Courtesy of Mish

The amount of sheer nonsense written about inflation expectations is staggering.

Let’s take a look at some recent articles before making a mockery of them with a single picture.

Expectations Problem

On July 17, 2017, Rich Miller writing for Bloomberg proclaimed The Fed Has an Inflation Expectations Problem.

Expectations matter because they shape how households and companies act and thus can go a long way in determining where inflation actually ends up. Consumers accustomed to meager inflation will resist paying up for goods and services.

“Lower inflation expectations make it all the more difficult for the central bank to achieve its inflation objective,” Charles Evans, president of the Chicago Fed, said in remarks posted on the bank’s website on July 14.

Key Element

The Business Insider says The Fed is missing a key sign of economic weakness coming from American consumers.

Andrew Levin, a career Fed economist who was a special adviser to Fed Chairman Ben Bernanke, told Business Insider he was worried by a noticeable decline in inflation expectations, both as reflected in consumer surveys and bond-market rates.

“The reality is that the longer-term inflation expectations of consumers and investors have shifted downward by about a half percentage point. Thus, even with the economy moving towards full employment, it’s not surprising that core PCE inflation remains about a half percentage point below the Fed’s inflation target,” he said, referring to a closely watched reading indicator that excludes food and energy costs.

“If the FOMC continues to ignore the downward drift in inflation expectations and simply proceeds with its intended path of policy tightening, actual inflation is likely to keep falling short of the Fed’s target and might well decline even further,” he said.

Janet Yellen Yesterday

In a brief speech following yesterday’s FOMC announcement Janet Yellen made these statements.

Turning to inflation, the 12-month change in the price index for personal consumption expenditures was 1.4 percent in July, down noticeably from earlier in the year.

For quite some time, inflation has been running below the committee’s 2 percent longer-run objective.

One-off reductions earlier this year in certain categories of prices such as wireless telephone services are currently holding down inflation, but these effects should be transitory.

Such developments are not uncommon, and as long as inflation expectations remain reasonably well anchored, are not of great concern from a policy perspective because their effects fade away.

Complete Nonsense

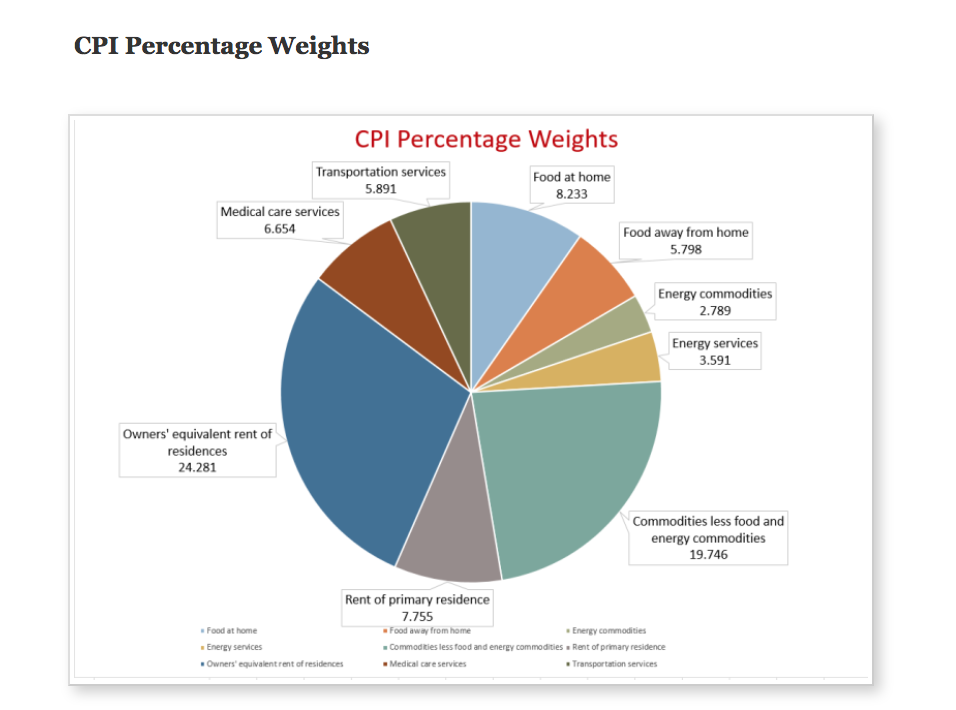

One can find thousands of such references, all of them idiotic. Let’s prove that with a single picture and a few comments.