Financial Markets and Economy

Heavy-Metal Markets Have Worrying Echoes of 2006 (Bloomberg View)

Heavy-Metal Markets Have Worrying Echoes of 2006 (Bloomberg View)

In April 2006, I was starting to worry about what I was seeing in financial markets. The phrase "heavy-metal markets" seemed to describe the paradox of stocks and bonds all rising at the same time, riffing on the joke that good heavy-metal music is created by making everything louder than everything else. Today, the market backdrop seems awfully reminiscent of that period.

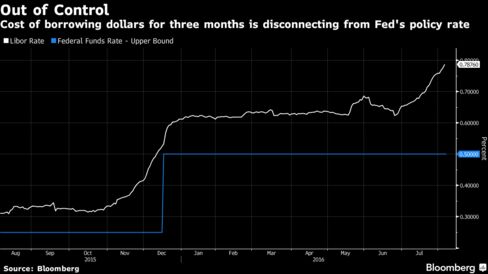

The Fed Is Losing Control of Global Monetary Conditions (Bloomberg)

Libor is coming unhinged (for a simple reason why, click here) from other borrowing costs and that has real implications for the cost of money in the real world.

When everyone realizes index funds are the way to invest, the market will suffer (Quartz)

No one loves index funds more than I do. I once worked for a company where I participated (with enthusiasm) in veritable jamborees celebrating their virtues and decrying the lunacy of active management. But even I am starting to worry we may be reaching peak low-fee.

The Fed’s shifting perspective on the economy and its implications for monetary policy (Brookings)

The headline on a recent piece by Ylan Mui of the Washington Post—“Why the Fed is rethinking everything”—captured the current moment well. The Federal Reserve has indeed been revising its views on some key aspects of the economy, and that’s been affecting its outlook both for the economy and for monetary policy. In this post I document and explain the ongoing shift in the Fed’s economic views. I then turn to some implications, suggesting among other things that, for now at least, Fed-watchers should probably focus on incoming data and count a bit less on Fed policymakers for guidance.

Are Negative Rates Backfiring? Here’s Some Early Evidence (Wall Street Journal)

Two years ago, the European Central Bank cut interest rates below zero to encourage people such as Heike Hofmann, who sells fruits and vegetables in this small city, to spend more.

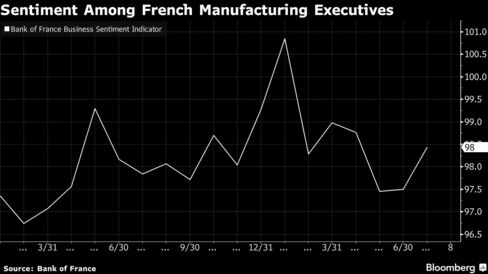

Bank of France Sees Economy Gaining Momentum in Third Quarter (Bloomberg)

The French economy is set to return to growth this quarter, the nation’s central bank said, as President Francois Hollande aims to cement a turnaround ahead of next year’s general election.

Reserve Bank may resort to more rate cuts and 'even quantitative easing' (The Guardian)

Reserve Bank may resort to more rate cuts and 'even quantitative easing' (The Guardian)

The Reserve Bank of Australia could be forced to cut the cash rate to 1% in the next 12 months and even resort to US and European-style monetary easing if global headwinds continue to weigh on the economy, experts have warned.

Copper is flashing a warning sign for China's economy (Business Insider)

Copper is flashing a warning sign for China's economy (Business Insider)

Copper is waving a red flag.

"Recent movements in copper inventories highlight the lack of significant demand for the metal, particularly in the ever important Chinese market," analysts at BMI Research wrote in a recent note.

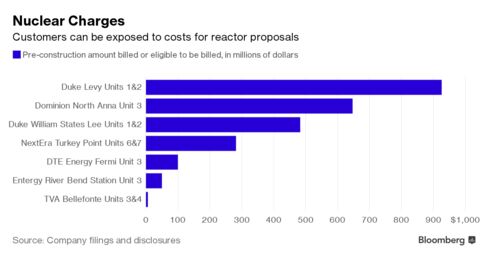

Customers Could Pay $2.5 Billion for Nuclear Plants That Never Get Built (Bloomberg)

U.S. electricity consumers could end up paying more than $2.5 billion for nuclear plants that never get built.

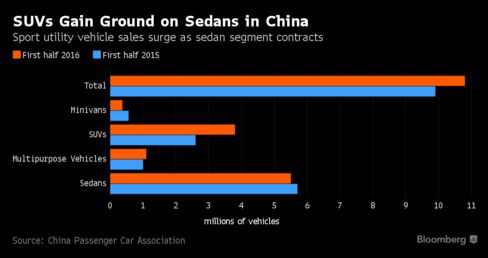

China Auto Sales Rising Most in 17 Months Spurs Inventory Relief (Bloomberg)

China’s passenger-vehicle sales accelerated the most in 17 months, as General Motors Co. and Guangzhou Automobile Group Co. boosted deliveries and dealers offering discounts helped clear inventories in the world’s biggest auto market.

Alan Greenspan And Marc Faber Agree The Fed Has Reached Zero Hour (Forbes)

The U.S. has become dependent on the Federal Reserve’s monetary policy to manage the economy. However, even though the Fed has kept interest rates at historic lows for the past 8 years, the economy’s growth has been anemic at best. Bruce Pile explains why Alan Greenspan and Marc Faber agree that the Fed has reached an important limit and its implications for investors.

