Courtesy of Pam Martens.

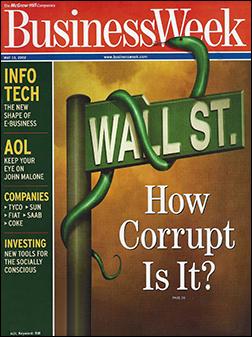

It was considered big news last week that House members Maxine Waters of the Financial Services Committee and Al Green of the Subcommittee on Oversight and Investigations have requested that the Government Accountability Office (GAO) launch an investigation of “regulatory capture” on Wall Street.

That news broke on Friday, one day after Senator Elizabeth Warren grilled the head of a Wall Street self-regulatory agency in a Senate hearing on a new study showing that stockbrokers with serial records of misconduct are allowed to remain in the industry. Warren also cited another recent study showing that even when investors prevail in arbitrations against bad brokers, they may never get paid. According to the study, over $60 million in fines owed to investors have not been paid since 2013.

The individual that Senator Warren was grilling is Richard Ketchum, head of the Financial Industry Regulatory Authority (FINRA), a self-regulatory body financed by Wall Street that oversees brokerage firms and has a division that runs a private justice system known as mandatory arbitration that hears all claims against bad brokers. FINRA was previously known as the National Association of Securities Dealers (NASD) but its reputation became so damaged as a self-regulator that it changed its name to FINRA. (Like that was really going to help.)

What the public doesn’t know is that for over 30 years, the GAO has been investigating these identical problems on Wall Street and making recommendations for cleaning up the mess. After 30 years, it should be abundantly clear that reading GAO reports and shaking one’s head isn’t getting the job done. Serious, radical reform of Wall Street is necessary and that means eliminating crony regulators and the entire self-regulatory system.

As far back as 1978, the GAO published the results of an investigation into the Securities and Exchange Commission’s oversight of the self-regulatory actions of the NASD. The report found flaws in the NASD’s examinations of brokerage firms and that the SEC had “not dealt aggressively enough with inspection oversight problems.”

…