Here's a nice way to boost the market:

Kick out the under-performing components! The Dow engages in this kind of manipulation all the time, most recently swapping Apple (AAPL) in for AT&T (T), who had a nice 100-year run before the American Telephone and Telegraph Company was replaced by a company that makes phones in China. Come to think of it – that's a very good summary of how the last 100 years has been going for America, isn't it?

Well, if the components that get kicked out are any indication of where countries are declining, we should be a bit concerned that Euro Stoxx kicked out Deutsche Bank (DB) and Credit Suisse (CS) this morning, replacing them with ASML (semi-conductors) and SGEF (Construction) in order to prop up Europe's version of the Dow as it begins to falter at the 3,000 line.

Rupert Murdoch (Wall Street Journal) owns the Dow and Deutsche Bourse (DBOEY) owns the Stoxx Index and both can do whatever they want when it comes to manipulating the numbers that global investors use to make trading decisions. Trillions of Dollars invested in ETFs that follow the indexes controlled by these two Top 1%'ers. Whether that makes you comfortable or uncomfortable is probably a good indicator of your political viewpoints…

Rupert Murdoch (Wall Street Journal) owns the Dow and Deutsche Bourse (DBOEY) owns the Stoxx Index and both can do whatever they want when it comes to manipulating the numbers that global investors use to make trading decisions. Trillions of Dollars invested in ETFs that follow the indexes controlled by these two Top 1%'ers. Whether that makes you comfortable or uncomfortable is probably a good indicator of your political viewpoints…

As you can see from our first chart, these shenanigans didn't even buy them the entire morning before the index plunged right back down from the small lift they got overnight in the futures (though the actual substitution takes place on Monday – so watch out for that!). Europe is down about 1.5% overall this morning, led lower by Italy and Spain, who have their own bank crises to deal with.

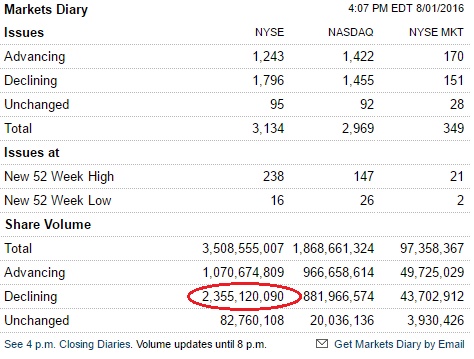

As you can see from yesterday's NYSE volume chart, despite the "flat" day on the S&P, what was really happening was that the headline stocks that move the indexes were propped up to mask MASSIVE selling in the broader market.

As you can see from yesterday's NYSE volume chart, despite the "flat" day on the S&P, what was really happening was that the headline stocks that move the indexes were propped up to mask MASSIVE selling in the broader market.

As I noted in last week's Live Trading Webinar, it's very easy to game the markets on low-volume days because the Banksters and Fund Managers know FOR A FACT that Billions of Dollars from people's paychecks (401K, IRA) will flow into the markets through dumb money ETFs that are, in large part, indexed to the Dow and Euro Stoxx. Now do you see how powerful it is to be able to control those indexes? Trust Uncle Rupert – he knows what's good for us!

That's how yesterday, there were more than TWICE as many sales as purchases by volume on the NYSE yet the index only fell 50 points, allowing the other indexes to ignore the action and hold generally flat for the day – also on ultra-low volume, also propped up by automated buy programs – the dumbest money in the World because, not only do these 401K and IRABots buy at the same time every day (see "Why Your 401K is a Scam"), but they publish a prospectus that tells the Banksters what stocks they will be buying in their formulas. This allows these evil bastards to front-run your retirement and take advantage of your obligation to buy with such transparency (thanks to regulations they lobbied for, of course).

Now you know why Elizabeth Warren gets so upset… By simply propping up a few headline stocks that move the indexes, the Banksters are able to force dumb money into buying the whole index, including all the crappy stocks they are trying to dump out of, while they SELLSELLSELL into the rally. It happens all the time but especially on the 1st and 15th of the month – days when the most people get paid.

In other Bankster shenanigans, the Bank of Australia cut rates again this morning and Italy's PM Renzi said "My view is that Italian banks are good" and it wasn't even Opposite Day! Japan's PM, Abe, unleashed his 28,000,000,000,000 Yen stimulus package and the general consensus in Japan was "not enough." The funny thing is they are right because Japan is already 1,200,000,000,000,000 Yen in debt so a 28Tn Yen stimulus ($274Bn) is only 2.3% of what they've already tried and that has, obviously, failed to help.

As I mentioned yesterday, we actually lost about $4,800 in the past two weeks in our paired Long and Short-Term Portfolios because we flipped decidedly bearish on the 14th and now we're waiting for some of these shoes to drop. One of our key shorts was cashing our FAS longs and leaving short FAS calls uncovered as we think $24 will be the top for XLF. July is over, so I can give you a free trade idea and I like the Ultra-Short XLF ETF (FAZ) at $33.71 and the way we can play for some bank failures is this:

- Buy 10 FAZ Sept $31 calls for $3.25 ($3,250)

- Sell 10 FAZ Sept $36 calls for $1.30 ($1,300)

- Sell 5 WFC 2018 $40 puts for $2.80 ($1,400)

That spread is net $550 on the $5,000 spread that's $2,700 in the money to start. The upside potential is $4,450 for an 800% return on cash if FAZ is over $36 in 45 days (Sept 16th) and the worst case is you own 500 shares of Wells Fargo (WFC) at $40 ($20,000), which is a great long-term hold and pays a 3% dividend.

We're expecting XLF to turn down as the smaller banks check in and, if not, we'll kill the trade for a small loss by the end of next week.

In the Futures, we made you insane amounts of money yesterday (from our Morning picks) so today is for Members only – join us in our Live Chat Room or during tomorrow's Live Trading Webinar (1pm, EST) for more big money fun!