Only 37% of NYSE stocks are over their 200-day moving average.

Only 37% of NYSE stocks are over their 200-day moving average.

Usually, that's the kind of statistic you see in a bear market but, miraculously, our masterfully manipulated markets don't need broad participation to make record highs because the Banksters have very good algorithms that tell them exactly which key stocks to buy to give them maximum leverage while putting as little money as possible into any given index.

You would thing the money men would hate anything with the phrase "Al Gor" in it but algorithms are the unsung heroes of the rally, used to manipulate stocks, options, ETFs, commodities, currencies – you name it and they can make it dance! They also cause very harsh market swings that we human traders are able to take advantage of and our 5% Rule™ at Philstockworld is designed to detect and predict algorithmic trading patterns so we can bet against them – or go along for the ride – depending on what makes the most sense at any given time.

.jpg) It's very profitable, too. Just yesterday, our long /NG (Natural Gas Futures) trade made over $1,100 per contract as we ran up from $2.26 in the morning to $2.37 in the afternoon.

It's very profitable, too. Just yesterday, our long /NG (Natural Gas Futures) trade made over $1,100 per contract as we ran up from $2.26 in the morning to $2.37 in the afternoon.

This morning, we made the call at $2.26 again and we just got a $300 run back to $2.29 and we can do this over and over and over again because the machines running the program never get tired or running the same pattern. We can even flip around and short under $2.40 (until it finally breaks) and take those rides down back to $2.26 (until that breaks) and, when our range fails us – we simply wait for the next predictable pattern to form and do it again.

That's pretty much all there is to Futures trading these days. While we do pay attention to the overriding Fundamentals that are driving the market (in the case of /NG, we lean bullish because it's getting cold in the winter – duh!), mostly we look for good, predictable patterns in the algos that show up on the charts which we can then take advantage of. Much as we complain about how the markets are blatantly manipulated – we don't mind so much that we won't make a few bucks playing along!

.jpg) Take the major indexes, for example. Yesterday, as you can see from the WSJ's Market Diary, the NYSE had almost 3 TIMES MORE SELLING than buying volume with 50% more individual stocks falling than advancing but the stocks that did advance carried more weight than the ones that declined and held the index relatively flat for the day – fooling traders into believing things were holding up well – even as 70% of the transactions were sales on the index.

Take the major indexes, for example. Yesterday, as you can see from the WSJ's Market Diary, the NYSE had almost 3 TIMES MORE SELLING than buying volume with 50% more individual stocks falling than advancing but the stocks that did advance carried more weight than the ones that declined and held the index relatively flat for the day – fooling traders into believing things were holding up well – even as 70% of the transactions were sales on the index.

On the Nasdaq, it's very easy for Fund Managers and Banksters to manipulate the index as they only have to buy 4 or 5 of the key stocks (AAPL (14.6%), MSFT (7.4%), AMZN (3.8%), GOOG (3.5%), FB (3.4%), GILD (3.2%), INTC (3.1%), GOOGL (3%)) and they can make the entire index say anything they want to. I wrote a similar post a couple of months ago showing how key S&P components are also manipulated to cover the tracks of hedge funds who want to quietly dump shares on the retail suckers they drive in to buy up their unwanted shares.

Keeping the index headline high FORCES people who automatically buy through 401Ks or IRAs to buy at top dollar – even as the bulk of the shares in the index are being dumped. Since the Top 1% have the algorithms that manipulate the indexes and ALSO control the algorithms that control the 401K, IRA and ETF buying programs – they literally cannot lose as they move money from their Bottom 99% customers life savings into their own trading accounts – AND THEY CHARGE YOU A FEE FOR THE "SERVICE"!!!

Keeping the index headline high FORCES people who automatically buy through 401Ks or IRAs to buy at top dollar – even as the bulk of the shares in the index are being dumped. Since the Top 1% have the algorithms that manipulate the indexes and ALSO control the algorithms that control the 401K, IRA and ETF buying programs – they literally cannot lose as they move money from their Bottom 99% customers life savings into their own trading accounts – AND THEY CHARGE YOU A FEE FOR THE "SERVICE"!!!

