Courtesy of Benzinga.

Barclays has upgraded two airline stocks, while downgrading three, to better reflect even a “modest risk of recession” over the next year. The brokerage’s top pick remains United Continental Holdings Inc (NYSE: UAL), and the next best idea is JetBlue Airways Corporation (NASDAQ: JBLU).

Upgrades

Analyst David Fintzen upgraded JetBlue to Overweight from Equal Weight, saying that a cabin refresh, new pricing strategy and other revenue initiatives would make the airline more “formidable” over the next 12–24 months.

Fintzen raised the rating of Southwest Airlines Co (NYSE: LUV) to Equal Weight on relatively better-than-expected RASM (revenue per available seat mile).

“We’re still not as bullish as most on LUV, as we don’t see the ability to be dominant in the industry as in the pre-9/11 era, nor do we see all that outsized a growth opportunity given the huge scale of LUV today,” the analyst wrote in a note to clients.

Downgrades

Meanwhile, Fintzen cut the rating of Aircastle Limited (NYSE: AYR) to Underweight due to “fear of fear.”

“We think the downside risk is slightly less than peer lessors, but still very substantial. On the other side, we view the upside as more limited versus peer lessors and, probably more relevant in our rating system, to many US airlines,” the analyst noted.

Barclays also slashed Allegiant Travel Company (NASDAQ: ALGT) to Underweight, saying that shares are likely more range-bound than others. Fintzen said if oil prices increase, then it would add the double impact of higher costs and a reduction in growth as aircraft utilization is reversed.

Meanwhile, Fintzen downgraded Virgin America Inc (NASDAQ: VA) to Equal Weight following its announced merger with Alaska Air Group, Inc. (NYSE: ALK) and the limited downside risk given the interest from JetBlue.

In addition, Barclays said its stocks could still rally about 20 percent, on average, if oil rises towards $40–$50/bbl, if not higher. On the other hand, its coverage universe face about 35 percent downside risk if economy slips into a US and global recession during 2016.

The Sector

On the sector front, the analyst expects domestic RASM should turn positive if this recent rally in oil proves “real” and domestic economic growth accelerates. However, if oil drifts back towards $30 and US GDP remains at around 1 percent, “we think positive RASM becomes highly unlikely in ’16, absent noticeable cuts to planned capacity (which we suspect wouldn’t materialize given margins).”

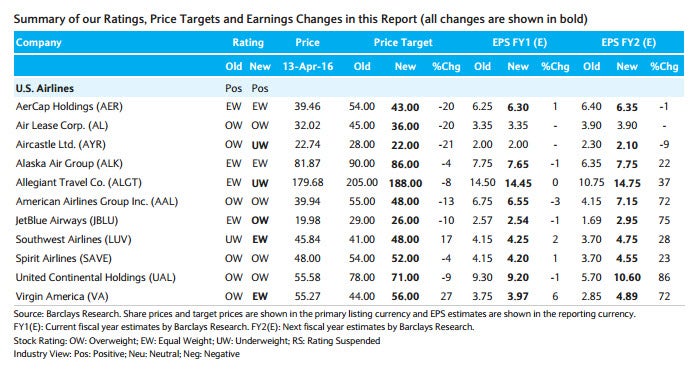

The following table shows the rating and price target changes of Barclays on airline stocks:

Latest Ratings for UAL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2016 | Credit Suisse | Maintains | Outperform | |

| Apr 2016 | Deutsche Bank | Downgrades | Buy | Hold |

| Mar 2016 | Stephens & Co. | Initiates Coverage on | Equal-weight |

View More Analyst Ratings for UAL

View the Latest Analyst Ratings

Posted-In: Analyst Color Upgrades Downgrades Price Target Travel Top Stories Analyst Ratings Trading Ideas Best of Benzinga