Abenomics lives!

Japan's Prime Minister Shinzo Abe was re-elected this weekend and his party was given a 2/3 majority in the Diet (Parliament) which paves the path to a Constitutional Amendment that will allow Japan, after a 72-year break, to re-arm their military and, of course, allows the Bank of Japan to keep printing Yen like Pokemon cards, which also exploded higher this weekend.

Of course, we told you this was going to happen in last Wednesday morning's post when I said:

In anticipation of BOJ action, we like /NKD long at 15,250 (tight stops below) and we'll be making an options play on the Japan ETF (EWJ) which is hopefully bottoming at $11.40.

Those /NKD Futures are now over 16,000 for a profit of $3,750 per contract in less than a week and EWJ should be heading to near $12 this morning so, even if you are only a stock player, that's +5% in less than a week – you're welcome! Remember, I can only tell you what's going to happen and how to make money trading it – the rest is up to you…

Sadly for the non-paying readers (I was told it's not nice to call them cheapskates), we don't give away free trade ideas during earnings months but I can tell you we're seeing some amazing shorting opportunities as certain stocks have gotten way ahead of themselves.

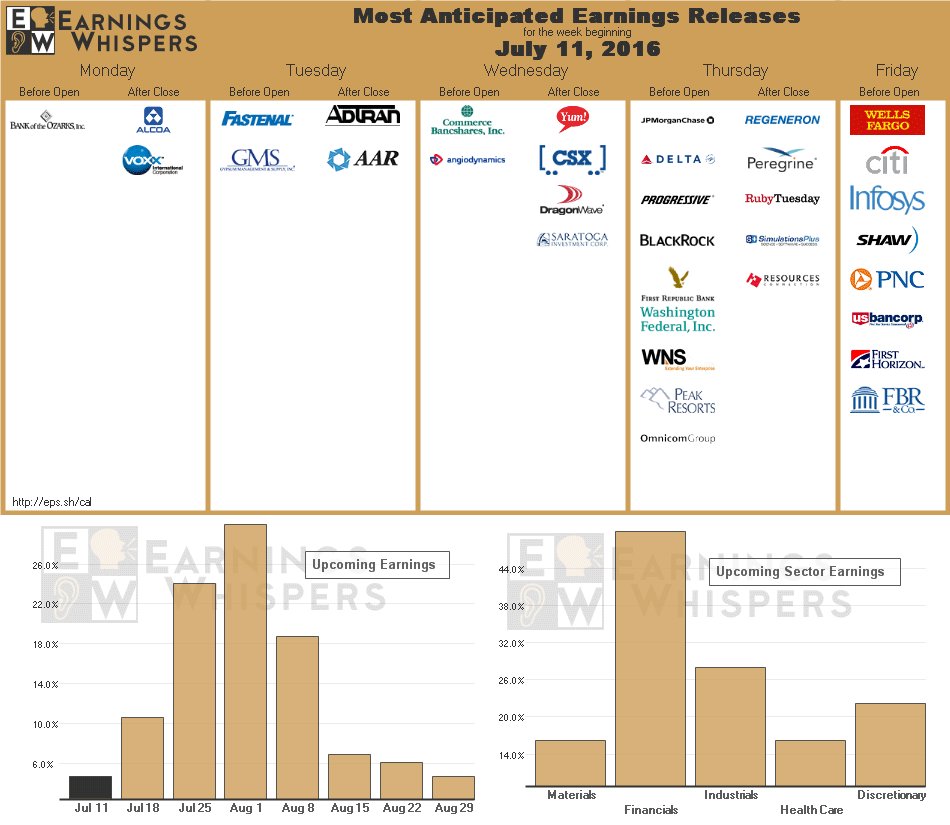

This week, we'll focus on the Financials but we'll have to be patient as the big boys don't weigh in until Thursday. Alcoa (AA) is splitting up the company so we're more interested in the conference call than the earnings report and Commerce Bank (CBSH) is one of those companies that may be ahead of themselves at $47.16 and Yum (YUM) is priced to perfection and CSX (CSX) may be too ambitious as well. It's too early to make bets, but the results will be telling.

There may be some serious surprises in store this quarter as the SEC has recently (May 17th) begun cracking down on the use of "non-GAAP" reporting so a big red flag for any companies that delay their reports and, of course, we're expecting to see some extreme revisions since the only time non-GAAP earnings have had more disparity to GAAP was 2008 – right before the market imploded as it turned out all those earnings and projections were BS!

There may be some serious surprises in store this quarter as the SEC has recently (May 17th) begun cracking down on the use of "non-GAAP" reporting so a big red flag for any companies that delay their reports and, of course, we're expecting to see some extreme revisions since the only time non-GAAP earnings have had more disparity to GAAP was 2008 – right before the market imploded as it turned out all those earnings and projections were BS!

Last year the discrepancy was over 30% for the average S&P company (cough, Tesla, cough, cough) and, if we assume some of them are legitimate (AAPL, GE, F…) – imagine how ridiculously imaginative some of the others are being! SEC Chairwoman Mary Jo White told an industry conference in March that new regulations may be needed to “rein in” firms’ that won’t comply with the generally accepted accounting standards known as GAAP.