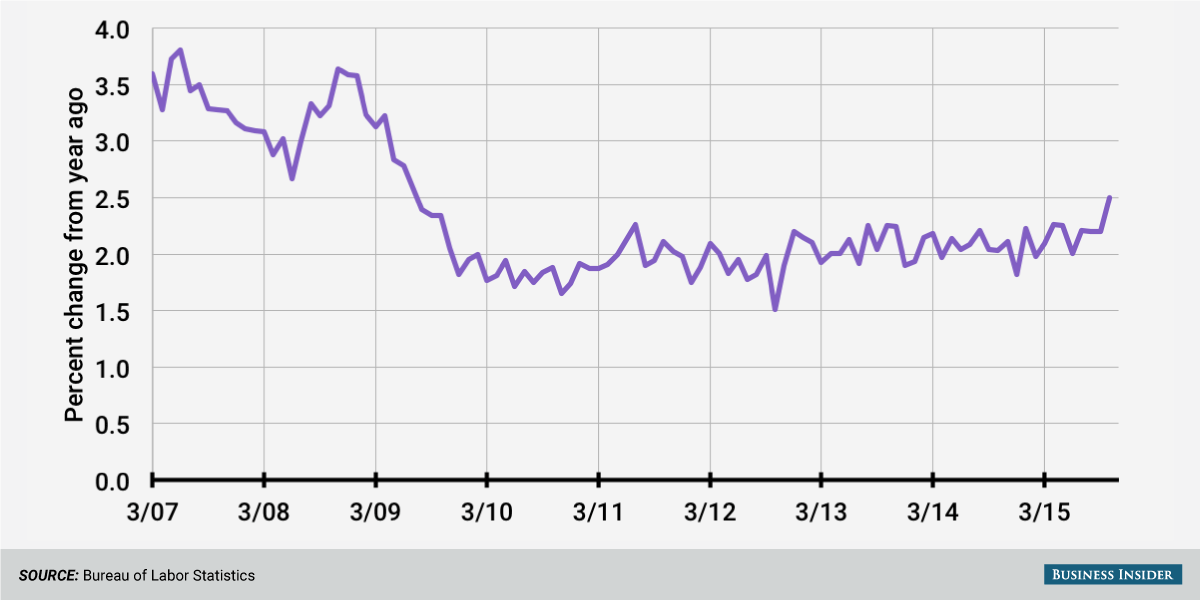

You can't beat them – so we may as well join them in this game, right? This morning we have our big data point for the week, Non-Farm Payrolls and we had a great number with 271,00 jobs added in October. Unemployment is down to 5% and wages are up 2.5% for the year and you would think the markets would be happy but, of course, they are not because Corporations don't like paying people to work there and, even worse, this drastically increases the odds of a Fed rate hike in December.

Wage inflation is the kind of inflation the Fed really tries to fight (though they never admit it) because the Fed does not work for you or our Government – the Federal Reserve is nothing more than a Banking Cartel that pushes the agenda of the Top 1% in a quasi-Government agency that President Wilson regretted creating almost as soon as it was formed and, in fact, said of his great mistake:

"I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men." -Woodrow Wilson, after signing the Federal Reserve into existence

That was in 1919 and, of course, 10 years later the excesses of Capitalism led to the collapse of the Global Economy. The Fed is still here, however – now a bit more restrained but in no real way changed from it's original mission – to make the banks as rich as possible. The only difference is that now they try to do it without completely destroying the economy to make their numbers.

As we expected yesterday, there is STILL no mention in the US media of last night's massive anti-Capitalism protests called the "Million Mask March". You can see there was quite a riot in the UK but it won't even be on the last page of your morning paper because the people who own the press don't want you to question Capitalism in any way, shape or form and letting you know that some people are upset might give you ideas – they don't want you having any ideas…

Our trading ideas for the day were to short into the weekend. Good or bad, the jobs numbers were not going to help and the very strong jobs number has popped the Dollar to 99.5, which is pushing down commodities (nice chance to go long on /NG at $2.33 again and gold (/YG) at $1,085 and silver (/SI) at $14.75). The good report solidifies the Fed hike and, since the markets are all pumped up on a free money high – that's going to be bad news, especially considering earnings have been such a disaster so far this Q:

Nonetheless, 7 of 10 market sectors are ABOVE the August (pre-crash) highs so no thank you to chasing those. We are, of course, very happily in CASH!!! and plan to remain mainly in cash into next quarter. That doesn't stop us from doing a bit of bargain-hunting while we wait and, of course, we have our fun earnings plays, like the one I sent to our Members on Shake Shack (SHAK) yesterday afternoon:

SHACK/StJ – That's a tempting short. You can sell 5 Nov $52.50 calls for $2.25 ($1,125) and buy 5 March $52.50 ($5.40)/57.50 ($3.70) bull call spreads for $1.70 ($850) and, if they miss, you get $275 + whatever is left on the long spread or, if they pop, you are protected up to over $57.50 with your $275 net credit plus the spread value.

SHAK did better than we expected and will likely be about $53.50 at the open but we sold the $52.50 calls for $2.25, so anything under $54.75 is a win for us – and we'll see how it plays out.

Have a great weekend,

– Phil