Courtesy of Joshua Brown, The Reformed Broker

In David Kostin’s Weekly Kickstart note for Goldman Sachs, the strategist talks about the six “known known” risks for US stocks this year. You know them by heart at this point: valuation, China, election, sentiment swings, rate hikes, buyback drought. One or two of these things will eventually matter and give us the next pullback.

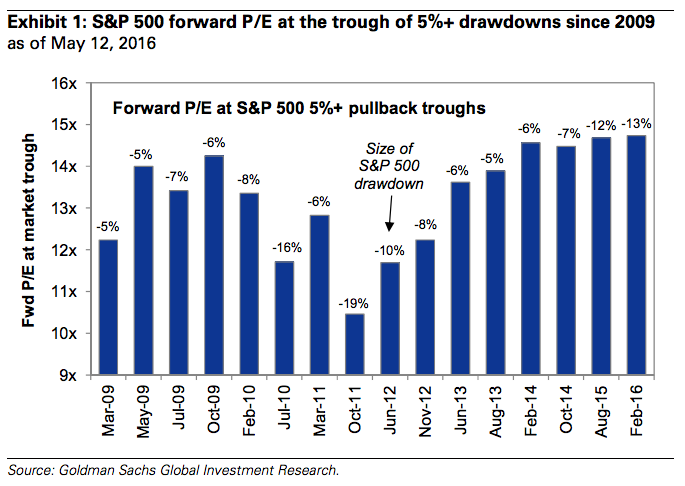

I thought this chart of the forward PE multiple at the trough of each drawdown was interesting:

A drawdown during the next few months could find the S&P 500 index falling by 5%-10% to a level between 1850 and 1950. 16 drawdowns greater than 5% have occurred since 2009, including the 13% correction that lasted 3 months and ended in February (Exhibit 1). S&P 500 trades at 2047 and has a forward P/E of 16.7x based on bottom-up adjusted EPS of $123. A 5% pullback would lower the P/E to 15.8x, implying an index level of 1950. A 10% correction would reduce the P/E to 15.0x and the index level to 1850.

Source:

US Weekly Kickstart

Goldman Sachs – May 13th, 2016