The Nattering Naybob discusses Bill Ackman, Pershing Square Holdings, Platform Specialty Products, Canadian Pacific, Valeant Pharmaceuticals, Platform Value, Leverage, the Index Fund Bubble and the Liquidity Gap.

Platform Value: The Fall?

Courtesy of The Nattering Naybob Chronicles

A mad folly, an extravagant visual orgy, a free-fall from reality into uncharted realms. Surely, it is one of the wildest indulgences a director has ever granted himself. Filmed over four years in 28 countries and a movie that you might want to see for no other reason than because it exists. There will never be another like it. – Roger Ebert

Excerpt:

Free falling mad folly?

From Bill Ackman's letter to Pershing Square Holdings' (OTCPK:PSHZF) shareholders: "Our biggest valuation error was assigning too much value to the so-called "platform value" in certain of our holdings. We believe that "platform value" is real, but, as we have been painfully reminded it is a much more ephemeral form of value… [which] depends on access to low-cost capital… and the pricing environment for transactions."

We pull no punches, what Ackman really believes but can't say is, his business model is based on keeping people in the market. Much like Roy (in The Fall) Ackman does not "Ack-knowledge" the market folly of the "platform value" paradigm which has obviously caused Pershing Square and his "Valeant Fall."

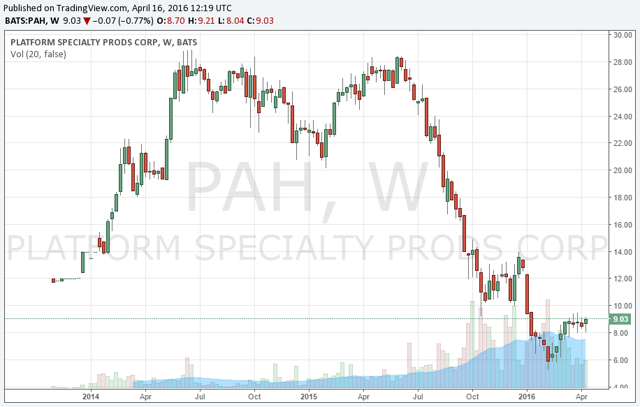

Platform Specialty Products

Above note, Platform (NYSE:PAH) jumped from $12 to a peak of $28 then collapsed to $5. Did someone play the greater fool with a speculative $5 stock, which jumped to $28, when they paid $25 a share?

Ackman: "Our most glaring, albeit small, unforced error was buying additional stock in Platform Specialty Products at $25 per share to assist the company in financing an acquisition. We paid too much… and because we assigned too much platform value to the company. Our assessment was incorrect."

[…]

What's Leverage?

Ackman on leverage: "stocks can trade at any price in the short term. This is an important reminder as to why we generally do not use margin leverage…The companies in our portfolio that have suffered the largest peak-to-trough declines are Valeant, Platform, Nomad, and Fannie and Freddie. The inherent relative risk of their underlying businesses and their more leveraged capital structures partially explain their greater declines in market value.… In retrospect, in light of Valeant's leverage… we should have made a smaller initial investment in the company."

This isn't rocket science, but did the experts at Pershing forget the part where investing in a company with leveraged debt (capital structure), even without a leveraged margin position, is nonetheless investing in a leveraged position? As we Nattered in "Eminence Front?," it would seem that everybody has been snorting the "white powder" of financial engineering for quite a while, and all but forgotten the fundamentals.