Financial Markets and Economy

Bank of Japan adopts negative interest rates (Ft.com)

The Bank of Japan has slashed interest rates to minus 0.1 per cent in a move that shocked markets and adds a new dimension to its record monetary stimulus.

Who's afraid of the big bad recession? We all are (Reuters)

If there were any suggestion that the fears that have gripped stock markets since the start of 2016 were the isolated stuff of paranoid financial investors, that evaporated with Friday's shocking meeting of the Bank of Japan.

Before the European Central Bank's own January meeting a week ago, the assumption of many watchers was that the world's big central banks would try their best to reestablish calm by doing little to tweak their current stances.

.jpg) The oil price crash made this broker £125 million in the last two months (Business Insider)

The oil price crash made this broker £125 million in the last two months (Business Insider)

The crash in the price of oil has not been kind to very many big businesses in the last year or so.

Major commodity firms like Glencore and Anglo American are struggling right now, and oil giant Shell just announced that it will cut 10,000 jobs in the coming year.

Believe it or not, oil is back in a bull market (Quartz)

It may have been wrong to call oil’s rise a dead cat bounce last week.

Amazon earnings fail to deliver because of delivery costs (Market Watch)

Amazon earnings fail to deliver because of delivery costs (Market Watch)

Amazon.com Inc.’s quest to deliver customers’ purchases faster drove the e-commerce giant to an earnings miss that sent its stock plummeting in after-hours action Thursday.

The stock was trading down 10.6% in premarket trade Friday.

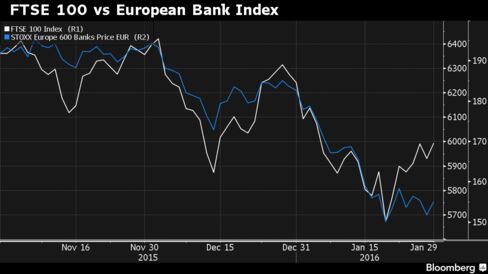

FTSE 100 Follows Global Gains; Bank Rebound Lifts HSBC, Barclays (Bloomberg)

Financial companies rebounded from yesterday’s slump to lift U.K. stocks higher, putting the FTSE 100 Index on track for its best week of the year.

Wall Street waits on GDP (Yahoo! Finance)

U.S. stock index futures indicated a higher open on Friday as traders anticipated the release of fourth quarter GDP.

Data showing the economy barely grew in the fourth quarter could set the tone for markets on Friday.

This is how a central bank could kill off cash with negative interest rates (Business Insider)

This is how a central bank could kill off cash with negative interest rates (Business Insider)

Since the financial crisis, the world's understanding of economics has been undergoing a lot of rapid change.

Ideas that would have been considered crazy just a decade ago are now seen as much more likely.

Rex Nutting: U.S. manufacturing is teetering on the edge (Market Watch)

After a few years of unusually strong growth, the U.S. manufacturing sector is really hurting again.

What Economists Got Wrong About Free Trade (The Atlantic)

What Economists Got Wrong About Free Trade (The Atlantic)

As trade has become a more and more integral part of the global economy,accepted economic wisdom has asserted again and again that overall, free trade is a good thing. Because trade brings so much in the way of competitive pricing and opportunities to buy and sell goods on a more massive scale, the drawbacks that come with it—job losses and declining wages for instance—are often thought to be outweighed.

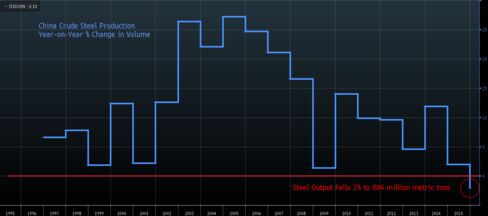

China Steel Production Has First Annual Drop Since 1981: Chart (Bloomberg)

Steel mills in China reported their first annual decline in output since 1981 as local demand contracted, prices sank to a record low and producers struggled with overcapacity. The China Iron & Steel Association said crude steel output shrank 2.3 percent to 803.8 million metric tons. In recent years China has churned out about half the world’s steel.

