Financial Markets and Economy

Is The Biotech Bear Market Over? (Forbes)

Another bearish signal may result if biotech stocks break below their long-term uptrend line.

The owner of the New York Stock Exchange is considering crashing Europe's biggest market merger (Business Insider)

America's Intercontinental Exchange is considering crashing the European market merger of the decade between Germany's Deutsche Boerse and the London Stock Exchange.

Wall St. Rises in Early Trading (NY Times)

United States markets were modestly higher in early trading on Tuesday as the market tried to recover from a loss the day before.

U.S. Has Record 10th Straight Year Without 3% Growth in GDP (CNS)

The United States has now gone a record 10 straight years without 3 percent growth in real Gross Domestic Product, according to data released by the Bureau of Economic Analysis.

Home-price growth continues as oil patch remains resilient, CoreLogic says (Market Watch)

Home-price growth continues as oil patch remains resilient, CoreLogic says (Market Watch)

U.S. home prices continued to be strong in January, according to a report released Tuesday.

Home prices rose 6.9% compared to a year ago in January, CoreLogic said. The real estate data firm’s price index rose 1.3% during the month.

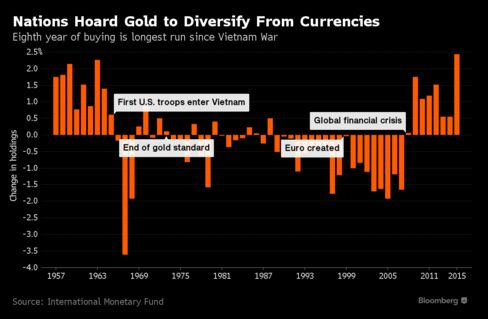

Central Banks Extend Longest Gold-Buying Spree Since 1965: Chart (Bloomberg)

Central banks have been net buyers of gold for eight years, with Russia, China and Kazakhstan among the biggest hoarders, International Monetary Fund data show. Countries purchased almost 590 metric tons last year, accounting for 14 percent of annual global bullion demand, the World Gold Council estimates.

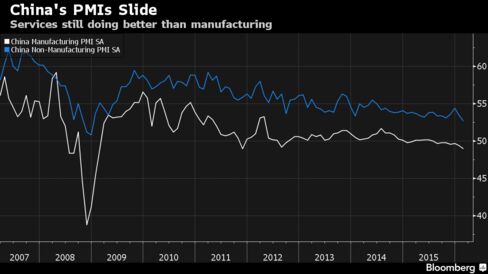

China's PMI Reports Show Slowdown Deepening as Services Slip (Bloomberg)

China’s factory gauge extended its stretch of deteriorating conditions to a record seven months while a measure of services fell to the weakest in seven years, underscoring the challenge for policy makers as they seek to cut overcapacity in manufacturing without derailing growth.

These ‘Dividend Aristocrat’ stocks have risen up to 24% a year for a decade (Market Watch)

Have you had enough negativity this year over the world economy, the U.S. stock market and the presidential election? Here’s some relief.

Bogle vs. Goliath (A Wealth of Common Sense)

Every year the National Association of College and University Business Officers (NACUBO) puts out a study on the investment performance of college endowment funds. It’s a comprehensive report that goes through the asset allocations and performance numbers of funds ranging from a few million dollars to funds with many billions of dollars (in the latest report there were over 800 funds in total).

How One Dairy Stock Became a Cash Cow (Bloomberg)

For Gillian Fyvie, a splash of milk on her cereal typically led to stomach ache, bloating and a swollen tongue. Not since making the switch.

The commodity price crash is killing Glencore — profit plunges by 69% (Business Insider)

Profit at Glencore, the mining and commodities trading company, fell by two-thirds in 2015.

Dollar strengthens as consumer spending stages a comeback (Market Watch)

Dollar strengthens as consumer spending stages a comeback (Market Watch)

The dollar edged higher against most of its G-10 rivals Tuesday as car-sales data added to evidence that consumer spending started to recover in the first two months of the year.

The ICE U.S. Dollar index a measure of the dollar’s strength against a basket of six rival currencies, was up 0.1% at 98.2340, adding to a slight gain from the day before.

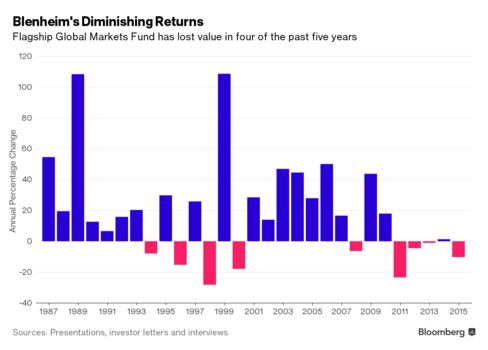

The Rise and Fall of Commodities Hedge Fund King Willem Kooyker (Bloomberg)

Thirty miles west of Wall Street, in an anonymous office park set among rolling hills and shady streets, lurks a giant of the commodities world.

