9,500. That's our line on the NYSE.

9,500. That's our line on the NYSE.

We finished the day at 9,504 but the S&P failed to hold 1,925 and the Russell never made it to 1,040 so we can't call this 3 of 5 over the line which means we don't have a bullish rally yet – just a bounce off the lows which will quickly start looking like a dead cat if the Russell fails to hold it's weak bounce line at 1,000, where we have a long position on /TF Futures. Likewise, the Nasdaq 100 failed to take back 4,200 – another key failure for the week.

We never made the bullish marks we were looking for in yesterday's post, so game off for the long play we discussed and game on for some hedges if you don't have any (we favor SDS and SQQQ, as discussed last time we were this high). All four of our tracking portfolio are in fantastic shape (full review yesterday in Chat) and we discussed locking in the gains by going to CASH!!!, because we're at a very tricky inflection point and it's hard to protect but we decided to press on and we'll see if we can clear those bounce lines next week.

That makes today more of a watch and wait day with Asia finishing the week slightly red for the day and Europe is down about 1% ahead of our open and our futures are down about 0.35% at 8:20. CPI comes out at 8:30 but nothing exciting expected there.

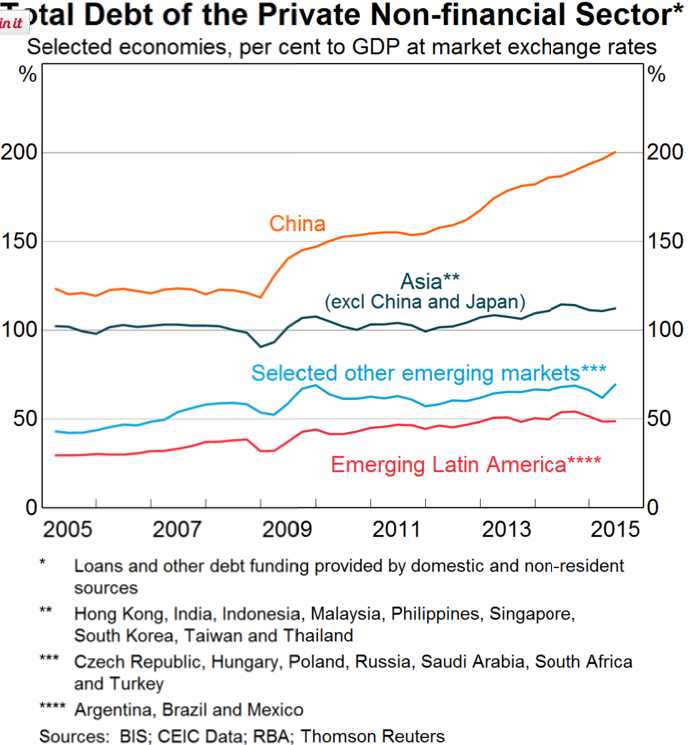

There's still a tremendous risk in the Chinese economy and, just this morning, Shaanxi Xinsheng defaulted on 4Bn Renminbi ($666M) and BAC analyst David Cui warns us, saying China must either A) Let the defaults take their course, risking a "chain reaction." or B) Continue printing money to bail out dysfunctional companies, putting downward pressure on the Renminbi. That will make China's foreign non-RMB debt more difficult to pay, creating "financial system risk."

There's still a tremendous risk in the Chinese economy and, just this morning, Shaanxi Xinsheng defaulted on 4Bn Renminbi ($666M) and BAC analyst David Cui warns us, saying China must either A) Let the defaults take their course, risking a "chain reaction." or B) Continue printing money to bail out dysfunctional companies, putting downward pressure on the Renminbi. That will make China's foreign non-RMB debt more difficult to pay, creating "financial system risk."

"In a scenario in which investors are not bailed out and thus become more cautious, e.g, rolling over some of the debt instruments in the shadow banking sector, some borrowers may struggle to obtain credit, for example, developers and coal miners. Whether this scenario would trigger a chain reaction is a key risk we would need to monitor. If shadow banking investors continue to be bailed out, this would imply a further strengthening of the implicit guarantee, and potentially, put pressure on growth, increase the debt burden and hurt RMB stability. We re-iterate our view that financial system risk is arguably the most important risk facing market this year … Until the debt issue is addressed, we believe it is unlikely we will see the bottom of the market."

Also this morning, Up Energy Development Group, a coal miner in China, defaulted on their convertible bond payment for Feb, putting the entire $444.8M (3.5Bn RMB) into a very questionable category. Over in Hong Kong, the pressure is mounting on property developers to drop prices before they too are defaulting on their construction loans. It is estimated that, if China continues to bail out these defaults, the Yuan will do a Japan-like drop and lose 30% of its value.

So China remains a concern but still one the rest of the World can hopefully shake off. Falling energy prices mean our energy sector too, may be defaulting on their debts in the near future but yesterday's drop in oil was nothing more than the end of a rumor that drove prices too high coupled with the end of the contract rollover period we told you last week (and the week before that) would drop prices and it's exactly on schedule.

Since last Monday, another 260,000 FAKE!!! orders have been rolled over, aided by BS rumors of supply cuts that drove prices high enough to let the traders roll out of trouble and fake demand for another month.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Mar'16 | 30.60 | 30.73 | 30.01 | 30.25 |

07:32 Feb 19 |

– |

-0.52 | 8024 | 30.77 | 64341 | Call Put |

| Apr'16 | 32.70 | 32.99 | 32.18 | 32.45 |

07:32 Feb 19 |

– |

-0.48 | 69773 | 32.93 | 483812 | Call Put |

| May'16 | 34.37 | 34.62 | 33.83 | 34.09 |

07:32 Feb 19 |

– |

-0.46 | 7612 | 34.55 | 240063 | Call Put |

| Jun'16 | 35.57 | 35.81 | 35.04 | 35.29 |

07:32 Feb 19 |

– |

-0.47 | 6983 | 35.76 | 184704 | Call Put |

| Jul'16 | 36.40 | 36.72 | 35.97 | 36.20 |

07:32 Feb 19 |

– |

-0.46 | 2718 | 36.66 | 88010 | Call Put |

Hell, the people who bought at $27.50 were even able to get out with a nice profit (we sure did!) while screwing the American people out of another few Billion Dollars at the pumps this week. We are now trading the April contract (/CLJ6) and we're long over the $32.50 line though it may spike lower as the last of the March contracts are extinguished.

Have a great weekend,

– Phil