U.S. economy likely hit a speed bump in fourth quarter (Business Insider)

U.S. economy likely hit a speed bump in fourth quarter (Business Insider)

U.S. economic growth likely braked sharply in the fourth quarter as businesses doubled down on efforts to reduce an inventory glut and unseasonably mild weather cut into consumer spending on utilities and apparel.

Gross domestic product probably rose at a 0.8 percent annual rate, according to a Reuters survey of economists, also as a strong dollar and tepid global demand hurt exports, and lower oil prices continued to undercut investment by energy firms.

U.S. stocks: Dow futures leap after surprise BOJ move, joining in global rally (Market Watch)

U.S. stocks: Dow futures leap after surprise BOJ move, joining in global rally (Market Watch)

U.S. stock futures pointed early Friday to sizable gains at the open, putting the market on track to join in a global rally after a surprise Bank of Japan decision.

The BOJ said it would adopt a negative interest rate policy for the first time, aiming to pre-empt further economic setbacks. Investors also await a reading on U.S. fourth-quarter economic growth, and shares in Amazon.com Inc., Microsoft Corp., Visa Inc., MasterCard Inc. and Chevron Corp. are likely to see active trading on their earnings reports.

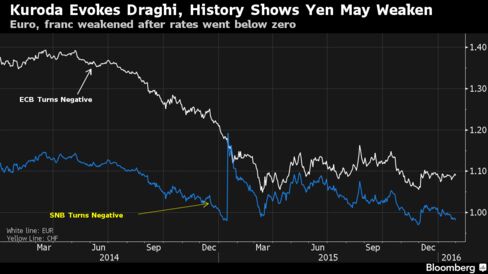

Kuroda Evokes Draghi With Move History Shows May Hurt Yen: Chart (Bloomberg)

If history is any guide, further weakness in the yen can be expected in the medium term after the BOJ introduced negative interest rates. The euro has declined in value against the dollar by more than 20 percent since Draghi turned negative, while the Swiss franc has weakened by about 4 percent since the SNB moved.

The Three Fears Sinking Global Markets (Project Syndicate)

Nothing about the condition of the world economy suggests that a major slowdown or recession is inevitable or even likely. But a lethal combination of self-fulfilling expectations and policy errors could cause economic reality to bend to the dismal mood prevailing in financial markets.

Ruble Leads Emerging-Market Gains as Traders Chase Rising Oil (Bloomberg)

The ruble held its lead among developing-nation peers in Europe after the Bank of Russia held interest rates for a fourth meeting.

Gold Whipsawed as BOJ's Surprise Move on Rates Sparks Turmoil (Bloomberg)

Gold was whipsawed on Friday after the Bank of Japan surprised investors by adopting negative interest rates, spurring a brief rally in the dollar and arresting a monthly rally spurred by haven demand.

This reliable indicator says we’re in a bear market for stocks (Market Watch)

One of the darkest clouds on Wall Street’s horizon is declining margin debt.

Bank of Japan's Negative Interest Rate Decision Explained (Bloomberg)

The Bank of Japan pushed interest rates below zero Friday, after years of keeping them at the lower end of the positive range.

SP 500 and NDX Futures Daily Charts – Uncertainty and Risk (Jesse's Cafe Americain)

Stocks tried to rally early but were pushed back in what turned out to be a wide ranging day.

China Trade Shock for U.S. Workers Was Avoidable (Bloomberg View)

China Trade Shock for U.S. Workers Was Avoidable (Bloomberg View)

In a piece earlier this week, I discussed some of the evidence that American workers have been hurt by free trade since China joined the World Trade Organization in 2000. I criticized economists for presenting a far too glib and confident public case for free trade when scholarly research has begun to show a more mixed picture.

