Marine Le Pen is still in the running.

Marine Le Pen is still in the running.

That was supposed to be a disaster but, in fact, she is polling so far behind her remaining opponent, Emmanuel Macron, that Europe has decided not to worry about the Far Right taking over France and the Euro and the European markets are staging a massive rally this morning.

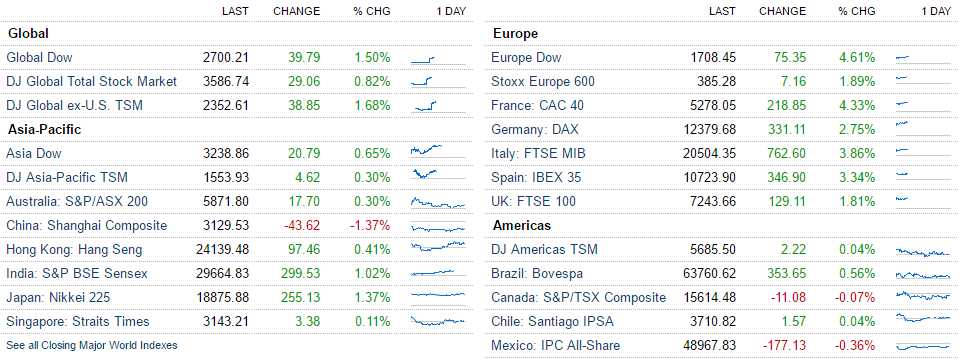

As of 5am (I have to be in NYC today for the Nasdaq open), the French markets are up 4.3% with Italy right behind at 3.8%, Spain 3.4%, Germany 2.75% and even the UK, who already elected to leave the madness far behind, are up 1.8%:

The Euro has blasted 1.5% higher, sending the Dollar down 1%, back to 98.90 (where we're long /DX as that's silly) and the US Futures are up 1% so far, but that's woefully behind the reaction the European equities are showing. Fortunately, on Thursday, in our Live Member Chat Room, we hedged the upside by going long Japan's Nikkei, saying:

Nikkei (/NKD) is now the laggard to the upside and also benefits from a rising Dollar so 18,600 is a good long line for them.

As you can see, the Nikkei popped 400 points for us over the weekend, yielding gains of $2,000 per contract and outperforming the Dow, which also pays $5 per point, by 100%. Fortunately, we took the short money and ran mid-day Friday and our portfolio adjustments left us less bearish than we had been (and we went long on Oil (/CL $50), Silver (/SI $17.80) and Coffee (/KC $133), so we'll see how they perform in this rally as well.

Not that anyone cares about actual news but Israel bombed a weapons depot in Southern Syria in retaliation for a mortar attack from Syria upon the Golan Heights on Friday. That's the kind of news that used to send the markets lower but I guess war in the Middle East is the least of our worries when Donald Trump and Kim Jong Un both have their fingers on nuclear buttons…

And, of course, the US Government will shut down from lack of funding on Friday and Trump still refuses to even discuss a budget that doesn't include a big, giant wall to keep the Mexicans from raping and murdering us which, I suppose, is what he was elected to do and it's Day 93 so next Monday will officially be Day 100 and I don't think Trump wants the Wall to be another check in the loss column as the reviews begin to pour in.

We're closing out the month with economic data from Chicago, Dallas, Richmond and Kansas City ahead of Q1 GDP on Friday, which is now expected to be an anemic 1% – yet does not seem to stop the markets from rallying back to record highs. Lots of Housing Data: Case-Shiller, FHFA Prices, New Home Sales, Mortgage Applications and Pending Home Sales as well as Consumer Confidence, Durable Goods, PMI and Michigan Sentiment will color hundreds of earnings reports starring:

Meanwhile (and again, I don't want to give the impression that Fundamentals matter in this market), looking at another kind of earnings – the Average Weekly Earnings have gone negative in 2017, coming off strong comps of the previous two years but again, how is it we're at record market highs when the GDP is in the crapper and the consumer clearly is not improving their spending power going forward?

This is still very much a hope-based economy and these sort of rallies can unwind very quickly when the bubble bursts. Though the French Revolution Part Deux is off the table, there's still North Korea, Syria, Iran, Venezuela, Japan Debt, China Housing, US Shutdown and Trade Wars to contend with so PLEASE, make sure you have some hedges in place – they are insurance, they are supposed to lose money in a bull market but that doesn't make them bad bets!

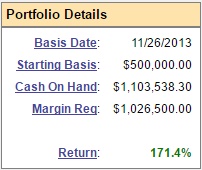

Our Short-Term Portfolio has lost $40,000 during the Trump Rally but the Long-Term Portfolio, which it protects, has gained over $100,000 and, more importantly, that net $60,000 gain is locked in and we cashed out some major positions last week, leaving us 81% in CASH!!! and yes, we will miss out 40% of a bigger rally, if it comes – but we will sleep very well each night, knowing we are well-protected.

Our Short-Term Portfolio has lost $40,000 during the Trump Rally but the Long-Term Portfolio, which it protects, has gained over $100,000 and, more importantly, that net $60,000 gain is locked in and we cashed out some major positions last week, leaving us 81% in CASH!!! and yes, we will miss out 40% of a bigger rally, if it comes – but we will sleep very well each night, knowing we are well-protected.

It's not May yet so I can't put a new hedge in the free post but you know the drill. The Nasdaq Ultra-Short (SQQQ) at $36.89 is still my favorite hedge because stocks like Amazon (AMZN) at $900, Tesla (TSLA) at $310 and Netflix (NFLX) at $144 are ridiculously over-priced and ripe for a huge fall on any sort of earnings disappointment.

Speaking of Tesla, both Tesla and Apple (AAPL) are going to be fighting for cobalt, which makes up 35% of a lithium-ion battery and, currently, global demand is for 885 tons but Macquarie Research projects that ramping up to 3,205 tons in 2019 and 5,340 tons in 2020. If they are even close to being right, then Scientific Metals (SCTFF) will be my new favorite penny stock (0.58) and there are no options on them, so it's a straight play on a US supply of cobalt that the Trump EPA is likely to approve for mining.

Like any penny stock, it's insanely risky and Matt Bohlsen at Seeking Alpha has some more traditional alternatives but none have any fun options for us to play so more fun to put a craps bet on SCTFF and see if we get a big winner. As I'm talking about the stock, I will not be buying any until next week and I will not pay more than 0.60 and probably will pick up $600 worth for my kids at most as it's no skin off their backs if it's worthless but maybe some nice money down the road if it works out. That's the kind of bet this is.

Get ready for an exciting week!