"I went down to the crossroads, fell down on my knees.

Down to the crossroads, fell down on my knees.

I'm standin' at the crossroad, babe, I believe I'm sinking down." – Cream

Earnings are simply not that exciting.

The growth in earnings was SUPPOSED to come from the Financials and the Energy Sector and we've gotten so-so reports from the Financial Majors and oil just collapsed to $50.50 yesterday (a profit of $2,500 per contract for those of you who followed our morning call to short at $53!) and that can't be great for Q2 profits if we stay down here, can it?

We've been telling you for years what a complete and utter scam the oil market is and knowing it's a scam is the secret to our success. Today is the last trading day for the May contracts and they still have 25M barrels of fake, Fake, FAKE!!! open orders to get rid of – down 100,000, 1,000-barrel contracts (80%) since Tuesday's post and, lo and behold – June is up 55,000 contracts (that are also FAKE) while the other 45,000 fake orders have been distributed across longer months – in order to fake that demand down the road as well.

Since we KNOW the trading is FAKE!!!, we KNEW they had to get rid of over 100,000 May orders in 2 days and we knew that would put pressure on oil and that made a good short – it's not very complicated and we do it ALL THE TIME because, although it's a total scam – it's a very predictable one…

Since we KNOW the trading is FAKE!!!, we KNEW they had to get rid of over 100,000 May orders in 2 days and we knew that would put pressure on oil and that made a good short – it's not very complicated and we do it ALL THE TIME because, although it's a total scam – it's a very predictable one…

After today, however, we will be flipping long on oil and, in yesterday's Live Trading Webinar, we identified a great long position on the Oil ETF (USO), using July call options and, of course, we'll be looking for opportunities to go long on oil in the Futures (/CL), using our brand new oil trading range chart. Oil will be pumped back to $55-60 into July (and then we'll go short again) so why fight the tide when we can ride along?

Speaking of scams, kudos to Andreas Hopf, over at Seeing Alpha for his article on "The Big Tesla Swindle" which does a great job of summing up all the reasons we have a conviction short on Tesla (TSLA) into earnings. As noted by Hopf:

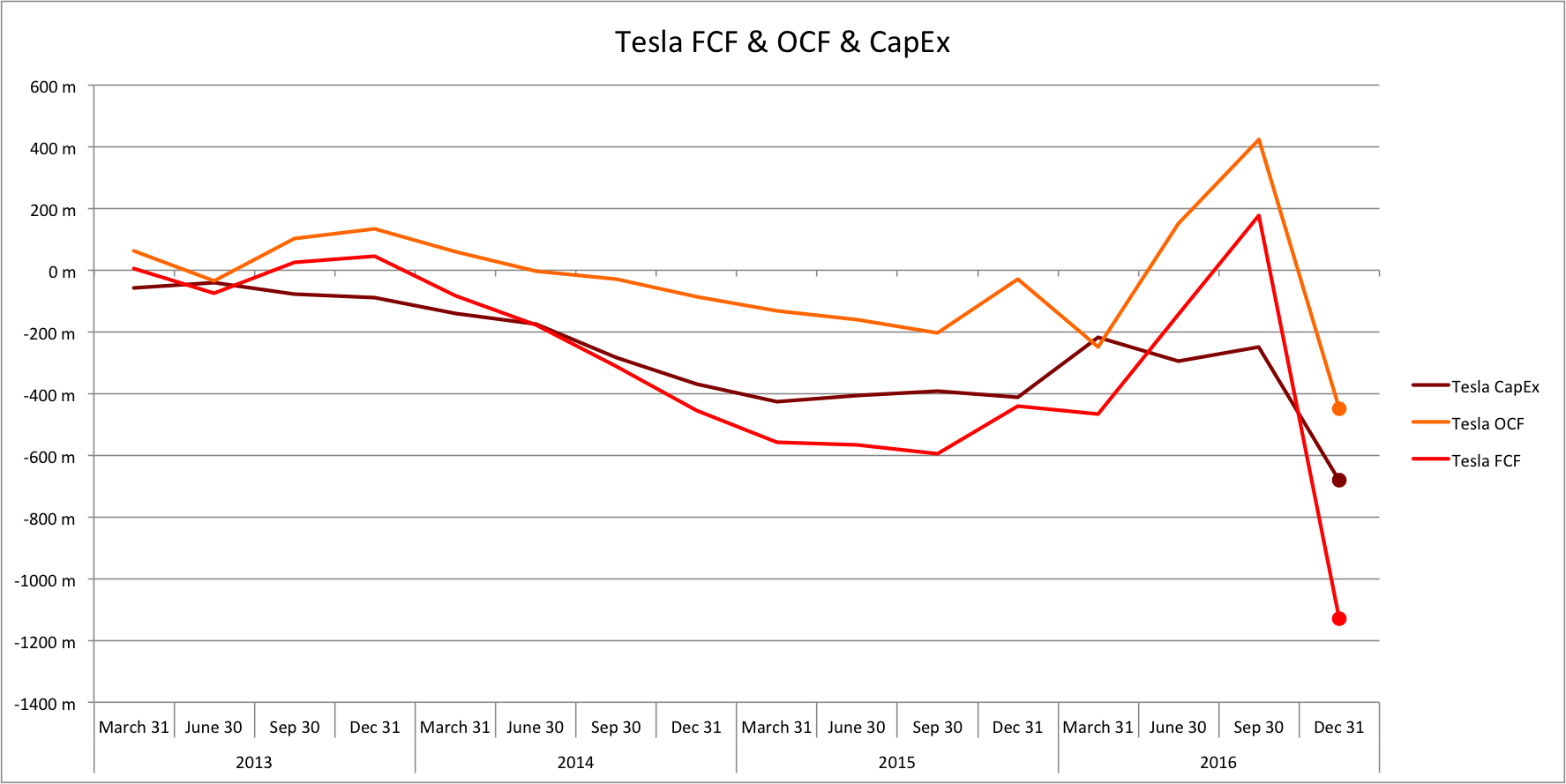

Tesla's current portion of long-term debt, due over the next 12 months, comes in at around $1 billion, while accounts payable are approaching $2 billion. CapEx is about to be boosted to $2 billion to $2.5 billion ahead of July Model 3 production – twice the total CapEx of 2016 plus half of that of 2015.

It is more than questionable that the required production equipment, the urgently needed service centre build-out and a denser international battery charger network can be financed without tapping capital markets again soon. FCF remains as illusory as ever and with SolarCity in the mix, itself an exquisite cash incinerator, Tesla gives birth to a new financial metric – cash burn from operations:

There's much, much more – I just love that "cash burn from operations" line, something I pointed out less eloquently after viewing Q4 earnings and deciding (too early) to short TSLA. Another factor in our timing of the shorts was that, in the US (where 58% of Tesla's are sold), there are only 48,058 $7,500 Federal Tax Credits available to Tesla and it's very unlikely the Trump Administration will approve extending tax credits to the exact kind of people who don't vote for them just to perpetuate the Global Warming Hoax, right?

That's going to effectively raise the price of Tesla's by $7,500 per vehicle by July (assuming they hit their sales numbers). Of course, it's doubtful TSLA will actually warn on future sales in this quarter's conference calls but you can imagine there must be some analyst somewhere who knows how to do math…

.jpg) We're also short Amazon (AMZN) into earnings as recent profit stumbles in the cloud business represent a real threat to Amazon, who lose money selling on the retail side and make it up with fat profits in cloud services (because they need the servers anyway to run their retail operation). This has, historically, given them a huge advantage over their non-retailing competition but Moore's Law means those advantages shrink every year and the growth of the cloud marketplace is shrinking.

We're also short Amazon (AMZN) into earnings as recent profit stumbles in the cloud business represent a real threat to Amazon, who lose money selling on the retail side and make it up with fat profits in cloud services (because they need the servers anyway to run their retail operation). This has, historically, given them a huge advantage over their non-retailing competition but Moore's Law means those advantages shrink every year and the growth of the cloud marketplace is shrinking.

After 6 years of very rapid growth, from $10Bn in 2010 to $120Bn last year (almost $20Bn average annual growth), the cloud market is projected to finish 2018 at $140Bn (half the growth) and plateau out under $200Bn in the 2020s, after which the price wars ensue as faster and cheaper servers chase after the same (relatively) amount of data storage needs:

That's our shorting premise for Amazon, nothing to do with retail, they are the greatest retailer in the World – because they are willing to sell things at a net loss. This makes your buyers very, very happy and keeps them loyal and, even better, it keeps investors betting on your company – as long as they think you could make a profit "if you wanted to." Read any bullish take on AMZN and that's what it comes down to – IF they wanted to, they could make a profit, so ignore the current losses.

As I noted in yesterday's post, we're shorting the Nasdaq in anticipation of a reality check on earnings and this week we still have a bunch of heavy-hitters waiting to report but next week and the week after are the peak for earnings and we shall see how things play out:

Travelers (TRV) and Verizon (VZ) are two more Dow components that are missing this morning, so that does not bode well for the Dow getting back over 20,500 – forget 21,000. On a brighter note, despite this not being a Free Trade Idea Month, I did give you a good one on Tuesday with Snap On (SNA), saying:

Speaking of fun ahead. If you want to play the President, he'll be stopping buy at Snap-On (SNA) today and Presidential visits tend to lead to gains as the Trump sheeple will buy anything he's selling. SNA is actually a nice little company and tools are a good infrastructure play so we can play them for a quick bump with the April $160 ($5.30)/165 ($2.90) bull call spread at $2.40, which will pay $5 above $165 on Friday for a $2.60 (108%) profit in 4 days if all goes well.

Earnings were this morning and SNA beat on the top and bottom line and should close well over our $165 target for the week and our spread will pay back $5 for a $2.60 profit (108%) in 4 days, as promised.

DO NOT pay $3/day to sign up for the PSW Report or you will get trade ideas like this on a regular basis and then you will have to pay taxes on your profits, which is really, really annoying.