The SEC’s Chief Accountant James Schnurr explained the problem for investors in a speech in March to accountants and lawyers who serve pharmaceutical and biotech companies. “I am particularly troubled,” said Schnurr, “by the extent and nature of the adjustments to arrive at alternative financial measures of profitability, as compared to net income, and alternative measures of cash generation, as compared to the measures of liquidity or cash generation.”

The SEC’s Chief Accountant James Schnurr explained the problem for investors in a speech in March to accountants and lawyers who serve pharmaceutical and biotech companies. “I am particularly troubled,” said Schnurr, “by the extent and nature of the adjustments to arrive at alternative financial measures of profitability, as compared to net income, and alternative measures of cash generation, as compared to the measures of liquidity or cash generation.”

CEOs, of course, disagree:

Seriously, these are the people who grew up to be CEOs of our fine American Corporations and, by the way Supreme Court, if Corporations are citizens, why are people allowed to own them? Since slavery is a criminal offense and since we are unable to punish our Corporate Masters for wage slavery, perhaps we can punish corporate management for enslaving our Corporate Citizens – I'd love to see Clarence Thomas ague his way out of that one!

This morning, in our Live Member Chat Room, we went long on Oil Futures (/CL) at $44.65 and already this morning we're hitting $45.65 for a $1,000 per contract gain in a couple of hours – just enough to buy ourselves a nice breakfast. We also went long on Gasoline Futures (/RB) at $1.357 and already we're testing $1.384 for a $1,134 per contract gain – lots of ways to make some quick money while we wait for the markets to open!

This morning, in our Live Member Chat Room, we went long on Oil Futures (/CL) at $44.65 and already this morning we're hitting $45.65 for a $1,000 per contract gain in a couple of hours – just enough to buy ourselves a nice breakfast. We also went long on Gasoline Futures (/RB) at $1.357 and already we're testing $1.384 for a $1,134 per contract gain – lots of ways to make some quick money while we wait for the markets to open!

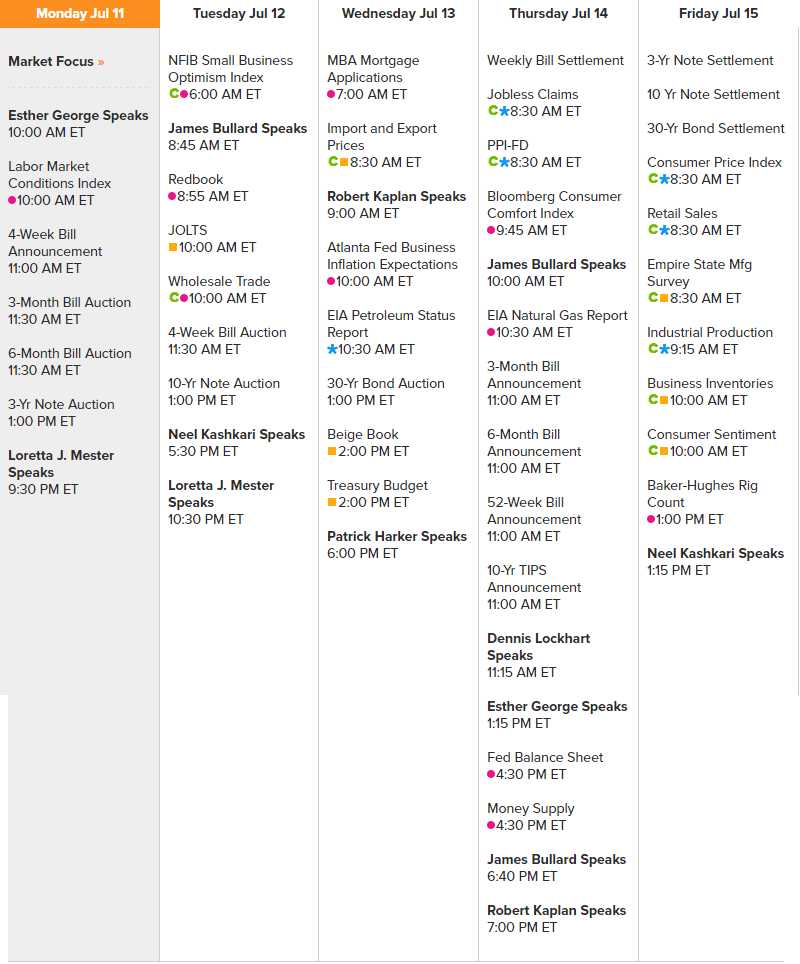

It's going to be a very exciting week with 13, count 'em, 13 Fed speakers on deck to spin the markets. My theory is that, if there are that many Fed speakers (and they are all doves these days), then something must be very wrong somewhere. Probably it's bank earnings but it could be anything given the shaky macro environment everyone seems to be ignoring with US indexes trading back at all-time highs.

We're not ignoring it – we're still mainly in CASH!!! and will likely remain that way through August as we wait to see if China falls off a cliff this summer. Also on deck is the trending American Revolution with less than 20% of our Citizens now saying they "always" or "mostly" trust our own Government. This does not bode well for the Republican majority in 4 months but maybe Trump will unite the party and rally the American people behind the GOP. Maybe.