This would be not good

Courtesy of Joshua M Brown, The Reformed Broker

Courtesy of Joshua M Brown, The Reformed Broker

Among the nightmare scenarios that could knock this market off its bull course and do some real damage would be the forced deleveraging of the “risk parity” funds that have grown to comprise hundreds of billions of dollars of institutional money.

As an overgeneralization, risk parity funds seek to target specific levels of volatility and create a sort of “all-weather” strategy where bonds are leveraged up to offset the wild swings of stocks. This strategy works well when bonds are the steadier asset component of the portfolio and are somewhat or very non-correlated to stock returns.

Unfortunately, this is not assured to always be the case. In the summer of 2013, after some hawkish comments on rates / QE from the Bernanke Fed, we found out just how scary things could be when stock and bond correlation shoots up and the enormous, rules-based risk parity hedge funds are not ready for it. The rules that govern their exposures trigger the sort of forced deleveraging that could really play havoc with the stock and Treasury markets. They also can be self-reinforcing if the unwind is powerful enough – selling begets more selling which, well, you get the drift.

With bonds and stocks both at elevated levels, and the leverage on bonds at risk parity funds very overweight, this is a legitimate thing to be thinking about right now.

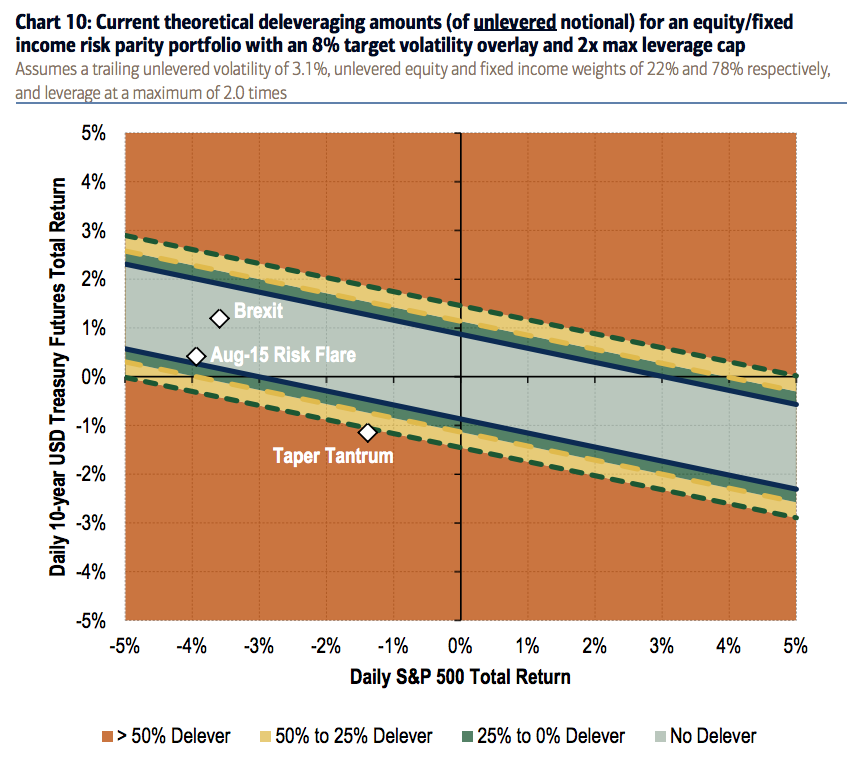

Bank of America Merrill Lynch’s Global Equity Derivatives Research team looks at the risks to the market posed by forced deleveraging of risk parity strategies – should we get a repeat episode of bonds and stocks selling off together…

Last week’s sharp sell-off in JGBs following the BoJ’s decision not to cut rates renewed investor fears of forced selling by risk parity funds. However, the spill-over into US Treasuries was relatively muted…For this very reason, the latent risk in this corner of the quant fund space remains worth monitoring.

To the extent that the leverage is via vol control overlays, there are reasonable concerns on the potential market impact should these model-driven investments be forced to simultaneously deleverage.

In the chart below, BAML breaks down the scenarios in which bonds and stocks either rise together, fall together or rise and fall separately. You can see that the aforementioned 2013 “Taper Tantrum” was a consequence of the sort of simultaneous volatility spike we should be concerned about:

Josh here – Anything in the lower lefthand quadrant, in terms of asset class vol, could trigger massive amounts of selling. The question is whether something like that could ultimately be contained, or how much damage would need to happen before it burns itself out.

The main takeaway here is the most risk of model driven deleveraging from vol controlled risk parity funds comes when both volatility and correlation of the underlying components rise together.

Source:

Understanding when risk parity risk increases

Bank of America Merrill Lynch – August 9th 2016