Financial Markets and Economy

More Pain Signaled in Asian Stock Futures Before China CPI Data (Bloomberg)

Oil halted its selloff near a six-year low, providing a boost to Asian energy producers following a global rout. Most commodity-linked currencies maintained declines, while copper futures rose ahead of data on prices out of China.

The stock market has done a lot of work 'to go nowhere’ this year (Business Insider)

From the outside, it doesn't look like the S&P 500 has done a whole lot this year.

Gold posts modest gain as stocks, dollar fall (Market Watch)

Gold posts modest gain as stocks, dollar fall (Market Watch)

Gold futures settled with a gain on Tuesday, as declines in global equities and a weaker dollar offered haven-related support for the metal.

But the climb was modest, as a recent drop in oil prices to a nearly seven-year low dulled the metal’s appeal as an inflation hedge.

BTG's Share Plateau Spurs Speculation Bank Is Major Stock Buyer (Bloomberg)

Grupo BTG Pactual SA shares plateaued near 15 reais for more than five hours Tuesday amid speculation that the bank was stepping in to support the stock and stem a plunge sparked by the arrest of billionaire founder Andre Esteves.

Now is not the time to exit the market (Business Insider)

Now is not the time to exit the market (Business Insider)

Astenbeck Capital, the energy and commodities hedge fund led by oil trading"god" Andrew J. Hall, is on track for its worst year ever.

The fund fell 10% in November and is now down 26.3% year-to-date, Reuters' Barani Krishnan reported on Tuesday.

Amazon is now bigger than Exxon Mobil (Quartz)

The year-long slump in oil prices has countless victims, and Exxon Mobil is certainly among them. The oil giant lost its spot among the five biggest US companies by market cap to Amazon on Tuesday (Dec. 8). At a market value of $318 billion (to Exxon’s $311 billion), the e-commerce giant is now only smaller than Apple, Google, Microsoft, and Berkshire Hathaway.

Kinder Morgan Cuts Dividend by 74 Percent to Conserve Cash (Bloomberg)

Kinder Morgan Inc. slashed its full-year dividend by 74 percent as the free-fall in crude markets reduced cash flow that the biggest North American pipeline owner needs to cover payments on $41 billion of debt.

Energy and Mining Producers Reeling as Price Collapse Deepens (NY Times)

Energy and Mining Producers Reeling as Price Collapse Deepens (NY Times)

The mining giant Anglo American is slashing its holdings and work force amid a plunge in commodity prices caused by waning demand from China.

The newest victim is the London-based mining firm Anglo American. On Tuesday, the company announced a drastic restructuring, which includes expanding job cuts, suspending its dividend, reducing its business unit and cutting its assets.

The market has gone nowhere this year, which could be great news for stocks in December (Business Insider)

Despite some wild swings in this year the S&P 500 has so far made it through 2015 basically unchanged.

Smith & Wesson Earnings Surge as Talk of Limits Spurs More Sales (Bloomberg)

Smith & Wesson Holding Corp. posted a gain in quarterly earnings and sales and raised its full-year forecast as heightened concerns over personal safety spur handgun purchases.

Oil selloff drives commodity-linked currencies to multiyear lows (Market Watch)

Oil selloff drives commodity-linked currencies to multiyear lows (Market Watch)

The collapse in the price of crude oil has dragged the currencies of several of the world’s largest exporters to fresh multiyear and multimonth lows Tuesday as low prices weigh on economic growth.

The Canadian dollar and the Norwegian krone were two of the largest decliners in the group, both falling to their lowest levels against the dollar in more than a decade.

Supermajority or Not, in Venezuela It's Still About Oil Prices (Bloomberg)

Just when it looked like change was coming to Venezuela, along came OPEC to spoil the party.

Airline stocks pulled down by Southwest’s lowered outlook (Market Watch)

Airline stocks fell Tuesday, as a downbeat revenue outlook from one of the sector’s stellar performers—Southwest Airlines Co.—weighed on investor sentiment.

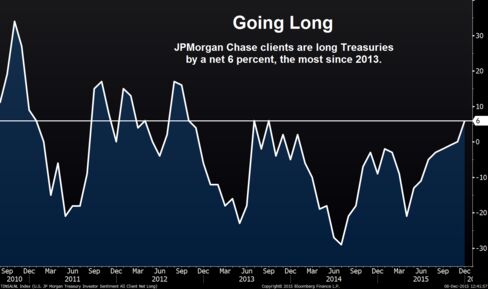

Treasury Investors Most Bullish Since 2013 as Fed Decision Looms (Bloomberg)

Last weeks rout in Treasuries may be attracting buyers to government debt, even as the Federal Reserve looks set to raise interest rates for the first time in a decade.

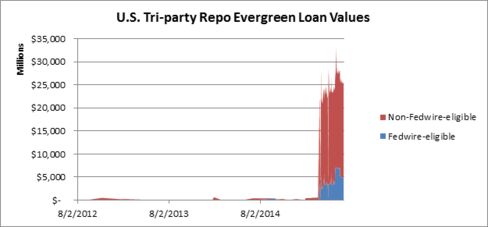

This Chart Shows the Incredible Rise in Extendable Repos (Bloomberg)

Behold, the scramble to meet new rules concerning bank funding, in chart-form.

Gold Daily and Silver Weekly Charts – Ol' Man River (Jesse's Cafe Americain)

Just like gold, which keeps rolling along, from West to East.

Copper Meltdown Burning Miners Is Boon to Builders as Costs Sink (Bloomberg)

Copper producers from Glencore Plc to Freeport-McMoRan Inc. spent most of this year getting slammed by the metals worst slump since the recession. But there are some folks who are cheering.

