Courtesy of Joshua Brown, The Reformed Broker

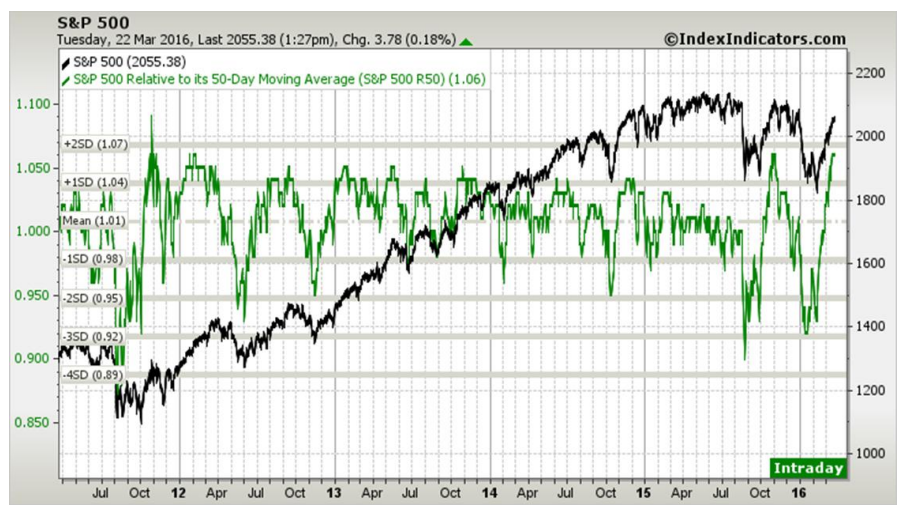

The berserker rally in the SPX that began in February now has the index “as extended it ever gets” in relation to the 50-day moving average.

Here’s Ray Jay chartist Andrew Adams, who also notes that breadth is confirming the run. I would add in that volume is not, it feels like a ghost town lately…

the S&P 500 is more than 6% stretched above its 50-day moving average, about as extended as it ever gets. That is almost two standard deviations above the average from the last five years!

If this is a headfake, it’s an elaborate one.

Source:

Charts of the Week

Raymond James – March 23rd, 2016