as “high yield” bonds.)

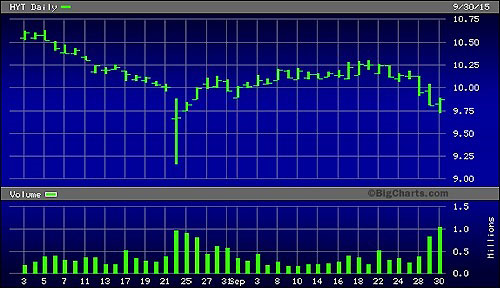

Icahn released a video (see clip below) assigning blame to companies like BlackRock which have bundled illiquid junk bonds into Exchange Traded Funds (ETFs), listed them on the New York Stock Exchange, and sat back and watched as millions of mom and pop investors were sold a bill of goods that these are liquid investments that can be exited at any time during the trading day. The danger, says Icahn, is that liquidity dries up when everyone heads for the exits at the same time. Icahn includes a graph in his video showing that the U.S. junk bond and leveraged loan market has grown from $1 trillion in 2007 to $2.2 trillion today.

…