Big Blue?

Courtesy of Nattering Naybob, Seeking Alpha

Excerpt:

Le Grand Bleu

One of the most stunningly beautiful films ever made, featuring gorgeous underwater photography and spectacular location shooting in the French Antibes, the Greek islands, Peru, and Taormina, Sicily…

[…]

Buoyant Yen vs. Dollar

Seeing through a turbid bowl of bilge water is difficult, especially when most of what they let you see is the BS that they want you to see. The only timing issue would be when the Chinese need dollars to maintain market liquidity, they must roll over Chinese forward dollar swaps and engage in spot intervention.

The PBOC and their proxies (Chinese and Japanese banks) need dollars to kick that huge and growing can forward. Symptoms: the JPY/USD would spike as dollars get released (sold on the short leg) and the yen borrowed negative to buy those dollars, get buried and disappear in JGB (back end or long leg) on the carry.

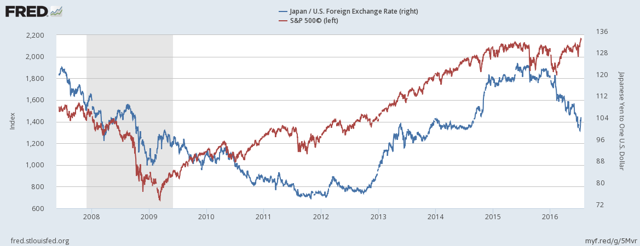

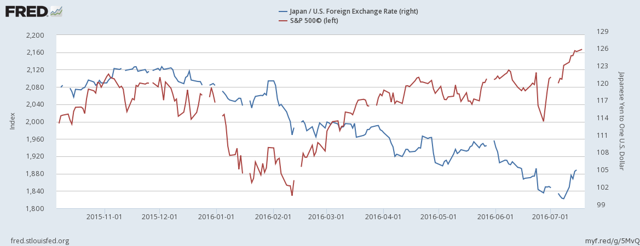

Above note the long term relationship (weaker yen = stronger SP500) here. Note the acceleration of the divergence since Feb. 11.

Above note, the latest bout of yen/dollar carry was June 23 to July 8 going from 106 to 100. See the divergence close up (stronger yen = stronger SP500) since Feb 1 here as the yen dollar carry trade went from 121 to 100.

Other symptoms, look for upticks is RMB borrowing costs, quarter end spikes occur in offshore hibor 10 day, hibor and onshore shibor, shibor curves, shibor 10 day. Potentially the next "reset" would be Q-end Sept. 30. However last year, liquidity crunches necessitated huge RMB devalue which forced the issue in early to mid Aug.

An advance copy of the Fed or BOJ minutes? Other than the feeble minded and ignorant, those soap opera contrivances of disinformation and misdirection actually control little. As the RMB and yen flows vis. eurodollar (wholesale) market currently control "dollar" arbitrage, an advance copy of PBOC schedule for devaluation and dollar forward swap rollovers would be preferred. Refer back to the turbidity of the water.

Deep Dives, Big Gains and resulting Narcosis or Madness?

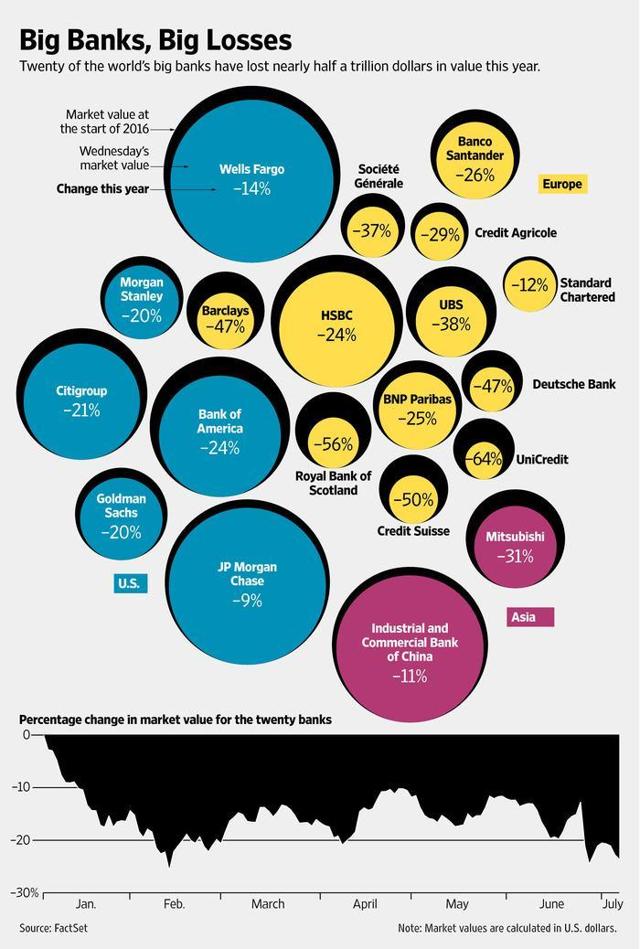

"Our top 20 banks have lost $500,000,000,000 in market cap so far this year but please, whatever you do, don't be concerned. These are the same analysts that told us not to be concerned about the same thing in 2008 – how quickly we forget! In local-currency terms, share prices for all 20 banks are down year to date, except Standard Chartered, which is flat." – Philip Davis

With global indices regaining their Brexit losses, and the SP500 making an all time high, our friend Mr. Davis added…

"Same with Italian Banks – they are not "fixed", they are only being allowed to fudge their books beyond the ECB rules. How does that spark a mega-rally that adds $1Tn to Global markets? This is MADNESS!"

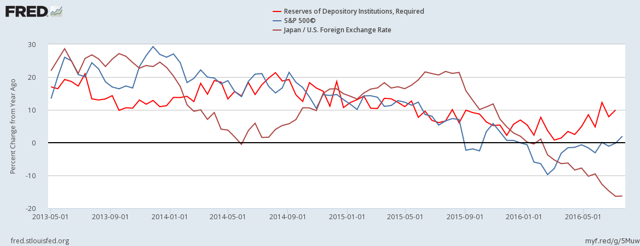

Above note the SP500 resurrection from Feb. 17 on where the blue (SP500) and red lines go up in tandem while the brown line (JPY/USD) dives deeper (stronger yen).

Remember the red line (required reserves) has a 30 day lag, so from (Sept. 2) which is really 30 days earlier, Aug. 2 through Oct. 25, under normal conditions we should see a seasonal pull back.

Caveat, as one can see, the rebound since Feb 17 has been caused by massive yen-dollar carry liquidity injections. If that continues, JPY/USD would go under 100, and then all bets are off.

Despite the big gains, markets regaining their highs, in the current NIRP, QE and IOER environment, selling and buying only begets further speculation which dissipates any proceeds from those speculative transfers vis. the "wealth effect" does not add to real or nominal GDP, and only draws off funds which would have been invested in such beneficial activity under normal circumstances such as capex, durable economic activity and new hiring. Resulting in economic hypoxia.