More bad news from Japan and China.

More bad news from Japan and China.

Industrial Production in China was once again revised lower – to 5.6% Growth from 5.7% in September while Fixed Asset Investments were only up 10.2%, slowing from 10.3% and, while these seem like good numbers, they are the slowest annual pace in over 20 years! The Chinese Government's official PMI figure came in at 49.8 in October – still contracting while the private Markit Survey measured worse, at 48.2.

China's Shanshui Cement will be the next major corporation to default on their bonds, heading into defaut on $314M next Thursday. Shao Jiamin, who heads HFT Investment Management (China's top bond fund) predicts "a substantial correction in riskier debt as the restart of initial public offerings drives money back into shares." Any collapse could damp Chinese investors’ enthusiasm for fixed-income, just as President Xi Jinping seeks to create a stable fundraising platform for small businesses and maintain access to financing for state-led infrastructure projects.

Just to the east of China, Japanese Business Confidence is down for the 3rd consecutive month to a 2.5-year low at 3, down more than 50% from 7 in September reflecting fears that a China-led slowdown in overseas demand may have pushed the economy into recession. The poor poll results will be followed by government data out on Monday, which is expected to show the economy slipped back into recession through September due to a drop in capital spending in the face of weak foreign and domestic demand.

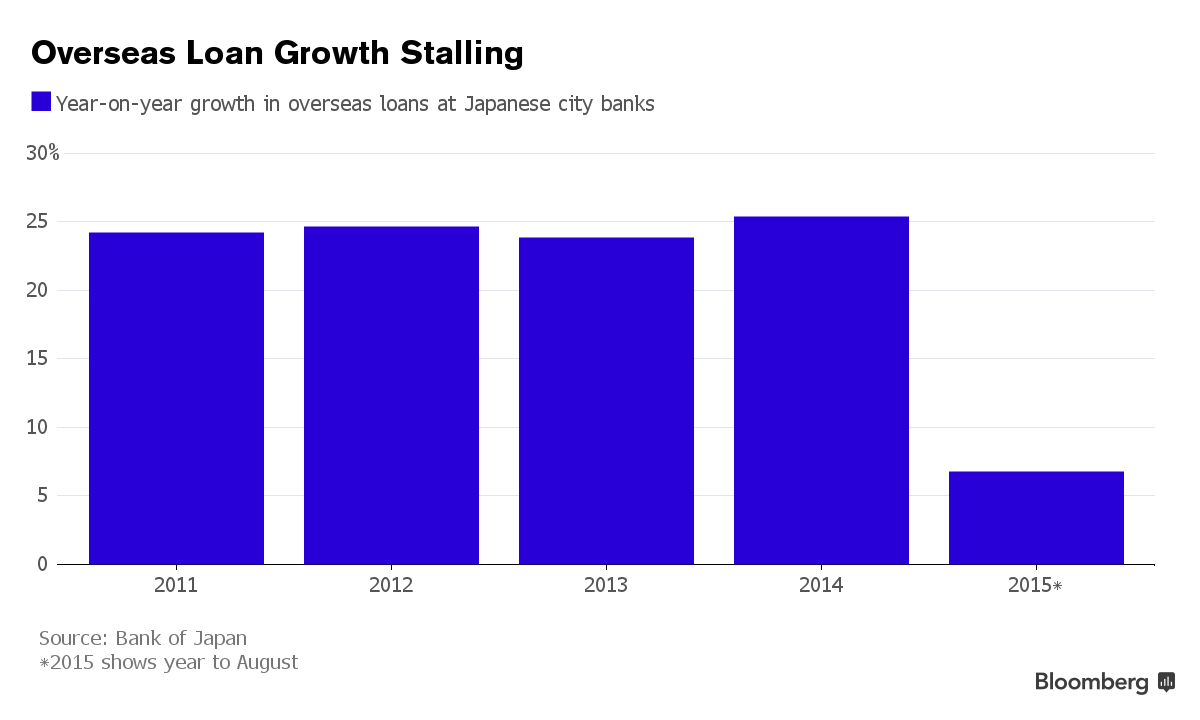

Meanwhile, Japan’s three biggest lenders will probably report a drop in second-quarter profit after Asia’s economic slowdown weakened overseas loan growth and global financial-market volatility crimped fee businesses. Combined net income at Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. fell 24 percent from a year earlier to 597 billion yen ($4.8 billion) in the three months ended Sept. 30, according to calculations based on the average of five analyst estimates compiled by Bloomberg.

Meanwhile, Japan’s three biggest lenders will probably report a drop in second-quarter profit after Asia’s economic slowdown weakened overseas loan growth and global financial-market volatility crimped fee businesses. Combined net income at Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. fell 24 percent from a year earlier to 597 billion yen ($4.8 billion) in the three months ended Sept. 30, according to calculations based on the average of five analyst estimates compiled by Bloomberg.

Portugal's center-right Government has toppled just two weeks after it was formed and an anti-austerity coalition has formed to challenge the EU over terms of their $85Bn bail-out.

This forces the EU to battle anti-austerity forces on two fronts just as Greece's loans are back up for rollovers (we only kicked the can 6 months down the road last time we "fixed" Greece and now it's time to kick it again).

Nonetheless, Western investors are BUYBUYBUYing stocks this morning as the G20 promises "inclusive and robust growth" and, by promises, I mean they are putting up billboards in an effort to keep the people feeling good about Christmas shopping – despite their current economic struggles. Yes, things are always going to get better – we even tell that to people who are dying, don't we?

The worse the data is, the more investors believe we will have more QE and more stimulus and, in fact, that is the theme of the G20 as the call is for the 20 Nations to do MORE to stimulate their economies, so the bad data couldn't have come at a better time – if you are a Corporate Citizen seeking more Government welfare, that is.

As it stands, with about 2/3 of the companies having reported for Q3, both earnings and revenues have been simply sad, with 5 sectors up and 7 sectors down and enough so that the overall earnings of the S&P 500 are down 3.5% from last quarter, when the S&P plunged from 2,100 to 1,850 after earnings in late-August. Fortunately, it's only Nov 11th – so why worry?

One big lesson our Members have learned this year at PSW is that it's a lot easier to get good prices for your position if you cash them out BEFORE the market begins to collapse. Days like today (as we re-test the highs) can be ideal for cashing in those long positions and adding a few shorts. After all, if the Banksters are going to fake a rally – we may as well take advantage of it!

As noted by Dave Fry, there are just eight (8) stocks in the S&P that have accounted for more than all of it's gains this year – without them, the entire index would be negative. Now THAT is a thin rally!

The volume on yesterday's move up was a joke and this morning we're being pushed even higher in the Futures, back to 1,190 on the Russell (/TF) and 19.800 on the Nikkei (/NKD) along with 2,085 on the S&P (/ES), 17,800 on the Dow (/YM) and 4,660 on the Nasdaq (/NQ). I listed the Russell and Nikkei first as they are going to be our key shorts – providing the others stay below their lines.

With just 17 days to go before Black Friday, it's going to be a very interesting holiday season and I'm very, very glad we're mainly in cash.

Anything below 10,500 in the NYSE is BAD and watch out for the Dow failing to hold 17,586 or the S&P failing at 2,063 but neither likely today as we got a nice boost while no one was trading: