2:30 AM.

2:30 AM.

That's what time tomorrow the Bank of Japan will have their press conference to announce their rate decision as well as, potentially, any new stimulus measures. Our own Fed will go 12 hours later (2pm) with Yellen speaking at 2:30 and, in case the markets are going completely off the rails by Friday, we have Dudley speaking at 9am, Rosengren speaking at 11am and Bullard speaking at 3pm because we'd hate to have a bad options expiration day, right?

Over the weekend, we already had a dramatic drop-off in Chinese Industrial Ouput at 5.4%, down 0.7% (11.4%) from last month and Retail Sales were down from 10.7% to 10.2%, also missing expectations of 11% (according to leading Economorons) by a wide margin. China is having a National People's Congress meeting this weekend but no major stimulus announcements are expected.

Over in Japan, there's a question as to the scale and timing of a very good report on Machinery Orders (+15%), with accusations the data is not even possible and is simply being used to manipulate the BOJ meeting. Things are, indeed, getting stranger and stranger. You might think that's unlikely but Australia JUST got caught falsifying their employment data to make the economy look better. As I said last week re. Japan, Abe is heading for a no-confidence vote so anything is possible when politicos try to hold onto their power.

If you want to know what's REALLY going on in China, you have to leave the planet, literally, and get a view from space. Fortunately, there's an app for that as SpaceKnow has a China Satellite Manufacturing Index based on analysis of thousands of photos taken from commercial satellites with an algorithm that compares photos of more than 6,000 industrial sites across China and assigns values for visual changes over time that indicate activity, such as visible inventory or new construction. The index comes from 2.2 billion individual satellite observations over 500,000 square kilometers spanning 14 years – now that's BIG DATA!

If you want to know what's REALLY going on in China, you have to leave the planet, literally, and get a view from space. Fortunately, there's an app for that as SpaceKnow has a China Satellite Manufacturing Index based on analysis of thousands of photos taken from commercial satellites with an algorithm that compares photos of more than 6,000 industrial sites across China and assigns values for visual changes over time that indicate activity, such as visible inventory or new construction. The index comes from 2.2 billion individual satellite observations over 500,000 square kilometers spanning 14 years – now that's BIG DATA!

As you can see from the chart, the results are double-plus ungood with REAL activity down about 3% in the past 24 months – that's no growth at all vs the 14% GDP growth claimed by the Chinese Government, which makes it very hard to reconcile the differences.

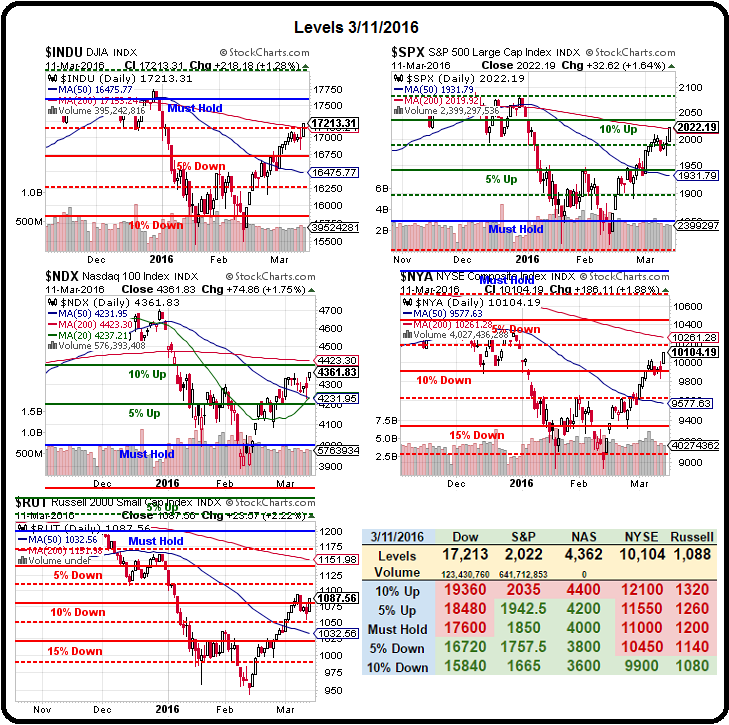

Back on Earth, we did not get good sell signals on Friday and that is why we play our Futures lines with very tight stops. Our main shorting lines were S&P (/ES) 2,000, Dow (/YM) 17,100, Nasdaq (/NQ) 4,325, Russell (/TF) 1,070 and Nikkei (/NKD) 17,000. The US indexes are still in range but the Nikkei popped to 17,200 so they are still our favorite short this morning (8:30) and the Dow failing 17,100 already is a bearish sign. Still VERY TIGHT STOPS on moves over the lines as it's a rough market to call.

Overall, we'd have to say the markets are TECHNICALLY rallying but the 3-day up move had a pretty low volume so it's certainly not conclusive and really, we're just waiting and seeing what the reaction to the Fed and BOJ statements will be tomorrow and Wednesday so today, Monday, is even more meaningless than usual – so let's not pretend we will have any insights when it's clearly a watch and wait kind of day.

The Dow and S&P have cleared their 200dma but that came on Friday's crazy run-up into the close. If they give it back easily, then probably that move was nothing but BS to reel in the suckers and it will be made even worse if those declining 200 dmas firm up as some sort of declining overhead resistance – the true mark of a bear market!

We're not bearish yet, however. More like neutral in our 4 Member Portfolios as we lock in our excellent Q1 gains and get ready for Q2 earnings, which will give us a much clearer picture on the "recovery". Meanwhile, with over $1Tn thrown onto the fire in Europe, we have that worry off the table and now we can just worry about China and Japan again – so things are looking up (kind of).

Have a good week,

– Phil