Verklempt: so shocked and overwhelmed that we cannot speak.

Verklempt: so shocked and overwhelmed that we cannot speak.

That's the reaction Bill Gross and I had to the FOMC statement yesterday (and you can hear our LIVE reporting at the time in our Webinar Replay). CNBC says Steve Leasman was also verklempt as that Fed report was indeed shocking. Yes, we knew they might not raise rates (but I was sure enough to make it yesterday's headline that they wouldn't) but we didn't think they would LOWER their rate forecast by 30% over the next 3 years – that was STUNNING!

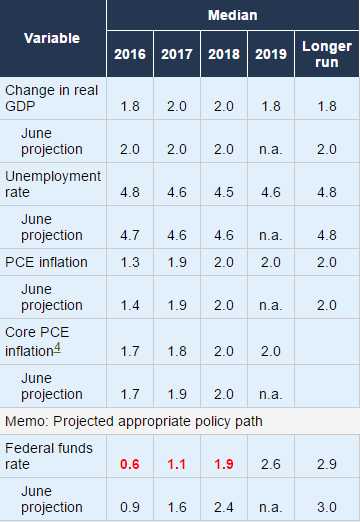

Note the red numbers highlighting the changes on the projected Federal Funds Rates – that was the shocker in yesterday's report and that was why I was wrong yesterday – because we were supposed to end the year at 0.9% average and that means we NEEDED to hike now because putting off the hike wouldn't give it time to get the average in line with the Fed's targets – it did not occur to Bill Gross or I that they would suddenly lower the targets.

This is not just putting off one raise, this is putting of 1/3 of all potential raises for the next 36 months and, before you grab your pompoms to celebrate infinite free money – think about the reason they are taking this action. Look at the top of that chart – long-term GDP projections are down 10%, from 2% to 1.8% – how is that a good thing? Inflation is 2% so the only "growth" in our economy is inflationary growth – that's pathetic!

Not as pathetic as Japan (yet) where the new crime against savers by the Central Banksters is being called "Yield Curve Control" where the BoJ will target 0% yield for the 10-year Japanese Government Bond, which had been negative for months. So it’s trying to push up the 10-year yield a smidgen. Shorter maturities would still sport a negative yield. This would steepen the yield curve. In effect, the BoJ will control the yield curve. By the end of next year, it might own 50% of all JGBs. As noted by Wolf Richter:

Not as pathetic as Japan (yet) where the new crime against savers by the Central Banksters is being called "Yield Curve Control" where the BoJ will target 0% yield for the 10-year Japanese Government Bond, which had been negative for months. So it’s trying to push up the 10-year yield a smidgen. Shorter maturities would still sport a negative yield. This would steepen the yield curve. In effect, the BoJ will control the yield curve. By the end of next year, it might own 50% of all JGBs. As noted by Wolf Richter:

"Why even pretend there’s still a bond market? Maybe it’s just for entertainment."

Now even the OECD is fretting about these scorched-earth policies that have been dogging the global economy, which just keeps getting worse. The OECD estimates in its Interim Economic Outlook that for member nations as a whole, GDP-per-capita will grow only 1% in 2016, “which is half the average in the two decades preceding the crisis.” Per-capita is what counts. It’s what people experience. It’s their slice of the economic pie.

Population growth papers over a lot of ills for economists: for example, in the US, 14 million jobs were created since the Financial Crisis, which has been touted endlessly. But the US population grew by 15 million people. Now there are fewer jobs “per capita” than there were at the depth of the Financial Crisis. That’s why per-capita matters.

Population growth papers over a lot of ills for economists: for example, in the US, 14 million jobs were created since the Financial Crisis, which has been touted endlessly. But the US population grew by 15 million people. Now there are fewer jobs “per capita” than there were at the depth of the Financial Crisis. That’s why per-capita matters.

1% GDP growth per capita in 2016 is terrible. And it’s likely happening because of these scorched-earth monetary policies. The OECD blames:

- “Weak investment”

- “Slower growth of total factor productivity”

- “Slowing of diffusion of innovations across firms”

- “And slowing innovation at the technological frontier.”

It adds: “These developments exacerbate the challenges to improving well-being of people in both advanced and emerging economies.” The problem for the OECD is this: people are consumers, and if consumers don’t do well, they can’t consume enough, and in consumption-based economies, that’s a cardinal sin.

As you can see from this BLS chart, retail sales (70% of our economy) can't grow without salary growth (duh!) yet, strangely, people have kept buying – forming a huge gap between retail sales and wages that is narrowing now in a way that it has done heading into previous market crashes. What causes these gaps? In the 90s it was the refinancing boom, where people borrowed from their homes to buy cool stuff like computers and big TVs. In 2006 it was another housing bubble until that popped (and also the Bush stimulus package) and now it's low rates – allowing people to borrow more than they've ever borrowed before but look what's happening:

Consumers, like businesses, retain a percentage of earned capital after deducting expenses, which can be used to expand consumption, repay debt, or be saved – that's their "margin" and it's gone sharply negative. Given data from the Bureau of Economic analysis, Pervale created a consumer income statement by taking personal income and netting out core expenses from personal consumption expenditures (PCE). This gives us an understanding of discretionary cash flow and provides a referenceable proxy for consumer health.

These margins have historically been a strong leading indicator of discretionary income and, if that dries up, we are in BIG TROUBLE!

This is not sour grapes because I was wrong about the Fed and still don't want to be bullish, this is about considering what it is that scares the Fed so much that they are willing to rob people of their retirement savings and throw Pension Plans into complete disarray in order to, hopefully, ward off this looming disaster.

It is the hope of the Fed that mandatory minimum wage laws will improve consumer margins before they begin to impact Retails Sales and drag the economy down with it because, frankly, the Fed is out of firepower – the BOJ is evidence of that – they can't do anything else to stave off their deflationary spiral and the Bank has to buy bonds at a HIGHER rate (0%) than the market demands (negative) in order to stop all rates in that nation from turning negative.

This is scary stuff folks. Yes, the market is moving higher and, if we can lift people's spirits – maybe we can push that margin gap to new records but what wave of the Fed's wand will fix it down the road – we're in uncharted waters and there's a lot of icebergs ready to tear this ship apart.

Be careful out there!