Fed's Dudley sees risks to U.S. economic outlook tilting to downside (Business Insider)

An influential Federal Reserve official on Tuesday said he sees downside risks to his U.S. economic outlook, an assessment that could flag a longer pause before the Fed's next interest-rate hike than he and his colleagues had earlier signaled.

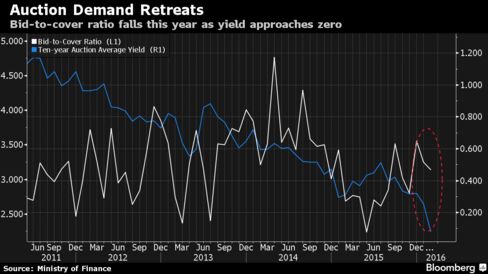

Japan Sells 10-Year Bonds at Negative Yield For the First Time (Bloomberg)

Japan's 10-year government bonds on Tuesday drew an average auction yield of -0.024 percent, declining below zero for the first time.

Rate Spread Signals Market Set for Expanded ECB Stimulus: Chart (Bloomberg)

The spread between the European Central Bank’s deposit rate and German two-year note yields is at its widest since November 2011, a sign of growing anticipation among traders for more aggressive easing from the ECB.

The Stock Index That Never Falls Two Years Straight: Chart (Bloomberg)

The Borsa Istanbul 100 index, which declined 16 percent last year, has never dropped two years in a row.

Politics

#NeverTrump and the coming schism in the Republican Party, explained (Vox)

#NeverTrump and the coming schism in the Republican Party, explained (Vox)

There’s a corner of the Republican Party that has quietly feared and hated Donald Trump for months. It’s spilled, messily, into the open. Just click on the hashtag: #NeverTrump.

Trump just saw his highest level of support to date in a CNN/ORC poll released this morning — fully 49 percent of Republican voters said they backed the bombastic billionaire. But in the same poll, about a quarter of Republicans overall said they would refuse to support him if he became the nominee.

America's Overseas Voters Are Not Impressed (Bloomberg View)

America's Overseas Voters Are Not Impressed (Bloomberg View)

In November 1968 a young Rhodes Scholar by the name of Bill Clinton was "mad as hell," as he told a friend back in Arkansas in a letter penned from Oxford University. Clinton's absentee ballot hadn't arrived in time for him to cast his vote for the Democratic nominee, Hubert Humphrey, who lost to Richard Nixon that year.

Bernie Sanders's Big Money (The Atlantic)

Bernie Sanders's Big Money (The Atlantic)

When Bernie Sanders makes a demand for money, he gets it. After winning the New Hampshire primary, the Democratic presidential candidate broadcast a plea. “I’m going to hold a fundraiser right here, right now, across America,” Sanders declared, urging anyone who would listen to visit his website and make a donation—“whether it’s 10 bucks, or 20 bucks, or 50 bucks.” Money poured in at a rapid clip. By the end of the next day, the campaign had collected a staggering $8 million.

Technology

Solar cells as light as a soap bubble? (MIT News)

Solar cells as light as a soap bubble? (MIT News)

Imagine solar cells so thin, flexible, and lightweight that they could be placed on almost any material or surface, including your hat, shirt, or smartphone, or even on a sheet of paper or a helium balloon.

Researchers at MIT have now demonstrated just such a technology: the thinnest, lightest solar cells ever produced. Though it may take years to develop into a commercial product, the laboratory proof-of-concept shows a new approach to making solar cells that could help power the next generation of portable electronic devices.

Health and Life Sciences

Health Tip: Keep Skin Looking Young (Medicine Net Daily)

If you want youthful skin, start with a regimen that protects your skin and keeps it healthy and glowing.

Mental abilities are shaped by individual differences in the brain? (Science Daily)

The results are published in the journal NeuroImage.

"A major focus of research in cognitive neuroscience is understanding how intelligence is shaped by individual differences in brain structure and function," said study leader Aron K. Barbey, University of Illinois neuroscience professor and Beckman Institute for Advanced Science and Technology affiliate.

Life on the Home Planet

Moment 'Tree Man' undergoes surgery to remove bark-like warts (The Telegraph)

A Bangladeshi man with bark-like warts on his hands and feet has undergone a surgery to remove the spread of the extremely rare growths.

Abdul Bajandar, 26, has become known locally as the 'Tree Man', thanks to the unusual growths.

Deepwater Horizon Spill Altered Shipwreck Ecosystems (Scientific American)

Deepwater Horizon Spill Altered Shipwreck Ecosystems (Scientific American)

Six years ago more than four million barrels of oil were discharged into the Gulf of Mexico following the Deepwater Horizon drilling platform explosion. Approximately one third of the oil ended up at the bottom of the gulf where shipwrecks lie. New findings now show that the microbial life has since thrived due to the spill and could threaten 500 years of history resting on the seafloor.