What do you think? (There's a comment section below  )

)

"CITRON EXPOSES UBIQUITI NETWORKS"

Does Ubiquiti Networks (NASDAQ:UBNT) actually have real products that sell to consumers? Of course! So did Valeant and WorldCom, but that does not stop its financials from having every indication of being completely fraudulent.

Citron will detail a series of alarming red flags and detail how Ubiquiti Networks is deceiving the investing public.

******

Rebutal by The Nattering Naybob, Seeking Alpha:

Left And Citron: The Boy Who Cried Wolf?

Excerpt:

Citron Shorts Again?

The latest target for infamous "activist" short seller Andrew Left and Citron Research is Ubiquiti (UBNT). After placing their short bets, the strategy involves launching torpedoes with intent to sink the stock, by publishing accusations of fraud or abuse. There is nothing illegal in these activities, as long as what Left and Citron publish is not fraudulent.

Before analyzing Citron's allegations of fraud, we will first exert some quick and dirty due diligence. An examination of Ubiquiti's debt service and short term liquidity situation should reveal whether they are in immediate danger.

Debt Service?

Below, UBNT debt to equity ratio is 43%, only a concern if earnings to interest payments ratios are not acceptable.

Courtesy SimplyWallSt

From Q4 2017 financials: income from operations 290M/4.8M = net interest expense = 60X, which is quite safe from a debt servicing standpoint.

Liquidity?

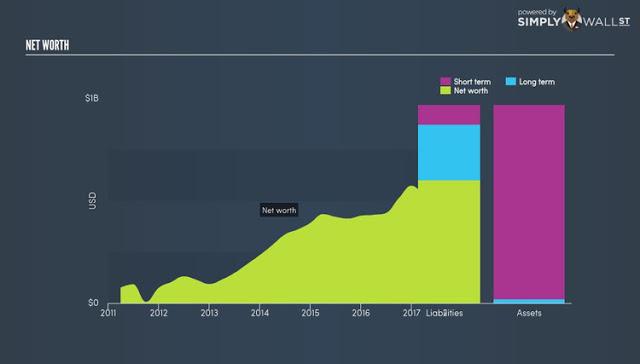

Below, near term liquidity measured as short term liabilities vs assets.

Courtesy SimplyWallSt

From the financials: Cash 604M; Current Liabilities 96M; Long Term Debt: 242M; Retained Earnings: 601M.

It appears that should adverse conditions arise, UBNT can readily meet expenses and debt (short and long term) with liquid assets.

Scratching the surface with the quick and dirty analysis above, with regard to debt service and liquidity, or can you pay the bills and debt, even if the note is called, there doesn't seem to be much to worry about here.

Taking It In The Shorts?

In the markets, some investors make it or take it, in the longs and or shorts. Below, Citron contends that the existing UBNT customer base does not "constitute a core competitive advantage". We address this further below.