.jpg) I told you so!

I told you so!

Yes, I say that a lot these days and that's because I regret not being more emphatic with my cash calls in 2007 and 2008 when I was a less-experienced writer and felt "silly" being the only analyst who was worried about the irrational exuberance of the time. A good example is our November Wrap-Up from 2007 and, specifically, November 6th, when I said:

I don't like to play the role of Chicken Little but I feel like the casting is forced on me because almost everyone else I talk to is a bull. I said my piece about the housing disaster on Monday and that's only ONE of the things I think are really terrible in the economy!

This is the problem with the markets, we are rallying on leaders and, in the case of oil companies, the worst kind of leaders, while the rest of the market; retail, regional manufacturing, services, dining, discretionary… is in the doldrums. Rallying the market based on the energy sector is like a group of hemophiliacs electing a vampire as their leader, it's a recipe for disaster. And who are our other "leaders"? Commodities stoking inflation! Holy cow people, does anyone actually live on the planet we're investing in?

Sound familiar? On October 29th, 2007, I had pointed out that the MSM was "yadda yadding" over the bad news saying:

Back in August I told readers about the dirty little secret of the financial press, they are ratings whores just like every other aspect of the media, and that means they will tell you whatever you want to hear! Newsletters (like this one) are no different because we rely on subscribers to pay the bills and subscribers don't like to hear bad news any more than the average person who chooses to watch Entertainment Tonight over the Evening News does.

I've pledged not to do that and I've lost a few readers in the process but we've made a little money along the way and had some fun so I'm pretty happy overall. I love the markets and I love the economy and I love this country but – come on people – let's be realistic about our prospects! We've got some serious problems yadda, yadda, yadda and I get bored talking about them myself but a good army drills and drills and drills to be prepared for a battle that may only last a few hours after which we separate the quick from the dead. I need you guys to be quick, and to do that we need to keep vigilant, even as we party on with the markets.

9 years later, the more things change, the more they stay the same. We began bottom fishing at 1,100 on the S&P in July of 2008 and yes, that was a bit early but we were buying cautiously. At the time (Aug 13th), I said:

9 years later, the more things change, the more they stay the same. We began bottom fishing at 1,100 on the S&P in July of 2008 and yes, that was a bit early but we were buying cautiously. At the time (Aug 13th), I said:

As dire as this may seem the key, from an investing standpoint, is that there is nothing new here. We know there is a mortgage crisis, we know retail sales were awful in July, we know we are slaving under the worst Administration that have ever been give free reign to plunder a nation for the benefit of their contributors – this is not news, and this is now what we look at in our investing decisions. We need to look forward and, as you can see from my April housing solution that can be triggered at any time and oil has already come down and the dollar is getting stronger – despite the tremendous fiscal irresponsibility of this administration because that too, can be reversed rather quickly.

So our investing premise remains unchanged. We like Technology, we like the beaten-down financials (the ones we think will survive), and we like our long-term blue chips as spreads to sell calls against because we view the economy as down but not out. We are expecting oil to bounce from $110 to $130, we are expecting the dollar to pull back to 74 – these things will not bother us and we will consider it very bullish if they don't go that far. Let the media panic the sheep in and out of stocks but nothing has changed for us since we started bottom fishing back in July at 11,200. We'll keep an eye on the Big Chart, which I will update tomorrow and we will make our short-term profits while adding to our long-term positions. As I said last night, even if we are right, this is not an easy path – but we choose the one that feels right and we can walk without fear.

The rest of that exciting year can be reviewed in our 2009 3-part retrospective:

The rest of that exciting year can be reviewed in our 2009 3-part retrospective:

- Stock Market Crash – Year One in Review – The Gathering Storm

- Stock Market Crash – Year One Review II – The Next 30% Down

- Stock Market Crash – Year One Review III – March Madness

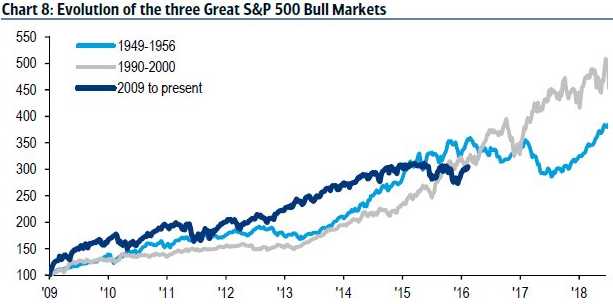

I sincerely hope that, a year from now, I'm not writing a review about the great crash of 2016 and no, I'm not expecting one this year but I do think the Fed(s) are getting low on ammunition and I do think the Global Economy is still in a precarious position and I do think the Global Governments are heading in the wrong direction, policy-wise (we need infrastructure spending, not low rates) so we're not shorting the markets just yet but we are hedging (see Tuesday's timely SQQQ hedge) and we are leaning towards large CASH!!! balances in all of our Members' Tracking Portfolios.