It’s Never Been Cheaper for Cities and States to Borrow Money…And They Refuse to Do It (Wall Street Journal)

Wall Street is urging governments to invest in big-ticket infrastructure projects. Voters and public officials have a different message: not so fast.

Another Electric Car Factory Is Coming to China (Fortune)

Another Electric Car Factory Is Coming to China (Fortune)

Electric car startup Karma Automotive, and its Chinese owner, appear to be planning to build a factory to make some of its cars in China, and could use that facility to revive a planned two-door electric car.

The GOP has replaced economic policy with vague threats “intoned in their best Dr. Evil voice” (Salon)

In his Monday New York Times column, Paul Krugman argues that given historically low interest rates and a historically high need for infrastructure development, anyone who is still arguing for cutting the national debt is deliberately working against American interests.

Two Charts that Show Why So Many Americans Are So Angry About the Economy (Wall Street Examiner)

Last week we got the “good news” that wages are rising. It has been a recurring story over the past several months. The headlines said that hourly wages rose by 0.3% in July on a seasonally adjusted basis. Annualized that works out to just under 3.7% on a compound basis. However, as usual, a bit of perspective is helpful.

Politics

Republican foreign policy experts are condemning Trump. It matters more than you think. (Vox)

Republican foreign policy experts are condemning Trump. It matters more than you think. (Vox)

Monday afternoon the New York Times published an open letter from 50 foreign policy hands who had served in Republican administrations pledging to oppose Donald Trump. The letter, which you can read at the end of this post, suggests Trump "would be the most reckless president in American history."

Technology

Bye humans! The Washington Post is using a robot to report on the Rio Olympics (Digital Trends)

Bye humans! The Washington Post is using a robot to report on the Rio Olympics (Digital Trends)

The Olympics is all about humankind’s ability to triumph over its naturally-imposed limitations and the world around it. So why, then, has the highly-respected Washington Post announced that it is handing much of the reportage of individual events over to Heliograf, its robot reporter?

The Electric Skateboard Company That Would Take Over the World (Wired)

The Electric Skateboard Company That Would Take Over the World (Wired)

It’s clear from the beginning that something is different about this couch. It’s a beaten-up gray and has the word “Boosted” written across the back in blocky orange letters—as in Boosted Boards, America’s favorite purveyor of electric-powered skateboards. Oh, and instead of feet, the couch has two Boosted longboards supporting it.

Park Your Private Jet in Your Own Backyard with this New Aircraft Concept (Forbes)

Park Your Private Jet in Your Own Backyard with this New Aircraft Concept (Forbes)

A team of German innovators has dreamt up the world’s first vertical takeoff and landing electric jet (beating Elon Musk to the punch).

Health and Life Sciences

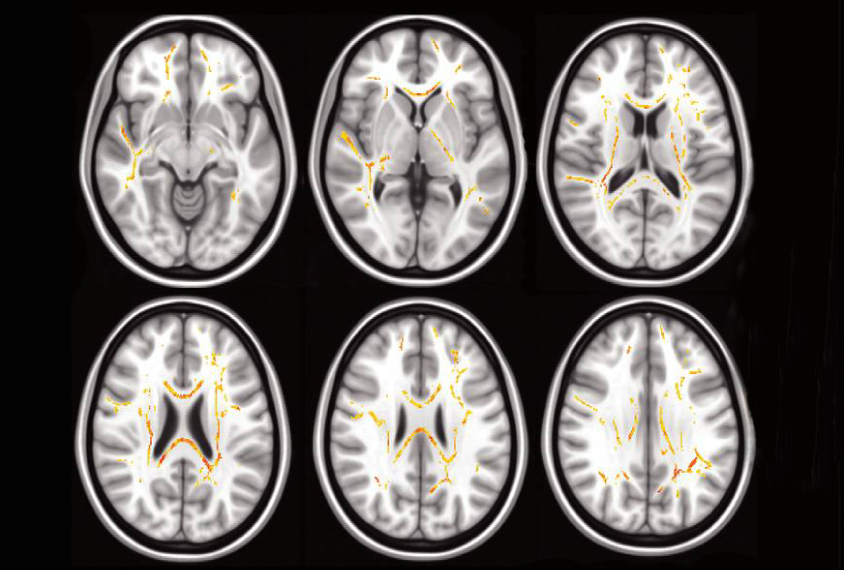

Autism, OCD and Attention Deficit May Share Brain Markers (American Scientist)

Autism, OCD and Attention Deficit May Share Brain Markers (American Scientist)

Autism shares genetic roots with obsessive-compulsive disorder (OCD) and attention deficit hyperactivity disorder (ADHD). The three conditions have features in common, such as impulsivity. New findings suggest that they also share a brain signature.

One drug is 'new hope' for three killer infections (BBC)

One drug can treat three deadly and neglected infections – Chagas disease, leishmaniasis and sleeping sickness – animal studies show.

Life on the Home Planet

Facebook sampled data from 160k users and determined cat people are sad and lonely (The Next Web)

Facebook researchers examined the behavior of over 160,000 users to help put an end to the cat vs dog debate once and for all. Its findings were actually in line with long-held stereotypes that dog people tend to be friendly, outgoing and generally likable while cat people are more likely to be single and sad.