It was a mixed bag.

It was a mixed bag.

In yesterday's PSW Report, we called for shorting the Dow (/YM) below the the 21,650 line and we never really got there but the Russell Futures (/TF) crossed below our 1,445 target and plunged another 20 points to 1,425, yeilding a nice $1,000 per contract win on the day. That was enough to offset our loss (so far) of $600 per contract on oil shorts at $48.50 (for those who did not use the tight stops suggested, of course).

Oil is $49.10 this morning and we still think the short story will play out during August but it's likely to be a rough ride along the way. The Nasdaq was good for a 100-point drop, yeilding gains of $2,000 per contract from our Wednesday morning call and the S&P (/ES) was rejected at our 2,480 line, dropping to 2,460 and that was also good for gains of $1,000 per contract in just two days.

In Wednesday morning's PSW Report, we also discussed our Wheaton Precious Metals (WPM) spread, which was net $3,825 at the time and is now net $4,180 so up $355 (9.2%) in two days – I told you it was good for a new trade. Chipotle (CMG) was also a great spread, going from net $16,900 to $23,050 for a very quick $6,150 (36%) gain but sadly, for Seeking Alpha readers, the report we submitted on Wednesday was rejected by the editors because they didn't feel the trades were "new enough" – since they were both derived from older trade ideas. Pinheads!

If you want to read our Morning Report BEFORE the market opens every day – you can sign up HERE – I've lost my patience with Seeking Alpha and will no longer submit content there – other than the occasional blog post and, for now, my Options Opportunity obilgations.

Speaking of politics: 32 Million thank yous to Republican Senators Lisa Mukowski, Susan Collins and yes, even John McCain for saving health care for 32M Americans (for now). They voted against the Obamacare repeal last night and there were gasps on the Senate floor when John McCain, who Trump just called a real hero for voting to allow debate on the bill, voted against the actual bill – even criticizing the partisan process by which McConnell and company were attempting to ram the bill through on.

At one point before the final vote, Trump called Pence, who handed the phone to McCain, a source briefed on the call told CNN. The call, just off the Senate floor, was brief and ultimately unsuccessful.

Speaking after the vote, Senate Majority Leader Mitch McConnell looked stunned and lamented the vote and the inability of the GOP to fulfill its long-term campaign pledge. "This is clearly a disappointing moment," McConnell said. "Our constituents have suffered through an awful lot under Obamacare. We thought they deserved better. It's why I and many of my colleagues did as we promised and voted to repeal this failed law. We told our constituents we would vote that way. And when the moment came, when the moment came, most of us did." "It's time to move on," he said, moving the Senate on to the defense authorization bill.

Speaking after the vote, Senate Majority Leader Mitch McConnell looked stunned and lamented the vote and the inability of the GOP to fulfill its long-term campaign pledge. "This is clearly a disappointing moment," McConnell said. "Our constituents have suffered through an awful lot under Obamacare. We thought they deserved better. It's why I and many of my colleagues did as we promised and voted to repeal this failed law. We told our constituents we would vote that way. And when the moment came, when the moment came, most of us did." "It's time to move on," he said, moving the Senate on to the defense authorization bill.

Trump, of course, had a little Twitter Tantrum this morning, sounding like a cartoon villain whose evil scheme has just been thwarted.

Of course, Seeking Alpha thinks talking about the health care bill is "too political" – even though it affects $3Tn of spending in the US – 15% of our entire GDP. The pressure that is placed on authors NOT to talk about politics is unbelievable, and a huge disservice to the readers. It's all about ad money – you can't piss off a sponsor – even if they are far left or far right nut cases and you can't upset a reader, no matter how wrong their view of the World is. That's why I run a subscription service – we don't have to bow to ad pressure and we're sure not going to bow to editorial pressure. What's sad is that readers don't know how how white-washed the content they do get to read usually is.

On Tuesday we told our subscribers we were shorting Amazon (AMZN) at $1,040 and I gave all my reasons there. Our trade idea in the Morning Report was:

AMZN is hovering around $1,040 and I'm very surprised they aren't down pre-market off Seagate's poor earnings. I imagine people think AMZN is taking market share from STX but, as I have told our Members for years, ultimately, cloud storage is a commodity and it will ultimately lose it's margins, no matter how big it grows. Amazon announces earnings on Thursday and the January $1,100 puts can be bought for $101.50 and the January $1050 puts can be sold for $72.50 which is net $29 on the $50 spread that's in the money to start. If you are really brave, you can sell the $1,200 calls for $21.50 and that drops the net of the spread to $7.50 with a potential $42.50 (566%) profit if AMZN is below $1,050 come January expirations.

This trade is going to pay of HUGE today, with AMZN plunging back towards the $1,000 line – you're welcome!

