According to Yahoo, "Intex Resources ASA, a mineral exploration company, engages in the discovery and development of mineral resources in Norway and the Philippines. The company explores for molybdenum and nickel deposits. It primarily holds an interest in the Mindoro Nickel project located in the Philippines. The company was formerly known as Crew Minerals ASA and changed its name to Intex Resources ASA in December 2007. Intex Resources ASA is headquartered in Oslo, Norway."

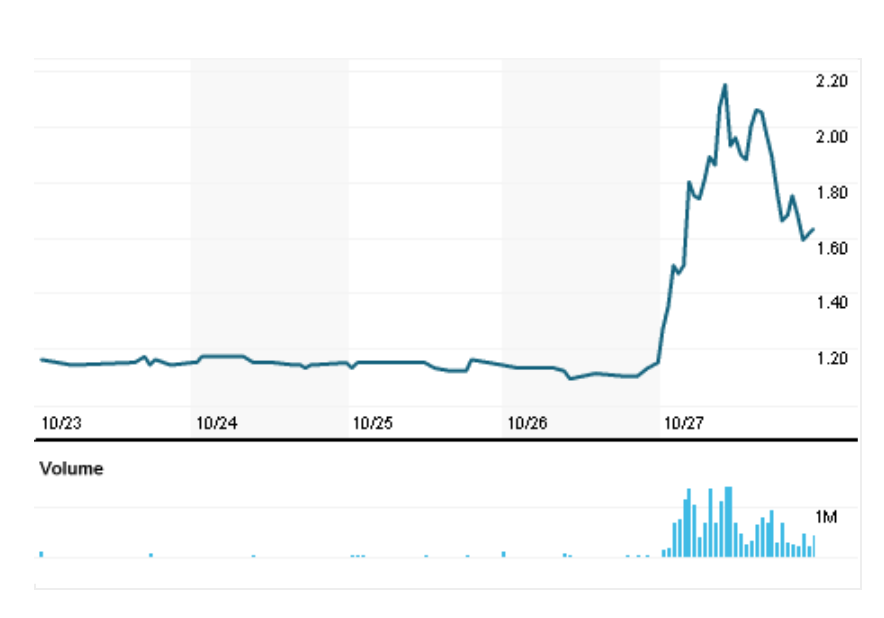

The stock (ITX.OL) jumped from $1.15 to $1.63 (42%) on Friday on news that it "was issuing the world's first asset-backed Initial Coin Offering, with the resulting tokens being exchangeable for the physical collateral" (ZH, below). The physical collateral, however, seems to be in the ground. Intex Resources has $665k in cash, a book value of $0.11 per share, no profits, no significant revenue, and one full-time employee. It spent all of $2,000 in operating expenses last year (Yahoo).

Friday's action:

Here's the Zero Hedge article:

Norwegian Mining Company Launches First Asset-Backed ICO

Courtesy of ZeroHedge

While the world debates whether blockchain-based Initial Coin Offerings are a fraudulent pyramid scheme, meant to take advantage of gullible investors who are desperate to get rich quick, or a revolutionary "post-equity" way of raising capital, a Norwegian mining company, Intex Resources ASA, has taken the next step in the latter, and last week announced it was issuing the world's first asset-backed Initial Coin Offering, with the resulting tokens being exchangeable for the physical collateral.

Although Intex is not the first corporation to approach ICOs as a means of raising capital, with Overstock revealing last week that it will launch an ICO on Nov. 1 using its proprietary tZERO platform, a strategy that will allow Overstock to raise capital without diluting its common equity float, Intex approach is somewhat different: the Company intends to issue asset-backed tokens which are backed by the Company's metal reserves; currently Iron Ore and Nickel Ore.

Where Intex' approach is unique, is that the newly issued Tokens will be based on blockchain technology and will be exchangeable into the physical product, i.e. Iron Ore, Nickel or products derived thereof. As a result, the company's Tokens are being pitched as an alternative tool for investors who are looking for Iron Ore or Nickel exposure/hedging or investors who simply want exposure in digital Tokens which have the security of underlying value assets (as opposed to Bitcoin and other unsecured and un-asset backed crypto currencies).