So I'm sorry to keep pointing out that I told you so but it's important that you realize I might actually know what I'm talking about when I tell you to be cautious or when I say no to our Members' inquiries about buying this or that stock when it's already near the all-time highs and, of course, I'm a little bit like an insurance salesman when I tell you to hedge because you have to take perfectly good money and "waste" it on insurance.

.jpg) As with our bullish turn in July of 2008, we can be early (it took the S&P a full year to get back to 1,100) but, in retrospect, it can't be argued that 1,100 was not a fundamental support level for the S&P – once the panic subsided. Also, our key strategy of Buying Stocks for a 15-20% Discount means our buys at 1,100 were really calling a floor at 880, which is right about where the S&P did bottom out (other than a panic low, which we took full advantage of on live TV).

As with our bullish turn in July of 2008, we can be early (it took the S&P a full year to get back to 1,100) but, in retrospect, it can't be argued that 1,100 was not a fundamental support level for the S&P – once the panic subsided. Also, our key strategy of Buying Stocks for a 15-20% Discount means our buys at 1,100 were really calling a floor at 880, which is right about where the S&P did bottom out (other than a panic low, which we took full advantage of on live TV).

Speaking of panic lows, I sent out an Alert to our Members early this morning (also tweeted) after the BOJ failed to add more QE to their already insane $732Bn/yr (would be $3Tn in the US economy) calling for BULLISH Futures trades off the lows on our indexes but shorting Oil (/CL) Futures as it tested $45.50 – just in case we were wrong. Oil already gave us a quick $250 per contract gain back below $45.25 and, now that we've seen GDP at 0.5% (in-line with weak expectations) we're completing the bounce move but we're taking those quick gains and running as well as this GDP report is nothing to crow about.

Speaking of Futures, we made a lovely $1,500 in 30 minutes during yesterday's Live Trading Webinar – the replay should be available later today on our main site for those of you who don't find it worth it to subscribe to the live feeds. Speaking of subscribing – our Options Opportunity Portfolio, which we share over at Seeking Alpha is now up 48.6% in it's 3rd quarter – well on track for our 60% annual goal. You can subscribe to that portfolio RIGHT HERE.

Speaking of Futures, we made a lovely $1,500 in 30 minutes during yesterday's Live Trading Webinar – the replay should be available later today on our main site for those of you who don't find it worth it to subscribe to the live feeds. Speaking of subscribing – our Options Opportunity Portfolio, which we share over at Seeking Alpha is now up 48.6% in it's 3rd quarter – well on track for our 60% annual goal. You can subscribe to that portfolio RIGHT HERE.

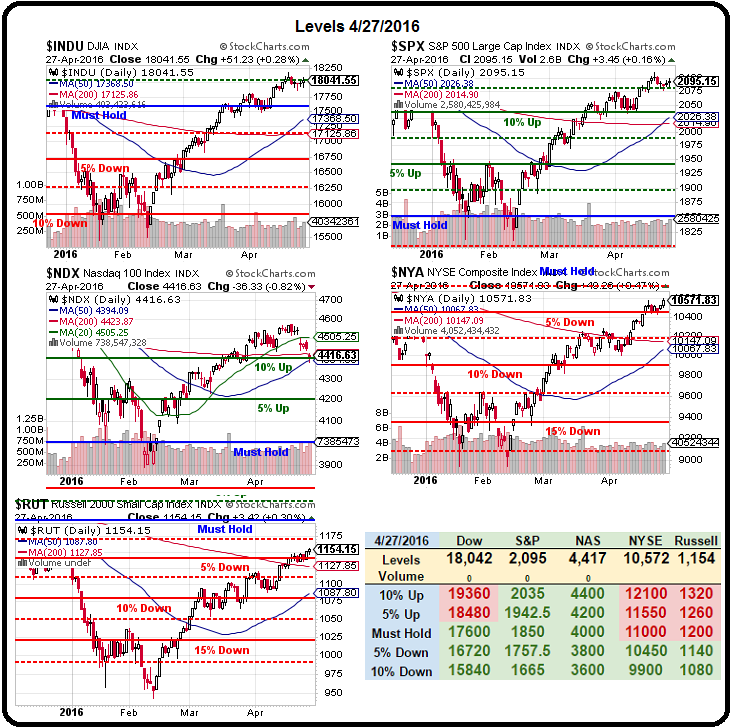

Over at PSW, the Options Opportunity Portfolio is just one of our 4 Member Tracking Portfolios and we have moved to a slightly bearish stance into earnings season, having just added additional hedges to lock in our very nice gains across the board. I urge you to do the same with your portfolio. Once the S&P is over 2,100 for a week or two and the NYSE is back over 11,000 (5% away) and the Russell is over 1,200 – I will be THRILLED to get more bullish but we already have TONS of bullish positions (and we even added one yesterday) already and we're being very selective about adding more with the market so toppy.

Please – don't make me say I told you so after it's too late!