The Q2 GDP report just came out (8:30) and the good news is it's up 2.6% but the bad news is last quarter's 1.4% growth has been revised down to 1.2%, keeping the average below 2% for the year, which is HALF of Team Trump's projections – the ones they are using to ram through ridiculous tax cuts for the Top 1%. The White House's chief strategist, Steve Bannon, broke with the team yesterday and called for a new 44% top tax rate on Americans making more than $5M a year and he was immediately and savegly attacked by new Trump (and Goldman Sachs) attack dog, Anthony Scarmucci, who actually said:

“I’m not Steve Bannon, I’m not trying to suck my own c—,” he said. “I’m not trying to build my own brand off the f—ing strength of the president. I’m here to serve the country.”

The new White House Communications Director also had words for Chief of Staff, Reince Priebus saying:

The new White House Communications Director also had words for Chief of Staff, Reince Priebus saying:

“Reince is a f—ing paranoid schizophrenic, a paranoiac,”

Impersonating Priebus, Scaramucci told Lizza: “Let me leak the f—ing thing and see if I can c—-block these people the way I c—-blocked Scaramucci for six months.”

Come on, do you really think the implosion of the United States Government doesn't matter to the markets and shouldn't be talked about or should I talk about it and pretend to be neutral in order to fool readers into liking me more? Yeah, that's the basis of a good author/reader relationship, isn't it?

The strongest net effect of a weak Government in turmiol is a weak Dollar and ours has plunged 8% since Donald Trump took office. That's a stealth tax not just on your income but the reduced buying power affects every cent you have in your bank as well as the assets you've accumulated over your entire life-time, including those equities you think are doing so well.

In fact, the S&P has gained 8.6% over the same period (from 2,270 on inauguration day) – we've only "gained" what the buying power of the Dollar has lost and, since you buy stocks with Dollars – well, I assume I don't have to paint the whole picture for you, right? So the market, priced in constant Dollars, hasn't even gone up as much as our GDP although that too isn't priced in constant Dollars so, had the Dollar not fallen 8% in two months – what would our GDP look like today? Probably negative – welcome to the Trump Recession!

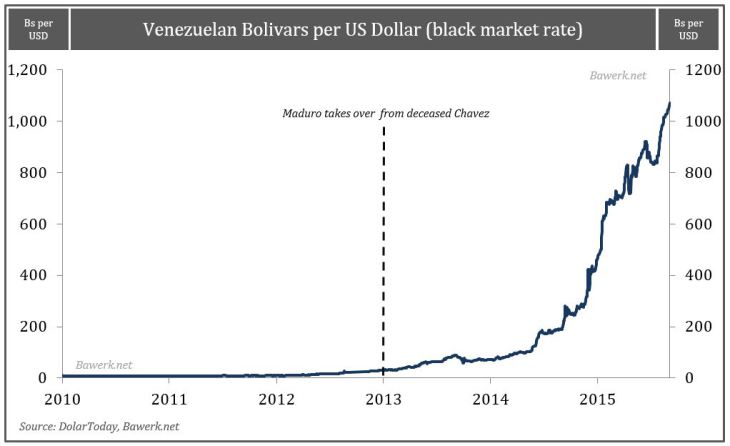

Veneuela is a government in turmoil and their money has gone completely worthless just 4 years after Maduro took over from Chavez and things are now bad enough in Caracas that the US has sent family members of Embassy officials home for fear of their lives. Meanwhile, over in Russia, Moscow is sending US Diplomatic staff home and is seizing properties used by Embassy staff (but not the Embassy) in retailiation for the "Fake News" that led the Senate to almost unamimously (98-2) sanction them.

Veneuela is a government in turmoil and their money has gone completely worthless just 4 years after Maduro took over from Chavez and things are now bad enough in Caracas that the US has sent family members of Embassy officials home for fear of their lives. Meanwhile, over in Russia, Moscow is sending US Diplomatic staff home and is seizing properties used by Embassy staff (but not the Embassy) in retailiation for the "Fake News" that led the Senate to almost unamimously (98-2) sanction them.

In the House, only 3 Repblican Congressment voted against the 419 Republicans and Democrats there who also backed sanction and Putin called this "SAD news" – very much like his protoge would say. Now it's up to the President to possibly veto the sanctions and Putin's dramatic actions have set him up to have a reason to urge caution and it would be interesting to see if Congress sticks to their guns and overrides his veto. Think this stuff doesn't matter?

Because reality is banned from the financial media – investors are happily oblivious to what's going on in the World around them and the markets are free to bubble away. There's an exellent article in Automatic Earth (thanks Scott) called "Debt Rattle" that makes for very good reading over the weekend but this chart says it all (have I mentioned how much I like CASH!!! lately?):

Have a great weekend,

– Phil