Courtesy of EconMatters

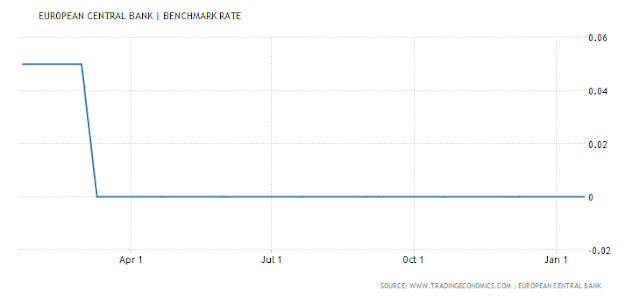

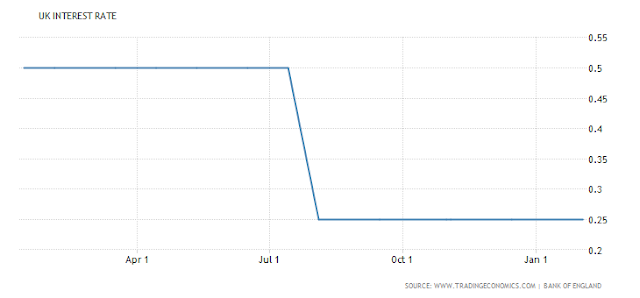

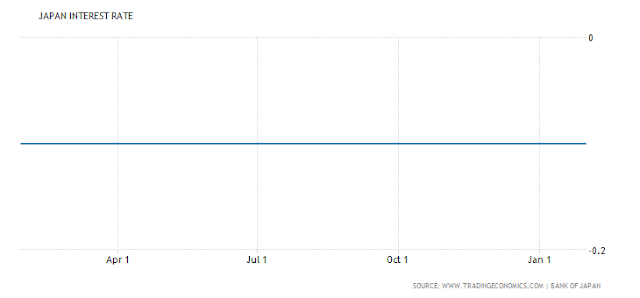

We discuss how the fundamentals don`t matter in a completely Rigged Market environment, Central Banks have basically given the blessing to Financial Markets "Cheat Like Hell"! If we are going to manipulate Financial Markets with Central Bank Policy it is hard to then turn around and tell Financial Market Participants to not manipulate assets.

This is why the entire market is divorced from the fundamentals, and Central Banks are to blame for the upcoming market crash when all the sudden the fundamentals of sound policies and financial principles matter again.

Cheating is usually off the charts at market tops, and one thing is for sure cheating and market manipulation is the highest I have since 2007 right before the crash. This stuff doesn`t happen by coincidence or accident in Financial Markets. We broke another bubble record Janet Yellen, maybe it is time to raise rates because the felons are running the prison right now, and very bad things always follow these set of circumstances for both the markets and the US Economy!