'It's a different world when the Fed is raising interest rates.' (Business Insider)

'It's a different world when the Fed is raising interest rates.' (Business Insider)

Jeffrey Gundlach, CEO and CIO of DoubleLine Funds, has a simple warning for the young money managers who haven't yet been through a rate hike cycle from the Federal Reserve: It's a new world.

In his latest webcast updating investors on his DoubleLine Total Return bond fund on Tuesday night Gundlach, the so-called "Bond King," said that he's seen surveys indicating two-thirds of money managers now haven't been through a rate-hiking cycle.

Politics

Once Militant, Now Millionaire. Next Up: South Africa President? (Bloomberg)

Once Militant, Now Millionaire. Next Up: South Africa President? (Bloomberg)

Cyril Ramaphosa is the only serving politician in South Africa who’s led both a labor union and a business empire. Now chances are rising that he’ll lead the country.

The country’s biggest labor group last month cautiously backed Ramaphosa to head the ruling African National Congress in two years — a post that would make him a shoo-in to succeed President Jacob Zuma in 2019.

The Upside to Trump's Latest Terrible Idea (Bloomberg View)

The Upside to Trump's Latest Terrible Idea (Bloomberg View)

Donald Trump wins again. Oh, he's still not going to be president. His new offensive — coming out for a "total and complete shutdown" of Muslim immigration and travel to the U.S. — won't get him any closer to taking over the White House. But he has once again succeeded in taking over the news cycle.

Technology

Will Robots Rule the Cities of the Future? (PSFK)

Will Robots Rule the Cities of the Future? (PSFK)

As we look into the future, we see people looking to robots for just about, well, everything. From machines that offer human-like advice to intelligent systems that restock our pantry when it is low, the automation of built environments is shaping the new ways in which cities of the future and society at large will navigate through its daily routine. The 2017 Forecast, the newest report from PSFK Labs, examines the promise of a more automated workforce, which moves closer to reality with wide-scale experiments in robotics.

HTC's Vive VR Headset To Launch In April (Fast Company)

HTC's Vive VR Headset To Launch In April (Fast Company)

The highly anticipated VR gear was announced last March. HTC also said it will have a new developers kit available at CES.

HTC announced today that it will release its Vive virtual reality headset next April, and that it plans on putting out a new developers kit at CES in January.

Health and Life Sciences

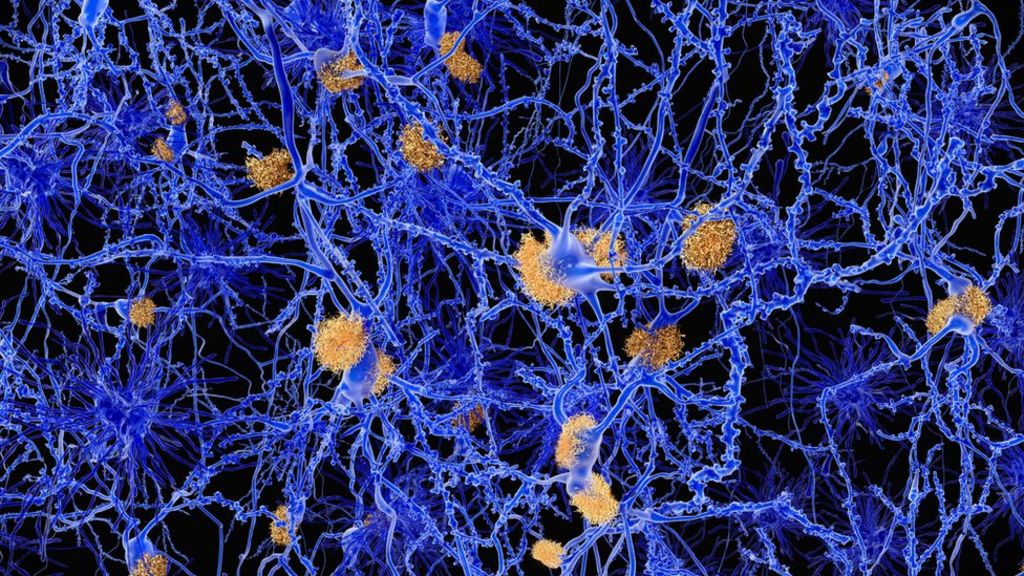

Molecule clears Alzheimer's plaques (BBC)

Molecule clears Alzheimer's plaques (BBC)

A molecule can clear Alzheimer's plaques from the brains of mice and improve learning and memory, Korean scientists have found in early tests.

Exactly how it gets rid of the abnormal build-up is not understood.

The small Nature Communications study hints at a way to tackle the disease even once its in full swing, dementia experts say.

Exercise May Make The Brain More Flexible (Forbes)

Exercise May Make The Brain More Flexible (Forbes)

The brain used to be the one organ that researchers believed was pretty unchanging over time, in contrast to other organs that are always replenishing themselves. After all, the brain sort of has to stay constant if it’s going to keep all our memories and experiences intact over the course of our lifetimes. But in recent years, neuroscientists have found that indeed the brain does retain some plasticity – malleability – and it seems to become considerably more plastic when people exercise their bodies.

Life on the Home Planet

Catholic Church defies Indiana governor and settles Syrian family in state (Mashable)

Catholic Church defies Indiana governor and settles Syrian family in state (Mashable)

A humanitarian aid organization affiliated with the Catholic Church welcomed a young Syrian family to Indianapolis, Indiana on Monday night, where they will be resettled, over the objections of the state's Republican governor.