The Force Awakens?

Courtesy of The Nattering Naybob

Excerpt:

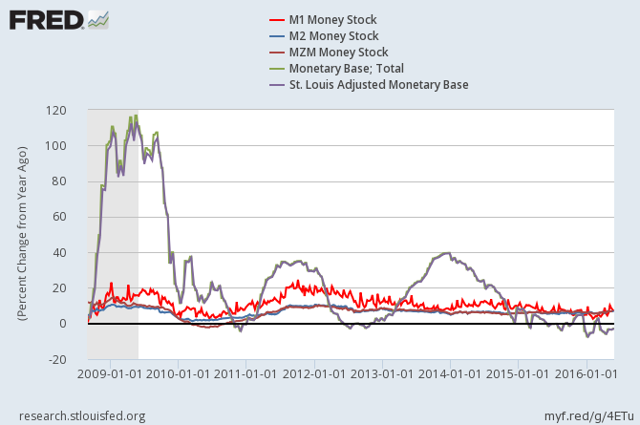

Monetary Aggregates

In Yoy % growth or ROC (rate of change) note the obvious effect of QE 1,2,3 on the monetary base (grey line) in the large camel humps; and since Q4 2015 in negative growth territory. The Force Awakens?

"by all aggregate measures, M1, M2, MZM, StLAMB, the money supply growth rates are still in contraction, with both monetary base aggregates in negative growth territory, or shrinking."

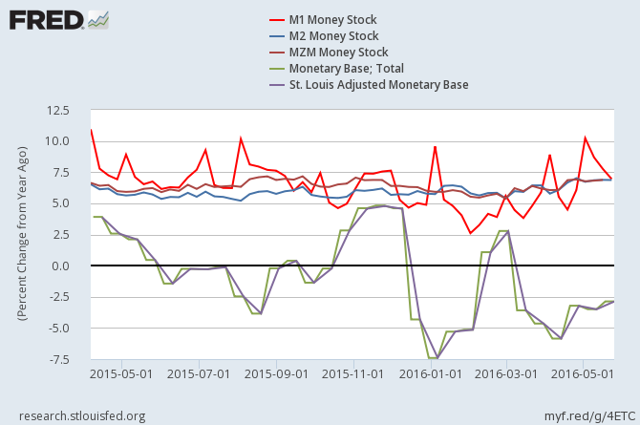

Above, upon further review, since Jan 6, note the monetary base aggregates (grey, green) decline in negative growth (up-shift) and since Feb 1, the corresponding reaction in M1 (red). Any surprise the markets rallied off a near term bottom on Feb. 11th? The Force Awakens?

[…]

And now it's time for intermission…

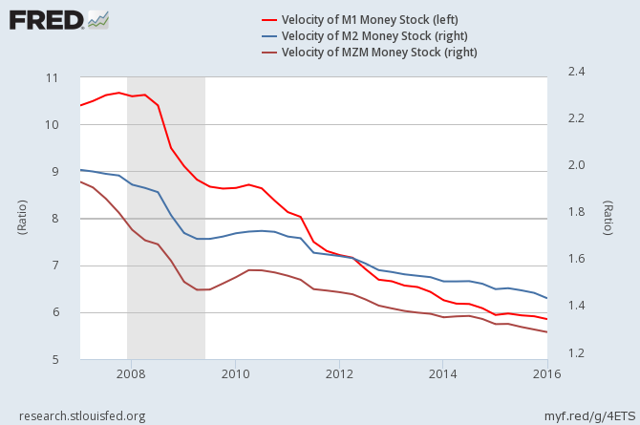

Monetary Velocity

On March 16th in Need For Speed? we Nattered about: Transactions Velocity (VT); Required Reserves; Is Money Printed in QE? Monetary Aggregates (M1;M2;MZM); Monetary Base (MB); Monetary Policy; Relevance and Dynamics.

"Since Q4 2007, M1 money supply velocity declining 50% from an all time high of 10.6 to 5.9, a depth not seen since 1975, with M2 and MZM also hitting all time lows. Note MZM peaking in 1980, and M2 in 1996, well before the current crisis."

Above note, upon further review, despite the decline in negative growth rates or up-shift for MB and M1, the velocity of those aggregates is still declining. The Force Awakens?

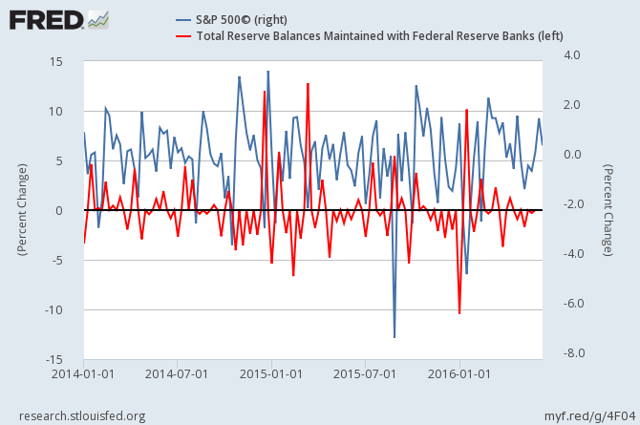

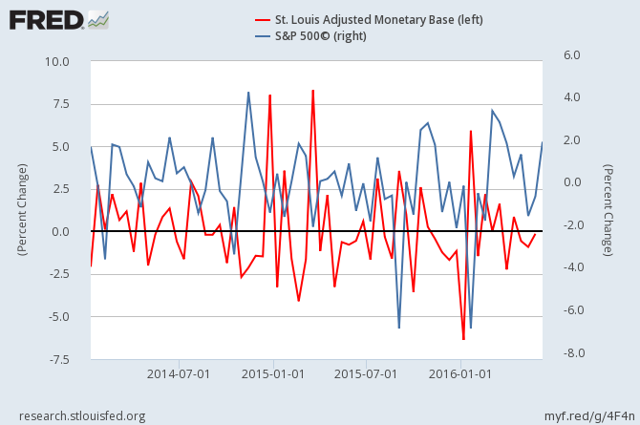

Aggregates and Reserves Maintained vs. SP500

Above note, as Nattered in Fed Statistical Elephant Tracks, and Need For Speed?, percentage change in Total Reserves Maintained with FED by Commercial Banks vs. SP500.

"…when FRB balances decline, the SP500 rises and vice versa, an inverse relationship. Since monetary aggregates and FRB balances mirror each other, is it possible that rises in monetary aggregates spur the FRB balances and the markets?" The Force Awakens?

Above note, percentage change in the St. Louis Adjusted Monetary Base vs SP500 [StLAMB]. So our previous Nattering would still seem so, and to rephrase more accurately: when StLAMB rises, FRB balances maintained rise and the SP500 declines, and vice versa. The Force Awakens?

Confirming since Feb 11, StLAMB down, total reserve balances maintained down, SP500 up, synthetic financialism up. Meanwhile, as Howard Cosell might have said, down goes monetary velocity, down goes Capex, down goes investment in economic development, down goes manufacturing, down goes industrial production, down goes imports, down goes exports, down goes GDP, down goes the jobs market, down goes consumer spending, down goes services, down goes the economy and down goes Frazier.