"Whooah, we're half way there

Livin' on a prayer

Take my hand and we'll make it, I swear

Livin' on a prayer"

Well that prediction didn't take long to play out!

In yesterday's report, we said it was time for a 500-point Dow drop and we got the first 200 yesterday and, as you can see from the Fear and Greed Index, the needle has moved from 59 to 31 already – halfway to EXTREME FEAR, where the sheeple start trying to sell stocks for any price and, in a thin market like this one – that can get pretty catastrophic.

Our long-term postions lost almost $100,000 yesterday (from $1.6M) but our short-term hedges gained $80,000, which means we essentially, automatically, begain cashing out as the market dipped. Of course, the real money comes when the market kicks in 5% or better and we're not counting on that happening in this gogo market – which is why we're not getting out of our long-term positions – yet.

We're also not adding to our long-term positions – yet – it's just too hard to say which way things will go but a nice correction is healthy and we're playing for a bounce this morning, using Dow 21,800 as our long like (/YM) as the Russell (/TF) bounces right off it's 200-day moving average at 1,370, which is also a good line to play long, with tight stops below.

Using our shorting line on the Dow Futures yesterday was good for gains of $1,000 per contact and hopefully we can re-enter the shorts as the strong bounce fails at 21,880 but, meanwhile, that's good for $400 per contract gains on the way up. Aren't futures fun? As we expected, silver and gold continued to blast higher as well, which is great for the trade ideas we discussed on Barrick Gold (ABX) and Wheaton Precious Metals (WPM).

Being well-hedged with a good BALANCE of positions allows us the luxury of sitting through these market upsets without panicking. In fact, all the CASH!!! (have I mentioned how much I like CASH!!! lately?) gives us the chance to be greedy while others are fearful – one of Buffett's top rules of investing.

We have certainly been fearful while others have been greedy this summer but it hasn't stopped us from making great gains. Our Options Opportunity Portfolio, which we trade and track over at Seeking Alpha, just ended it's second year on Aug 8th and is up 211% in two years – the best performing portfolio at SA! It's a great service, you should check it out – just ask ACLend:

Phil's analysis and timing are phenomenal. I have learned an invaluable amount of information from him on strategy, positioning, and trade management as well as how to identify my own opportunities and conduct sound portfolio management. He is responsive to questions and has a passion for teaching which shows in his tireless commitment to real-time interaction with his clients. In following Phil for five years, I have seen him call more good trades than I can remember and he makes himself accountable for reviewing his analyses and trading history. Phil's service is the best money you can spend on trading education.

There are lots of testimonials on the site, you can check them out but I think the proof is in the pudding or, in this case, in the portfolio, which is full of trades like the two I shared with you yesterday. Unlike the Long-Term/Short-Term paired portfolios we keep at PSW, the OOP is a combination of the two that started out with $100,000 (and we still make trade that are generally appropriate for that level, despite having over $300,000 now) where the hedges are part of the same portfolio.

This allows us to avoid the effects of violent market swings while we stick to our tried and true system of "BEING THE HOUSE – Not the Gambler" and collecting premiums from all the suckers who think they know how to predict the market. I was intervied on the subject at the beginning of 2016 in Forbes and the trade idea I gave them as an example (pg 4) was a long spread on UCO that was net $1,050 and made back $200 less than our $5,000 goal for a net gain of $3,750 (357%) in 6 months.

These are publically published trades – our system is not complicated to learn and our trade ideas are laid out in the OOP (and our other portfollios) just as clearly. We are not right all the time but, when your winning trades make 357%, you can afford a few losers, right?

These are publically published trades – our system is not complicated to learn and our trade ideas are laid out in the OOP (and our other portfollios) just as clearly. We are not right all the time but, when your winning trades make 357%, you can afford a few losers, right?

In the last two weeks, we've discussed a few of the hedging strategies we've been using in our Member Portfolios at PSW and in the OOP at Seeking Alpha and, of course, they are up today but it's more important to see how they play out if we do continue towards that 500-point drop zone next week.

