If they are going to keep giving us set-ups, we'll keep making money.

If they are going to keep giving us set-ups, we'll keep making money.

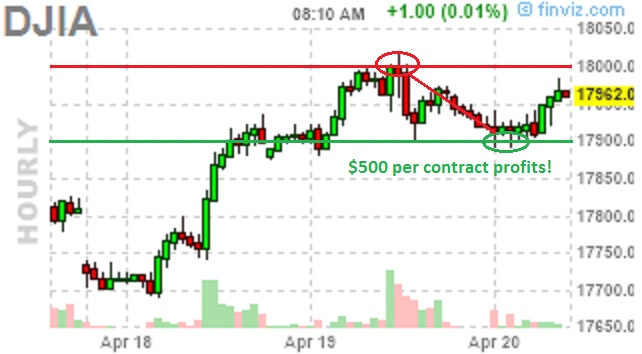

Yesterday, I don't think I could have been more clear than to headline our pre-market post "Technical Tuesday – Short the Dow at 18,000! S&P 500 at 2,100!" We even had a helpful illustration to hammer the point home, for those who like visuals. As you can see on the updated chart, the Dow made us a quick $500 per contract profit with a similar gain on the S&P.

Remember – I can only tell you what the market is going to do and how to make money from the move – the rest is up to you!

The Nasdaq had an even greater fall, plunging from our 4,585 line on /NQ all the way down to 4,505 which, at $20 per point per contract, was a nice $1,600 gain on each short contract. The real star of the day, however, was Natural Gas, where the July (/NGN6) contracts we discussed in the morning post (if you subscribe here, you'll have it in your inbox every morning!) continued on to $2.32 this morning – up $1,200 per contract from where we took half off the table with a $700 gain (all detailed in the morning post).

The Nasdaq had an even greater fall, plunging from our 4,585 line on /NQ all the way down to 4,505 which, at $20 per point per contract, was a nice $1,600 gain on each short contract. The real star of the day, however, was Natural Gas, where the July (/NGN6) contracts we discussed in the morning post (if you subscribe here, you'll have it in your inbox every morning!) continued on to $2.32 this morning – up $1,200 per contract from where we took half off the table with a $700 gain (all detailed in the morning post).

Oil (/CL) is still a great short below our $41.50 line from yesterday. Inventories are at 10:30 and I doubt they will help.

The Natural Gas ETF (UNG) is, of course, our trade of the year and we've discussed that to death (see this weekend's Top Trade Review for our current position). Also discussed to death is today's news – I already put up a tweet on that with all the charts and news that will be driving the market today – as we discussed in our Live Member Chat Room earlier this morning.

Today should actually be a pretty dull day, we still like yesterday's shorting lines but tight stops above as the ECB makes their policy announcement tomorrow morning and that means we've all got Draghi Fever – maybe he'll throw another Trillion onto the fire? In the very least, Draghi Fever will serve as a backstop for the bulls and any hint of more easing will cause yet another rally that we will short the crap out of into the weekend but, for now, it's more of a watch and wait day with cautious play around our levels.

Today should actually be a pretty dull day, we still like yesterday's shorting lines but tight stops above as the ECB makes their policy announcement tomorrow morning and that means we've all got Draghi Fever – maybe he'll throw another Trillion onto the fire? In the very least, Draghi Fever will serve as a backstop for the bulls and any hint of more easing will cause yet another rally that we will short the crap out of into the weekend but, for now, it's more of a watch and wait day with cautious play around our levels.

If Draghi does hold rates steady, as he is likely to do, it will actually be a good thing as it's what they UK wants and will likely help keep them in the Union in the upcoming Brexit vote (June). A weekend campaign to scare UK voters out of leaving the EU has been very successful and now polls have shifted in favor of staying in and that's boosting the Euro, weakening the Dollar and giving commodities (priced in Dollars) a much-needed lift. The stronger Euro has also helped the Yen drop back to levels the Nikkei finds bullish (back to 17,200, where it's a very tempting short again):

That's why we're done with the /NG longs and back to shorting oil – if Draghi eases, the Euro plunges and the Dollar rises but, if Draghi does nothing, Europeans will be disappointed and oil will lose some of it's growth outlook and down we go again (not to mention the Kuwait strike is over already – as I predicted yesterday morning).

So that's today's easy money trade – other than that, it's more of a watch and wait sort of day and tune in this afternoon (1pm, EST) for our Live Trading Webinar.