But that still leaves an enormous question unanswered. What policy steps could the U. S. and other industrialized countries have taken to blunt the worst effects of trade with China? Did policy makers err, or was China’s entry into the global trading system simply an unforeseen negative shock to U.S. workers, like a hurricane or volcano? What might have been done differently?

Politics

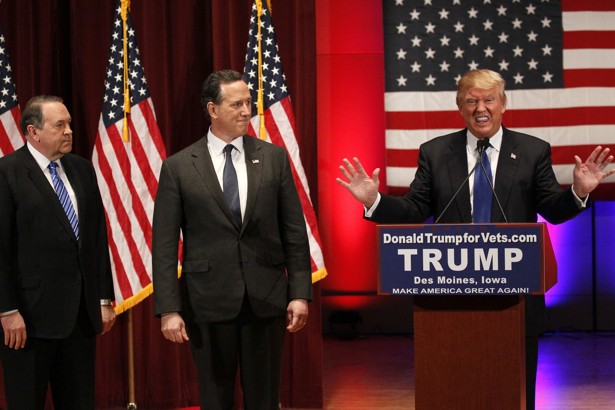

Trump Counterprograms the Debate (The Atlantic)

Trump Counterprograms the Debate (The Atlantic)

What have the Republican debates ever done for Donald Trump? They’ve generally featured a bunch of other candidates taking shots at the frontrunner, who tended to perform listlessly, making faces and lashing out at his foes every now and then. They’ve seemed to have no effect on his standing in the polls. And sometimes the moderators—notably Fox News’s Megyn Kelly—have gotten under his skin.

Ted Cruz’s National Security Plan Features War Crimes (Think Progress)

In Thursday night’s GOP debate, the final matchup before the Iowa caucus, Sen. Ted Cruz (R-TX) repeated his promise to conduct “carpet bombing” in the Middle East to combat ISIS forces. Yet he did not acknowledge that carpet bombing is a war crime under the international Geneva Conventions.

The Fox News moderators challenged Cruz on his voting record not lining up with his “tough talk” on national security.

Technology

Turn Your Car Windshield Into a Transportation Sidekick (PSFK)

Turn Your Car Windshield Into a Transportation Sidekick (PSFK)

Carloudy is an e-ink display that works to give car drivers a whole new navigation experience. The mechanism of the display makes it a standout, essentially converting any car windshield into an augmented reality display.

Apple could release a 'cutting-edge' wireless-charging iPhone next year (The Verge)

Apple could release a 'cutting-edge' wireless-charging iPhone next year (The Verge)

Apple is working on wireless charging technology for the iPhone and iPad, and it may see release as soon as 2017, according to a new report in Bloomberg. The company is said to be developing technology with partners that could charge a phone from at least some distance; current devices with "wireless" inductive charging, like several competing phones as well as Apple's own Watch, need to be in contact with a charging mat or pad to draw sufficient power.

Health and Life Sciences

Brain Protein Might Offer New Clues to Alzheimer's Treatment (Medicine Net Daily)

A protein in the brain may hold a key to slowing progression of Alzheimer's disease, a new study suggests.

And boosting this protein might be as simple as increasing exercise and social activity, experts say.

Life on the Home Planet

Europe's summers 'warmest in 2,000 years' (BBC)

Europe's summers 'warmest in 2,000 years' (BBC)

The past 30 years in Europe have likely been the warmest in more than two millennia, according to new research.

The study used tree ring records and historical documents to reconstruct yearly temperatures going back 2,100 years.

Japan puts military on alert for possible North Korean missile test (Reuters)

Japan has put its military on alert for a possible North Korean ballistic missile launch after indications it is preparing for a test firing, two people with direct knowledge of the order told Reuters on Friday.

"Increased activity at North Korea's missile site suggests that there may be a launch in the next few weeks," said one of the sources, both of whom declined to be identified because they are not authorized to talk to the media.