Financial Markets and Economy

Global economic uncertainty weighs on Fed outlook (BBC)

Global economic uncertainty weighs on Fed outlook (BBC)

The risk of a global economic slowdown was a key factor in the decision not to raise interest rates in March, the minutes from the Federal Reserve's meeting show.

Fed members feared a slowdown could make it difficult to reach the bank's targets on employment and inflation.

IMF Warns of Possible Crises for Emerging Markets Hit by Outflows (Wall Street Journal)

An exodus of cash from emerging markets in recent years is closely tied to developing economies’ slower growth rates and could end with financial crises in the countries involved, the International Monetary Fund said Wednesday.

The Fed was divided over whether to raise rates (Business Insider)

The Fed was divided over whether to raise rates (Business Insider)

Minutes of the Federal Reserve's March policy meeting released Wednesday showed that the committee was divided over whether to raise interest rates in April.

The Fed's policy-setting arm — the Federal Open Markets Committee (FOMC) — left its benchmark rate unchanged in March, as expected.

Can Economies Rise as Emissions Fall? The Evidence Says Yes (NY Times)

Throughout the 20th century, the global economy was fueled by burning coal to run factories and power plants, and burning oil to move planes, trains and automobiles. The more coal and oil countries burned — and the more planet-warming carbon dioxide they emitted — the higher the economic growth.

Stop Checking Your Phone, You're Killing the Economy (Fortune)

Stop Checking Your Phone, You're Killing the Economy (Fortune)

The growth of worker productivity in the United States has all but ground to a halt, rising just 0.3% on average per year from 2010 to 2015. Economists have a million hypotheses—everything from a decline in technological innovation to the hangover from the Great Recession from 2007 to 2009.

Why Bull Markets Make Everyone Miserable (The Reformed Broker)

You might have expected a bit of elation on Wall Street about the massive performance the US stock market has exhibited off of the February lows. You’d have been wrong. There’s no joy to be found, with the S&P 500 once again hovering just below last year’s all-time high.

Oil prices up on U.S. inventory draw, but traders warn on premature rally (Business Insider)

Crude futures were lifted by a raft of supportive indicators in early trading on Thursday, although some traders warned that physical supply and demand fundamentals did not warrant a strong price recovery at this stage.

China's stock market resurgence could be the start of something big (Business Insider)

China's stock market resurgence could be the start of something big (Business Insider)

After a relentless sell-off late last year — seeing many mainland indexes halve in a little over six months — Chinese stocks have recently found their footing.

Monotonously, and somewhat suspiciously, they have been pushing higher since hitting a multiyear low in February, buoyed by further monetary-policy stimulus from the People's Bank of China, an increase in the use of margin lending, and, of course, suspected buying from China's so-called national team of state-backed investors.

As an Investor, Osama bin Laden Was Bullish on Gold (NY Times)

It appears so. At the end of 2010, Al Qaeda found itself suddenly flush after securing a $5 million ransom, and the group had to decide what to do with its windfall. At a time when the financial uncertainty of the Great Recession made gold a hot investment, Bin Laden turns out to have been as bullish about the precious metal as any Ron Paul devotee, Tea Party patriot or Wall Street financier.

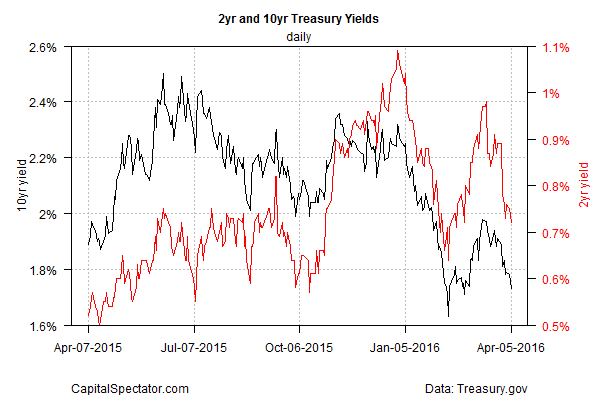

Will Falling Treasury Yields Create New Headwind For US Equities (Capital Spectator)

The risk-off trade is back in high gear, according to Treasury yields. The downside momentum in the benchmark 10-year yield is particularly conspicuous, based on daily data through yesterday (Apr. 5) via Treasury.gov.

'Brexit' No Barrier to U.K. Stock Valuations at Record Premium (Bloomberg)

Doubts are mounting about the future of the U.K.’s membership in the European Union, but you wouldn’t know it from the country’s stocks. Rather than being punished for a lack of certainty, they’ve become the most expensive ever relative to others in the region.

Yahoo expects 2016 revenue to drop about 15 percent: Re/code (Business Insider)

Yahoo expects 2016 revenue to drop about 15 percent: Re/code (Business Insider)

Yahoo Inc estimates revenue to drop nearly 15 percent and earnings to fall by over 20 percent in 2016, Re/code reported on Wednesday.

SunEdison, Valeant And Apple – Enron’s Lessons & Rationalizations (Value Walk)

Whitney Tilson in his email discusses Fastow’s lessons & rationalizations Re. Enron; SunEdison, Apple, Valeant Why we think we’re better investors than we are; My comments on Berkshire and the Airlines; man up, Allergan shareholders (tax inversions); an open letter to a NC State legislator; Opioids and Polk Awards.

Panama – The Coming Crash of Capitalism (Forbes)

Watching the alarming scene of global capitalism today is akin to seeing a vehicle hurtling at full speed towards a wall and while shouting and screaming on the sidelines the pilot remains oblivious and keeps pushing on the accelerator. You know it is going to crash as you watch in disbelieving horror. The Panama Mossack Fonseca affair is another milestone that the vehicle of 21st century capitalism goes whizzing by on the road to crashing against the wall.

