Will this market ever go lower?

If not, it's very easy to make money in a never-ending bull market. For instance, the S&P ETF (SPY) is currently at $244 with the S&P at 2,439, so they run pretty much neck and neck and, if we think the S&P isn't going lower, then the SPY Jan $236 ($14)/245 ($8.05) bull call spread is $5.95 and we can sell Jan $212 puts for $3 to net $2.95 on the $9 spread which will make $6.05 (205%) by January if SPY is over $245. That's how easy it is to triple your money in a bullish market and, if you want to check out a dozen other examples of that technique working over the past 6 months, check out our Top Trade Review, with our first 14 trades (2 months) of 2017 netting $19,185 so far.

Making money in a bull market is easy, the trick is not losing it when the market turns sour! We only had 3 losing Top Trade Ideas (out of 14) in the first two months of 2017 and one of them was a Russell (TZA) hedge, which was SUPPOSED to lose money if the market went up. By funneling a percentage of our profits into well-constructed hedges, we are able to lock in a substantial portion of our gains against a downturn. We had that tested a few weeks ago when the market dipped and our portfolios passed with flying colors.

In fact, we actually make more money on the way down than we do on the way up because we're tilting bearish with some highly-levered positions but we did have to adjust a few last week to reflect the possibility that this market is going to keep going higher and higher and never ever stop – because that's kind of how it feels at the moment.

As I've noted before and as you can see on Doug Short's Equities/GDP chart (the Buffett Indicator), this market is getting a very 1999 vibe and only in 1999 has the market gone this insane with valuations. Never before have so many people paid so much money for such little earnings!

When the DotCom bubble burst in March of 2000, it wasn't so much a downturn in profits that killed the market – there weren't any profits in the first place. What killed the market was a simple change in attitude, when people woke up from the frenzy of buying and suddenly began to realize that a pet food company with a sock puppet doesn't deserve a $1Bn valuation. Will people wake up and realize a car company with a battery doesn't deserve a $60Bn valuation? Will people wake up and realize a taxi company that doesn't own any taxis isn't worth $65Bn? Will people wake up and realize a retailer that delivers from an on-line catalog at a 3% margin isn't worth $200Bn? It's hard to say, people are pretty delusional (just look at who's President).

So we keep playing the bullish game and keep making bullish picks but ALWAYS with some hedges – just in case. We're also keeping plenty of CASH!!! on the sidelinees – just in case – because history has a funny way of repeating itself, doesn't it?

So we keep playing the bullish game and keep making bullish picks but ALWAYS with some hedges – just in case. We're also keeping plenty of CASH!!! on the sidelinees – just in case – because history has a funny way of repeating itself, doesn't it?

Speaking of repeating – there was another terrorist attack in London this weekend with 7 dead and this morning, Saudi Arabia, Bahrain, Egypt and the UAE have cut ties with Qatar, sighting that nation's ties to terrorism. To some extent, they may be using Qatar as a scapegoat (tensions are escalating to be sure) and also it might be good for the price of oil.

We still like /CL long over $47.50 and the Oil ETF (USO) long over the $10 line into the July 4th weekend but, after that, we don't think $45 will hold, so just a fun, early summer play. Similarly, Gasoline (/RB) Future are a good long above the $1.56 line (tight stops below) over the same period. Also, Coffee (/KCU7) is back where we like playing it long at $128, that trade idea made just under $4,000 last Tuesday from our May 24th Webinar. Of course these trades have already been discussed in our Live Member Chat Room – which you can join here if you'd like to know about these opportunities as they happen.

On the Indexes, we still like our short calls from Friday, which were:

Nonetheless, the market marches onward to record highs with the S&P (/ES) Futures tapping 2,437 this morning and Russell Futures (/TF) back to 1,405, which we like for a short with tight stops above (see our 5% Rule™ discussion from our Live Member Chat Room, where we called this move yesterday). Speaking of Futures, we went long on Oil (/CL) at $47 and Gasoline (/RB) at $1.56 early this morning, also in our Live Member Chat Room, taking advantage of the overnight weakness to re-load our oil longs.

See how consistent we are! Friday's job growth was anemic, there is more terrorism, the President is being investigated, housing is bubbly (especially in China and Australia) and Central Banksters now own more than 1/3 of all tradeable bonds on the planet – up from 15% in 2003 and 20% in 2009. Now they all SAY they will be unwinding them but how and to who?

See how consistent we are! Friday's job growth was anemic, there is more terrorism, the President is being investigated, housing is bubbly (especially in China and Australia) and Central Banksters now own more than 1/3 of all tradeable bonds on the planet – up from 15% in 2003 and 20% in 2009. Now they all SAY they will be unwinding them but how and to who?

The issue here is that the Commercial Banks (who have kept their percentage steady) would not have added Trillions more in debt notes and no one else (widows, orphans) who owns bonds have the capacity to take even half the Fed's bonds off their hands – let alone all the Central Banks at once. This is a guaranteed catastrophe in the making yet no one is paying attention – as if we can just keep rates unnaturally low forever with no consequences.

Hey, it's worked so far – let's press our luck, right?

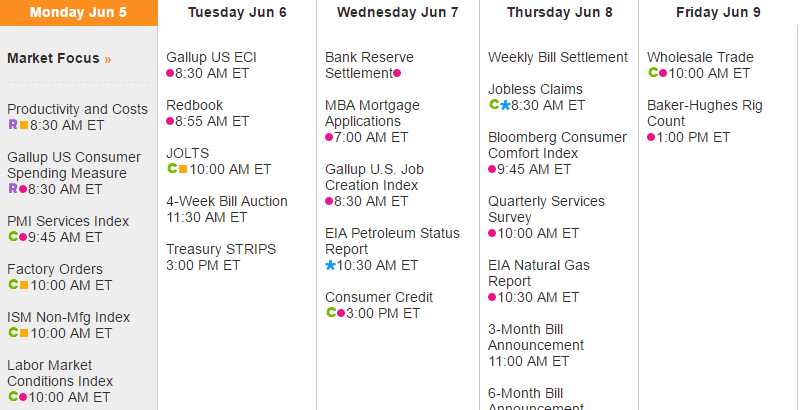

It's a very boring trading week with no (none) Fed speak scheduled and not much data either:

As usual, Monday's are fairly meaningless (we didn't even trade last Monday and no one cared) so we'll watch and wait today and see if our index shorts pay off (tight stops above if they don't) and, if not, we'll try again at the next level because we can afford to lose $50-100 quite a few times against the thousands we'll make on another nice dip, right?