Nattering Naybob discusses the general economy, the labor market, wages, savings, consumer credit, commodities and the US dollar, and their potential effects on asset prices.

Bull Economy

Courtesy of The Nattering Naybob

From Martin at Macronomics: "Given the recent US Q3 GDP print at 2% (well below 3.9% growth in Q2) and given the current high level of inventories we highlighted recently in our conversation "Cinderella's golden carriage," it seems to us that US GDP is weaker than expected and is going to be "weaker for longer."

From Bloomberg: "Struggling overseas demand and declines in commodity prices that are hurting investment in energy and agriculture continue to limit orders for American manufacturers. At the same time, robust domestic growth buoyed by labor-market momentum and burgeoning wage gains are supporting consumers' spending power and preventing U.S. factory activity from slowing even more."

Limited orders in manufacturing, yet robust domestic growth are buoyed by labor market momentum and burgeoning wage gains? The inference: if the economy were not so robust, we might be in recession? Begging the question, how can manufacturing be limited and yet the economy, wage gains and spending robust?

From SA: "The Fed has been right as rain on jobs, but other indicators – including inflation and manufacturing surveys – paint a significantly weaker picture of the economy."

Let's play matador with this robust bull.

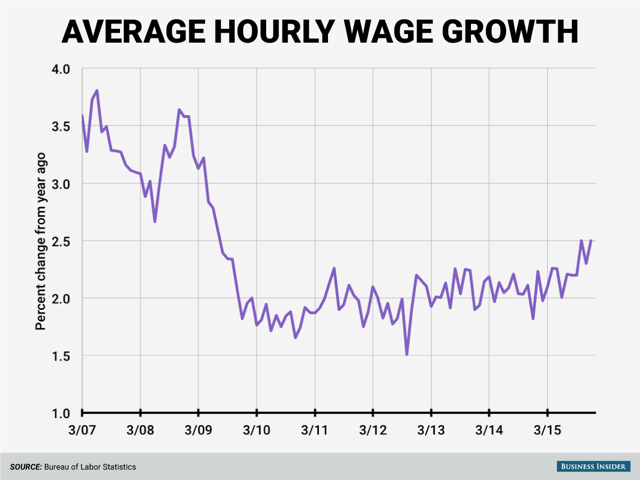

Burgeoning Wage Gains?

Above note, from Table B-3, despite a YoY +2.5% increase, average hourly earnings MoM declined to $25.24 while the growth rate remains anemic and 1% below pre-crisis levels. Since 1999, as undercalculated by CPI-U, real median household income has declined 7.2%, or is it 11%, or is it 25% as we previously Nattered here? In any case, over the last 17 years, income HAS DECLINED.

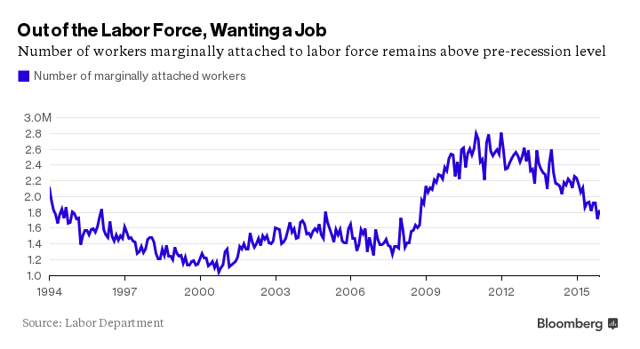

Robust Labor Market Momentum?

Above note, an estimated 1.8M out of the labor force and wanting a job remain 33% above the pre-crisis levels. In addition, those working part time involuntarily has increased 33% — 2007: 4.6M and 2015: 6M.

Above note, from table A15 – U6 underemployed levels at 10% are 25% above pre-crisis levels.

Read the full article: Bull Economy at Seeking Alpha.

Picture via Pixabay.