Yen For Dollar?

Godzilla, 1954 – The world is beset by the appearance of monstrous creatures, but one of them may be the only one who can save humanity. Producer Tomoyuki Tanaka stated that, "The theme of the film, from the beginning, was the terror of the bomb [atomic]. Mankind had created the bomb, and now nature was going to take revenge on mankind."

Above note JPY versus USD's steady ascent with yesterday's [April 27] huge +3% post BOJ candle. Last night's +3 JPY/USD move, and a 14% move since June 8, 2015, have had an impact on Japan's banks, exporters and economy.

The Yen, which is now up 10% since February… that's very bad for Japan's export-based economy as the same $20,000 Toyota that put 240,000 Yen on TMs books in Feb is now putting 216,000 Yen in their pockets in April. They already made the car and shipped it 3 months ago and they paid their workers and parts suppliers in weaker Yen at the time so this change in currency essentially wipes out all of their profit on the car – that's why this matters so much – especially to a net exporter (and that goes for China too).

The example above speaks to currency risks which can affect the books (cash flow), in real terms, when currency changes are adjusted for differences in inflation. Long term, most currency fluctuations tend to be offset in real terms by price changes. In addition, hedging can be affected through futures, swaps, or options.

[Here, TNN discusses the different kinds of currency risk, transaction risk, portfolio risk and structural risk.]

A 15% drop in USD/JPY drops margin to 2% (operating expense in yen rises +15%), resulting in a drop of 85% in operational cash flow, amplified by a -15% dollar revenue drop = 95% less cash flow.

In order to reduce the mismatch in flows, most auto manufacturers naturally hedge by opening manufacturing plants in their prime markets, vis Toyota manufactures in the US, lowering their structural exposure to USD. Again, price changes can come into play.

Three things have made the yen jump against the dollar.

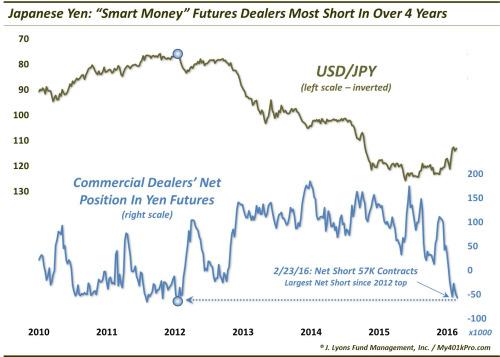

1. Short covering – Everybody, including the big banks, was betting on BOJ furtherance of ETF and bond buying, which would weaken the yen. When the assumed handout turned up empty, all those commercial net short positions got torched, pushing the yen even higher on short covering.

Above note, commercial net short JPY at a four-year high.

2. Carry trade margin call – When the yen rises, carry traders who previously borrowed in cheaper yen to obtain "dollars" must cover their rising yen positions, forcing liquidation of liquid assets to make margin calls. Hence, the Nikkei and other major indices sell off.

Above note, the large Nikkei 225 red candle and the relationship to the JPY/USD pair.

Above note, Godzilla, 2014.

3. Declining global "dollar" liquidity – The yen is still the carry trade of preference to swap into dollars. Borrow cheap yen, obtain dollars through forward swaps paying a negative spread. When yen are bought to swap out dollars, this ultimately takes yen off the market, lowering the float – less yen, higher value. At the same time, dollars being swapped are released or flooded into the market, so float increases – thus, a lower dollar.