The great hope for China's economic future is suddenly looking better (Business Insider)

The great hope for China’s economic future — the nation’s vast services sector — showed renewed signs of life in March.

Things are getting tougher for Harley-Davidson in the US (Business Insider)

Things are getting tougher for Harley-Davidson in the US (Business Insider)

In the US motorcycle market, Harley-Davidson has long been the choice of bikers who want a big, loud, comfortable cruiser, or a bike with some deep, made-in-the-USA credibility.

Sure, there are some big bikes and cruisers from other manufacturers, but this particular style of motorcycle has long been associated with a roaring Harley V-Twin-engined hog.

Why global ‘currency truce’ may not last (Market Watch)

A weaker dollar accompanied by a strikingly more dovish Federal Reserve is feeding the notion that global policy makers reached some sort of soft agreement to at least call a truce in the “currency wars” that saw the world’s central banks competing to weaken their respective currencies in a bid to steal export business from each other.

Economics Builds a Tower of Babel (Bloomberg View)

Economics Builds a Tower of Babel (Bloomberg View)

In Lewis Carroll’s "Through the Looking Glass," Humpty Dumpty proudly declares: "When I use a word, it means just what I choose it to mean– neither more nor less." To which Alice replies: "The question is whether you can make words mean so many different things."

Humpty Dumpty could have been an economist. The modern economics profession made a collective decision, long ago, to develop a system of jargon in which words have multiple, sometimes contradictory meanings. Unfortunately, the general public’s reaction tends to be similar to that of poor Alice.

Investors are overlooking Apple's next $50 billion business (Business Insider)

Apple, the world's most valuable company, isn't shy about revealing how many of its computers, tablets, phones, and smartwatches are in use: over 1 billion, according to CEO Tim Cook.

Politics

Trump and the Borderers (The Atlantic)

Trump and the Borderers (The Atlantic)

Imagine a successful presidential candidate whose political style was “characterized by intensely personal leadership, charismatic appeals to his followers, demands for extreme personal loyalty, and a violent antipathy against those who disagreed with him.” In many parts of the country, voters might recoil from such an approach. But as Donald Trump has discovered, it exercises a powerful appeal in a region stretching from Appalachia down into the old southwest.

'New York values' haunt Cruz at Trump's massive Long Island rally (Mashable)

'New York values' haunt Cruz at Trump's massive Long Island rally (Mashable)

Donald Trump went after Sen. Ted Cruz hard on Wednesday at a massive rally on Long Island, firing up an enormous crowd of New Yorkers by attacking Cruz's past comments deriding "New York values."

"Do you remember during the debate when he started lecturing me on New York values like we're no good, like we're no good," Trump said to boos from the thousands of people packed into Grumman Studios in Bethpage, New York."

Technology

Your Water Heater Can Become A High-Power Home Battery (Popular Science)

Your Water Heater Can Become A High-Power Home Battery (Popular Science)

Although wind and solar energy are growing in popularity, storing that clean energy costs a lot of money. If consumers wanted to keep their green energy in Tesla's Powerwall home battery, for example, they would have to shell out $3,500. That may be why Tesla discontinued sales of its largest Powerwall a couple weeks ago.

Will Automated Restaurants Soon Replace Entry Level Workers (PSFK)

Will Automated Restaurants Soon Replace Entry Level Workers (PSFK)

Carl Jr.’s CEO Andrew Puzder has a vision for his very own fully automated restaurant. “Machines are always polite, they always upsell, they never take a vacation, they never show up late, there’s never a slip-and-fall, or an age, sex, or race discrimination case,” Puzder said in Business Insider.

Inspired by his visit to Eatsa, an entirely automated restaurant located in San Francisco, Carl Jr.’s CEO posits that a robot-run eatery may be an attractive prospect for millennials who, according to him, seem to favor ordering through kiosks rather than people.

Health and Life Sciences

Regeneration could be lurking in our genes (Futurity)

Regeneration could be lurking in our genes (Futurity)

If you trace our evolutionary tree way back to its roots—long before the shedding of gills or the development of opposable thumbs—you will likely find a common ancestor with the amazing ability to regenerate lost body parts.

Powdered Booze Could Fix Your Clogged Arteries (Popular Science)

Putting the "party" in "artery"

Scientists have discovered that a compound already approved by the FDA can dissolve away this buildup in the blood vessels more effectively than existing treatments.

Life on the Home Planet

Mexico City's Doubling Down on its Car Ban to Clear Smoggy Skies (Gizmodo)

Mexico City's Doubling Down on its Car Ban to Clear Smoggy Skies (Gizmodo)

A plan to restrict private vehicles from Mexico City’s downtown hasn’t done enough to reduce air pollution, so the city is now asking twice as many cars to stay off the roads.

As a sprawling city at a soaring altitude, Mexico City is prone to intense smog because it’s surrounded by mountains, which trap particulate matter in what are called inversions. But it has gotten much worse in recent weeks, with ozone levels in particular skyrocketing to 1.5 times what is considered healthy, forcing the city to draw up new restrictions that went into effect last Monday.

Teenage girl killed by exploding Takata air bag in Texas (Chicago Tribune)

The girl is the latest victim of malfunctioning air bag inflators that have killed 10 people in the U.S. and another in Malaysia, touching off the largest automotive recall in U.S. history. More than 100 people have been hurt by the inflators, which can explode with too much force, blowing apart a metal canister and sending shards into drivers and passengers.