It's a whole different world when you have a well-hedged portfolio because, when the market drops – instead of worrying about how much you lost, you look at all the money gained on your hedges and decide where you want to go shopping. Of course the main place we deploy our short-side gains is into the longs we are losing money on – we dollar-cost-average into long positions that we already like before we go looking to add new ones.

I mentioned yesterday that we like Chicago Bridge and Iron down here at $12 and now Macy's (M) is back on sale around $20, with no help today from JC Penny's (JCP) sad earnings, which is knocking them down another 25% this morning. The fallout from that disaster should give us a firm bottom on Macy's – as their bad news for the quarter is already priced in. We like M long-term for their real estate value and also the fact that they trend more towards the Top 10% shoppers (M owns Bloomingdale's too), who have no idea how bad the economy still is for the bottom 90% and are happily spending money.

To set up an options spread on M, we can do the following:

- Sell 5 2019 $18 puts for $3.25 ($1,625)

- Buy 10 2019 $18 calls for $4.50 ($4,500)

- Sell 10 2019 $25 calls for $2.10 ($2,100)

That works out to a net cash outlay of $775 on the $7,000 spread, which means if M is back over $25 in Jan, 2019, the net profit would be $6,225 (803%) and your worst case is you end up owning 500 shares of M at net $18 ($9,000) plus the $775 cash you laid out is $9,775 or $19.55, still a discount to the current price.

So, when we use options to construct a trade like that, our upside is 803% of our cash outlay and our downside is owing the stock for a discount (see "How to Buy Stocks for a 15-20% Discount") and, of course, then we have our hedges to take the sting out of any downturn there may be in the stock price and, of course, we still have the flexibility to pull the plug any time we want to, if we lose faith in our long premise (the real estate value of Macy's, in this case).

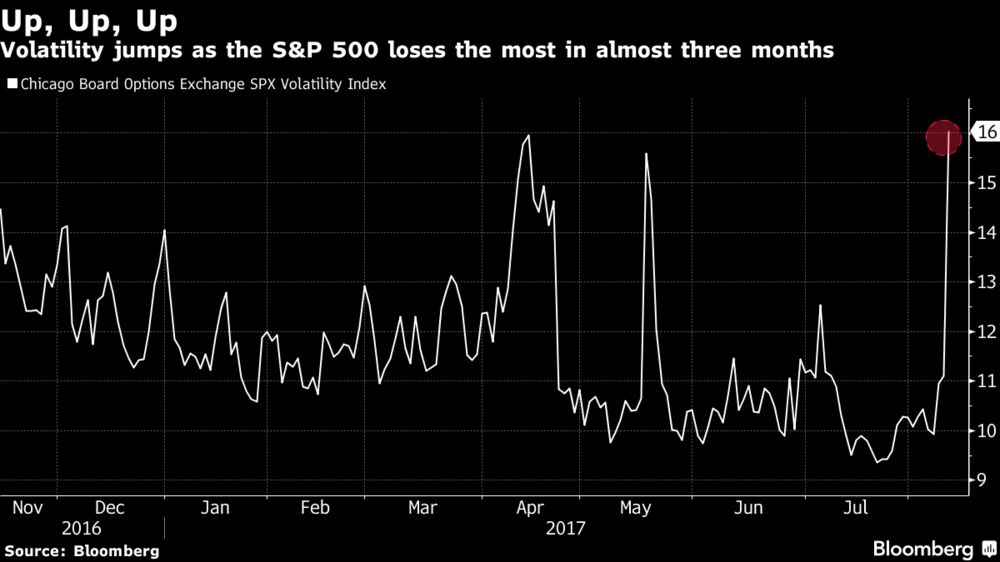

We had another huge spike in volatility yesterday but, as I said, today we're playing for the bounce this morning and that will drive the VIX back down but we think the bounces will fail (see our Live Member Chat Room for the bounce levels) and next week we should continue to see falling markets and a rising VIX. As I noted above, 21,880 is where we re-initiate our short on the Dow Futures (/YM), probably a 10% pullback on the VIX after yesteday's 45% gain.

As I said to our Members yesterday – who is going to want to go long into the weekend when there is an irrational madman in power who has his hands on nuclear weapons and is already threatening to use them? I'm also worried about what Kim Jong Un might do in response….

Have a great weekend,

– Phil