Courtesy of Lee Adler of the Wall Street Examiner

(Originally published at David Stockman’s Contra Corner)

House prices comprise the most important measure of inflation that is ignored by the Fed and mainstream economists. It’s not included in the CPI or PCE. Instead, the BLS and BEA use a ginned up measure called Owner’s Equivalent Rent (OER) which has substantially understated actual house price inflation, particularly in the past 4 years.

The OER component of June CPI was +3.2% year over year. That’s closer to reality than the 2.2% reading of June 2013, which didn’t pass the smell test at all as home prices rocketed higher by 15% for much of the year. While somewhat less laughable, the current reading is still 2.3 percentage points below actual housing inflation reported in real time data from Redfin.com. The current margin is actually substantially less than it has been since 2012. At one point in 2013 the difference was nearly 13 percentage points. I call this “ignored inflation.” The Fed and economic policymakers as well as Wall Street economists and talking heads, simply pretend that it does not exist.

Considering that housing is weighted at roughly 40% of core CPI, the net result is a substantial, long running understatement of CPI. The mainstream economic disinformation machine would have you believe that CPI measures inflation. It doesn’t.

The BLS developed CPI as a means to index government worker salaries, government benefits, and government contracts to cost of living increases. The result has been a narrowly defined, arbitrary basket of consumer goods, with methods evolving to suppress the rate of increase as much as possible while meeting the straight-face test. We all know about the use of hedonics to replace rising prices with cheaper substitute goods. But the most important change in suppressing the inflation rate was removing housing prices from the index in 1982 and substituting Owner’s Equivalent Rent.

Using OER continues to yield the government significant savings, but it also continues to mislead the Fed into thinking that inflation is lower than it actually is. That results in overstatement of real wage gains, real household income, and real “household wealth.” They have been losing purchasing power much faster than the government reports. Keep this in mind when the July data starts flowing early next month.

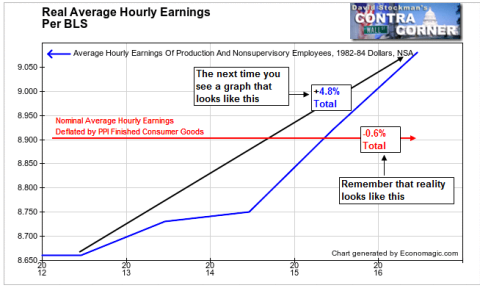

For example, the reported growth rates in real household earnings have been weak to begin with. The reality is actually significantly worse than reported. This chart is an example.

The government reports that the real average hourly earnings of production and nonsupervisory workers have risen by a total of 4.8% since 2012, or about 1.2% per year. Using a less manipulated deflator such as the Finished Consumer Goods PPI, real average hourly earnings have declined by 0.6% since 2012– essentially flat. In the real world, we know that. Only Wall Street economists and the Fed seem not to. They want you to ignore reality, so that they can keep their little Fed-catered private party going.