Commenting on the new capital raise, Lars Beitnes, Chairman of the Company, said the "the new world of secure digital currencies and tokens opens up a whole new way for listed companies to raise capital. We believe our ICO would be the first of many to come from other companies in Norway and internationally."

While it remains to be seen how accepted it is, by effectively pledging collateral behind the ICO, the company eliminates of the biggest concerns the rightfully skeptical investing public has regarding ICOs: the fact that they have no "fair value." However, once pegged to an underlying asset, that argument loses much of its potency.

What exactly is the collateral behind the new ICO? The answer, according to the press release, are the iron ore assets in the company's Ambershaw mine in Canada:

As the Iron Ore asset owned by Ambershaw Metallics Inc. (AMI) is the closest to production the parties anticipate initial development of a Token with Iron Ore (or products derived thereof) as the underlying asset, in cooperation with AMI. The Company has 5% direct ownership and an option to acquire majority control in AMI. AMI expects to start concentrate production in Q2 2018. AMI estimates that in the initial mining phase it can produce approx. 330,000 tonnes of concentrate annually. The current sales price for 65% Fe concentrate is estimated to approximately USD 93 per tonne, with production cost of USD 35 and estimated freight cost of USD 15-20 per tonne.

Beitnes pointed out what Overstock CEO Patryck Burne noted last week, namely that "one of the great benefits with raising capital through an ICO is that there is no dilution for the shareholders, in addition to the benefits of transparency, the asset backing and it being attractive compared to traditional capital funding."

Beitnes then notes the interest in digital currencies by other international companies – such as BP, BNY Mellon, Credit Suisse, Deloitte, Intel, J.P. Morgan, MasterCard, Microsoft and UBS, among others – and notes that "seeing these great companies taking interest in this new world of financing, gives us comfort that this is the future for corporate capital raising. They are all members of the Enterprise Ethereum Alliance, where we also plan on becoming a member."

As for the chief reason for the company's decision to use an ICO to raise capital – besides euporic investors who are more than eager to allocate capital to the new platform despite repeat warnings by regulators that these may be fraudulent – Beitnes writes that the Tokens could offer "interest-free financing to the Company and its mining subsidiaries by selling future production in advance" and adds that "for the Company the most obvious potential of issuing Tokens is the possibility of bridging the gap between current reserve-value and equity value, in addition to providing a possibility for non-dilutive financing for our shareholders."

Going one step further, Intex' partner in the launch, Harmonychain, said that it is already preparing a market for the ICOs as a surrogate for trading the underlying iron ore and nickel assets that collaterlize the ICO:

"We have already registered IRON and NICKEL on the EC20 blockchain" said Bjorn Zachrisson, CEO of Harmonychain AS, "and we are looking into ways to distribute the tokens and have them tradable on reputable token exchanges".

Needless to say, it is still far too early to know if this proposed asset-backed ICO will be a success, although the concept of an asset-backed ICO is certainly novel and may eliminate many of the fears of ICOs blowing up worthless in the future, in the process opening up the pathway to another capital raising process, one which gives ICO investors at least some implicit collateral protection behind their investment.

One thing that's clear: the market's euphoric response to the announcement, with Intex stock soared on the Oslo Stock Exchange, nearly doubling on huge volume.

Meanwhile, as we wait to see if the Intex experiment is successful, a more ominous development is the unchecked proliferation of older, shadier ICOs, many of which are certainly frauds. Here, the problem as laid out by The Business Blockchain author William Mougayar is that the world continues to be flooded with legacy ICOs, which may end up imploding in the not too distant future, crushing investor interest in the asset class, and killing off ICOs as a potentially credible, regulated way of raising capital.

This was my Inbox this morning. 15 ICOs closing in 36h. As @fredwilson writes this morning, buyer beware. https://t.co/0crLDDUxKB pic.twitter.com/YmlP8JyPB9

— William Mougayar (@wmougayar) October 29, 2017