Oh my God!

Oh my God!

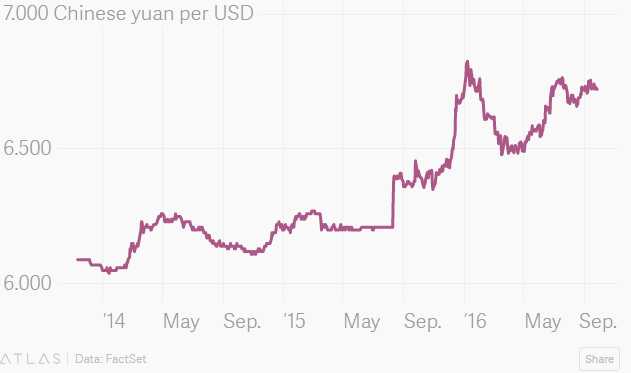

Shame on any editor who pretends politics shouldn't be discussed in financial posts – their cowardice has led to the election of a man who doesn't even understand that China has been propping UP their currency, at the insistence of the US and other nations, and have lately been REMOVING their supports and the devaluation of the Yuan is what the REAL market values are currently showing.

In May of last year, in fact, the IMF officially stated the Yuan was no longer undervalued. Since 2015, the People’s Bank of China, the central bank, hasn’t been keeping the currency cheap. Rather, it’s been defending the yuan, drawing down its foreign-exchange reserves in order to keep the value aloft.

Why would it do that, knowing that might hurt the export sector, which provides a huge share of jobs? In the last few years, demand for the yuan has come less and less from trade, and more from investment flowing into China to speculate on the currency’s appreciation against the dollar—a self-reinforcing phenomenon. Those inflows help prevent cash squeezes in the banking system, and push down borrowing costs. Letting the yuan’s value drop might drive that investment out of China, draining cash from the financial system dangerously fast.

Why would it do that, knowing that might hurt the export sector, which provides a huge share of jobs? In the last few years, demand for the yuan has come less and less from trade, and more from investment flowing into China to speculate on the currency’s appreciation against the dollar—a self-reinforcing phenomenon. Those inflows help prevent cash squeezes in the banking system, and push down borrowing costs. Letting the yuan’s value drop might drive that investment out of China, draining cash from the financial system dangerously fast.

Is it too political to point out that the President-Elect of the United States of America COMPLETELY WRONG in his currency statements. Trump isn’t just wrong about what Beijing is doing, he’s wrong about the impact it might have. This year, even though the yuan depreciated against the dollar, Chinese exports have not picked up thanks to the weak global economy. “It has become less effective and unnecessary for Beijing to use a cheaper yuan to boost exports,” noted Shuli Ren of Barron’s recently, because “the pie is getting smaller and competitive easing can only get you so far.”

Recently, with China’s foreign currency reserves falling to the lowest since 2011, the Chinese central bank are believed to have sold the dollar to ease yuan’s decline, in an attempt to curb record capital outflows—doing exactly the opposite of what Trump claims. Should I keep quite about this idiocy because this is a financial newsletter and Trump has armies of letter-writing fanatics that will suppors his ridiculous flat-earth views, no matter how detrimental they are for our economy?

Make no mistake about it, we've elected a dangerously uninformed person to run this country and he is appointing an even more dangerously uninformed cabinet and if you think that's not going to affect the stock market, as Jeff Foxworthy would say – "You might be a Republican."

Over the weekend, China complained to the U.S. after Trump flouted almost four decades of diplomatic protocol by directly speaking with the leader of Taiwan, which Beijing considers a rogue province. China urged U.S. authorities to adhere to the so-called one-China principle and “prudently” handle issues related to the self-governed island. The relatively measured response suggests China wants to keep the incident from escalating into a full-blown crisis.

Arrrgh!!! It annoys me to talk about this stuff as much as it annoys you to hear about it. Let's do what most people do and pretend it doesn't matter until it's too late. The Raiders beat the Bills and moved up to 10:2 but the Chiefs beat the Falcons and are right behind them at 9:3 the Patriots are also 10:2 and no one in the East is going to touch them while no one in the AFC South even has a winning record!

The NFC South is just as bad – must be something in that red state water – and the NFC East also has a dominant team with the Cowboys beating the Vikings to move up to 11:1. Cowboys/Vikings sounds like an episode of Deadliest Warrior (a great show if you haven't seen it). So, with home field advantage going to the Cowboys and Patriots in the playoffs, they become the likely Superbowl match and the Patriots still pay 4:1 and the Cowboys pay 3:1 so you can bet on both and have a decent chance of a win. See, we're still talking about investing….

Anyway, it's Monday and Monday's are usually meaningless, low-volume affairs – even when our President does insult the World's 2nd largest power over the weekend. The Futures are, in fact, up this morning as Italy's Prime Minister resigns and that too is being shrugged off – mainly because the renewed uncertainty keeps the ECB on the table with more QE and you know how much the markets love their FREE MONEY!

Anyway, it's Monday and Monday's are usually meaningless, low-volume affairs – even when our President does insult the World's 2nd largest power over the weekend. The Futures are, in fact, up this morning as Italy's Prime Minister resigns and that too is being shrugged off – mainly because the renewed uncertainty keeps the ECB on the table with more QE and you know how much the markets love their FREE MONEY!

Looking ahead this week we have just 3 Fed speakers, all today, ahead of their quiet period into next week's rate announcement. We had nice move up in Consumer Spending, from $93/day in October to $98/day in November on the average and $5 is a lot when you multiply it by 250M adults x 30 days = an addditional $37.5Bn per month flowing into the coiffers of Corporate America – that is a positive economic story not to be ignored.

We're back to testing that 2,200 line on the S&P (/ES) Futures and the markets are getting a bit of a boost as the Dollar plunges back to 100.44, which is down 1% since the open and that's lifting the Futures but we'll be looking for short entries as we cross back under at Dow (/YM) 19,250, S&P (/ES) 2,200, Nasdaq (/NQ), Russell (/TF) 1,325 and Nikke (/NKD) 18,500. /NKD is currently my favorite short as the weak Dollar is not good for the Nikkei so, especially if 100.50 is broken on the Dollar – it's a good play while the US indexes are more fun to play if the Dollar bounces back.

For the rest of the week, all eyes are on Monte Paschi, who now have no hope of an Italian bailout and have to hope the ECB will save them but investors can quickly lose faith and that can quickly spill over to affect other banks so, needless to say – be very careful out there!